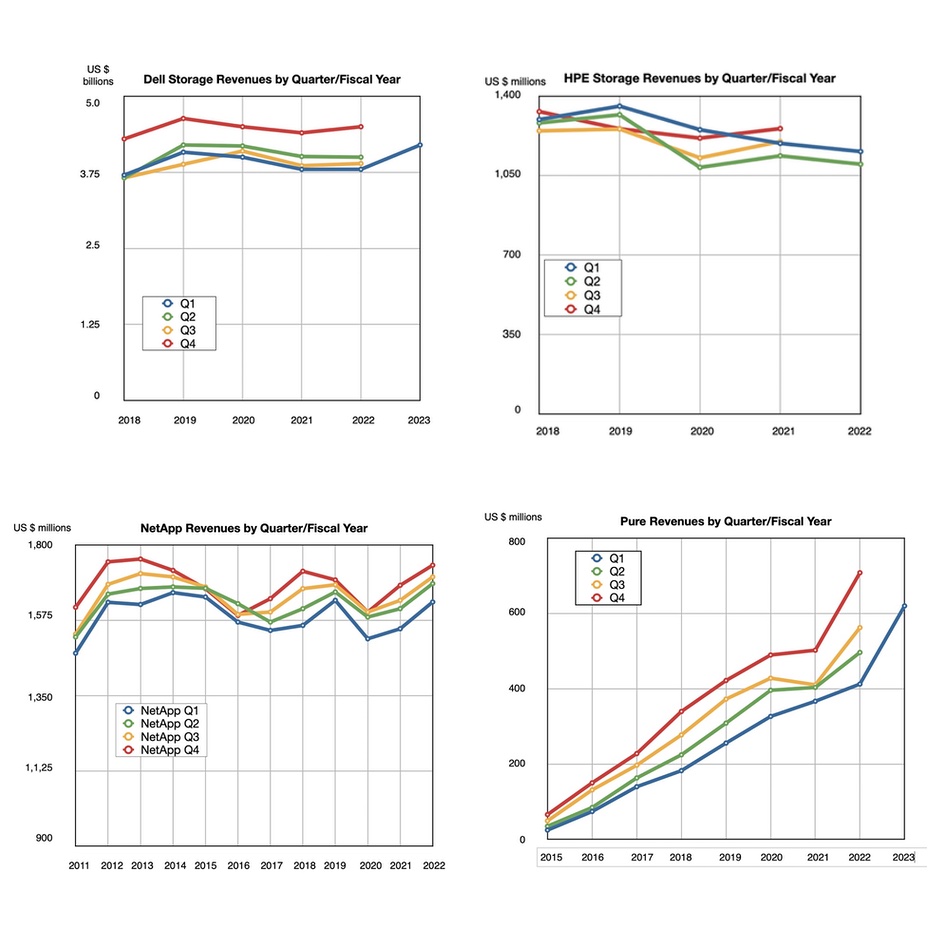

Forgive the headline pun but apocalypse it is not. We have compared the storage growth rates for Dell, HPE, NetApp, and Pure Storage and spotted standout differences with HPE declining, Dell starting an upswing, NetApp rising on the back of 8 consecutive growth quarters, and Pure starting its eighth year of growth, albeit with a two-quarter hiccup in 2021.

Our charts track storage revenues by quarter within fiscal years, and reveal quarterly revenue changes by fiscal year. Industry leader Dell’s pattern since 2018 is growth to 2019 and then a gentle downturn for two and a half years until Q3 of 2022 when growth restarted, accelerating sharply in its most recent quarter.

HPE exhibits a growth stoppage in Q4 2019, a quarter earlier than Dell, then declines until Q1 2021 after which growth restarts but gets snuffed out three quarters later with its most recent quarter showing a three percent decline to $1.1 billion. Its overall trend-line on the chart is one of decline.

NetApp’s history goes back earlier but, like Dell and HPE, it shows growth halting three years ago; actually in Q4 2019, and plunging throughout 2020. It then exhibits a consistent rise for eight straight quarters, beating both HPE and Dell in the percentage growth rate stakes.

That’s good stuff but NetApp, in turn, is outshone by Pure Storage, the smallest supplier in our foursome, whose growth rate consistency and revenue rise is spectacular.

All this prompts us to ask why these four suppliers have such different revenue change patterns.

One factor is that Pure only sells all-flash arrays (AFAs) to the on-premises and near-cloud markets while the others have wider product portfolios, with entry-level, mid-range, and high-end products, AFAs, disk and hybrid flash/disk arrays, purpose-built backup arrays (not NetApp), scale-out filers (Dell) and hyper-converged appliances (not NetApp again).

All four are transitioning away from perpetual licenses to as-a-service offerings, building a storage software presence in the public clouds, and providing storage for containerized workloads.

In general all four are pushing AFA products, so why is Pure doing so well? Does it simply have a better product? It is tempting to say that Dell and HPE are mature suppliers with less room in the market for dramatic growth Pure-style. NetApp is also a mature company, and it is growing at a faster rate than either Dell or HPE. It is possibly benefiting from being earlier into the public cloud arena with its Data Fabric concept, success in partnering with Amazon Web Services, Microsoft Azure, and Google Cloud, and recent CloudOps product services.

Pure would say that it is growing at a faster rate because it has better products, a better upgrade program, and better as-a-service offerings. The others will certainly dispute that but their arguments are made less convincing by either negative growth or significantly slower growth rates than Pure.