The Cloud Operations (CloudOps) business looks so good for NetApp that the company has increased its overall revenue targets.

This was revealed at a NetApp Investor Day conference on March 22. NetApp thinks its public cloud annual recurring revenue (ARR) will be $2 billion by its fiscal year 2026, up from $1 billion in 2025. NetApp should now reach its $1 billion public cloud target by 2024 – a year sooner than predicted.

Analysts Aaron Rakers and Jason Ader told their subscribers that NetApp’s total addressable market (TAM) has increased, up to $96 billion by 2025, and is growing at 8 per cent compound annual growth rate (CAGR). Back in September, NetApp calculated that it was looking at a $90 billion TAM by 2023, with a rough 7 per cent CAGR.

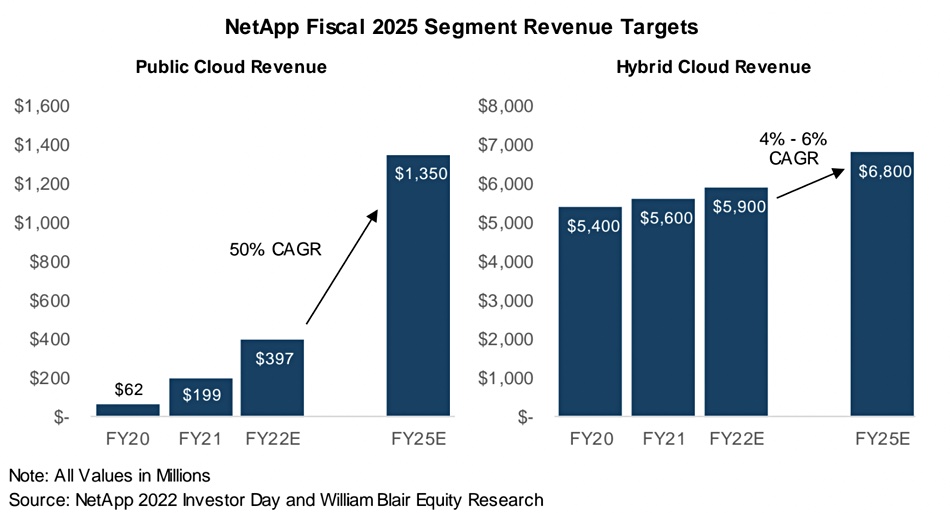

It has set itself new revenue targets as a result. Ader said NetApp’s hybrid cloud business TAM has a 4–6 per cent revenue CAGR with fiscal 2025 revenue targets of $6.6 to $7 billion. Public cloud revenues should be $1.3 billion to $1.4 billion with an expected 50 per cent public cloud revenue CAGR.

Add the two together and NetApp expects between $7.9 and $8.4 billion in revenue by fiscal 2025.

NetApps steady growth in selling to a largely installed base has been boosted by its Cloud Operations (CloudOps) business.

NetApp is the only systems and storage company with a CloudOps portfolio geared toward helping customers move applications to the public cloud in an automated, manageable, and application-optimizing way. Public cloud usage can be incredibly complicated. There are, for example, 475 compute instance types in AWS, and customers have to cope with excessively complicated prices, both compute and storage instances, and Lambda functions.

This is a tall order to manage manually and there is a shortage of people skilled enough to do it. NetApp’s CloudOps tools are intended to help automate the process. The company is seeing a market in which virtually all businesses and organizations are moving some applications to the public cloud. It sees companies in general moving to become AI-driven, digital organizations, spanning hybrid and multi-cloud environments. In other words, its CloudOps portfolio has a horizontal, cross-market appeal.

NetApp said CloudOps creates an opportunity to find new buyers and expand NetApp’s overall customer base, enabling land-and-expand sales strategies, as well as cross-selling opportunities.

Its CloudOps portfolio has not been replicated by Dell, HPE, IBM, Pure or any other suppliers, and gives NetApp an opportunity to gain new customers and then cross-sell its other products and services to them.

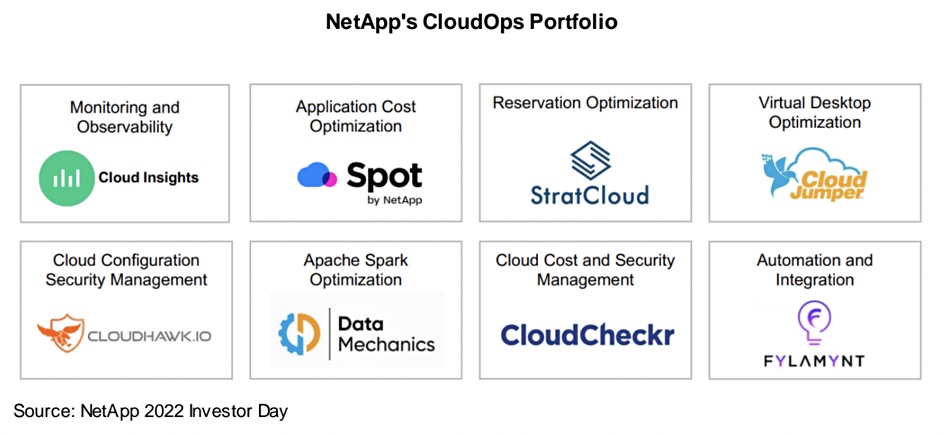

Ader summarised NetApp’s CloudOps portfolio:

- Cloud Insights: Monitoring and observability, noted to be deployed at ~750 top 1,000 companies;

- Spot: Application cost optimization, public cloud integration. NetApp highlighted this as a key cornerstone of NetApp’s CloudOps portfolio;

- StratCloud: Reservation optimization;

- Cloud Jumper: Virtual desktop optimization;

- Cloudhawk.io: Cloud configuration security management;

- Data Mechanics: Apache Spark optimization;

- CloudCheckr: Cloud cost and security management, now part of Spot to enable greater visibility. The company highlighted CloudCheckr alignment with MSPs and systems integrators (Accenture, Tech Data, Deloitte, Navisite, WWT, Eplexity, Ingram, and more);

- Fylamynt: Most recent acquisition focused on automation and integration.

NetApp has also moved its core storage services to the main public clouds under its Data Fabric rubric, claiming it is the only storage vendor with fully managed, first-party services on AWS, Azure, and Google Cloud, with an integration in IBM Cloud as well. It can also sell its CloudOps services to its existing customers when they move applications to the cloud. Only 12 per cent of its installed base use its public cloud services currently, giving it a lot of growth headroom.

Inside NetApp’s base, all-flash array (AFA) penetration is 35 per cent and this should grow to somewhere between 40 and 45 per cent by fiscal 2025.

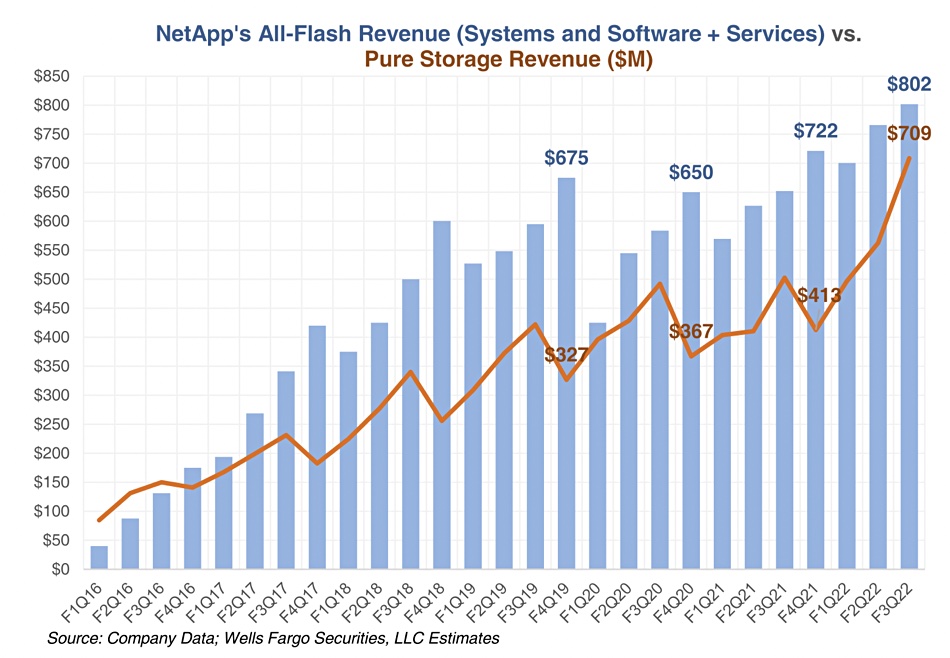

Rakers provided a chart comparing NetApp’s AFA revenues with Pure Storage’s:

It shows Pure Storage’s (flash-based) revenues catching up with NetApp’s AFA revenues, with Pure bringing in 88.4 per cent of NetApp’s total in the latest quarter. NetApp’s revenue in its latest quarter was $1.6 billion compared to Pure’s $709 million. It will be interesting to see if NetApp can widen the gap with Pure using its public cloud and CloudOps portfolio.