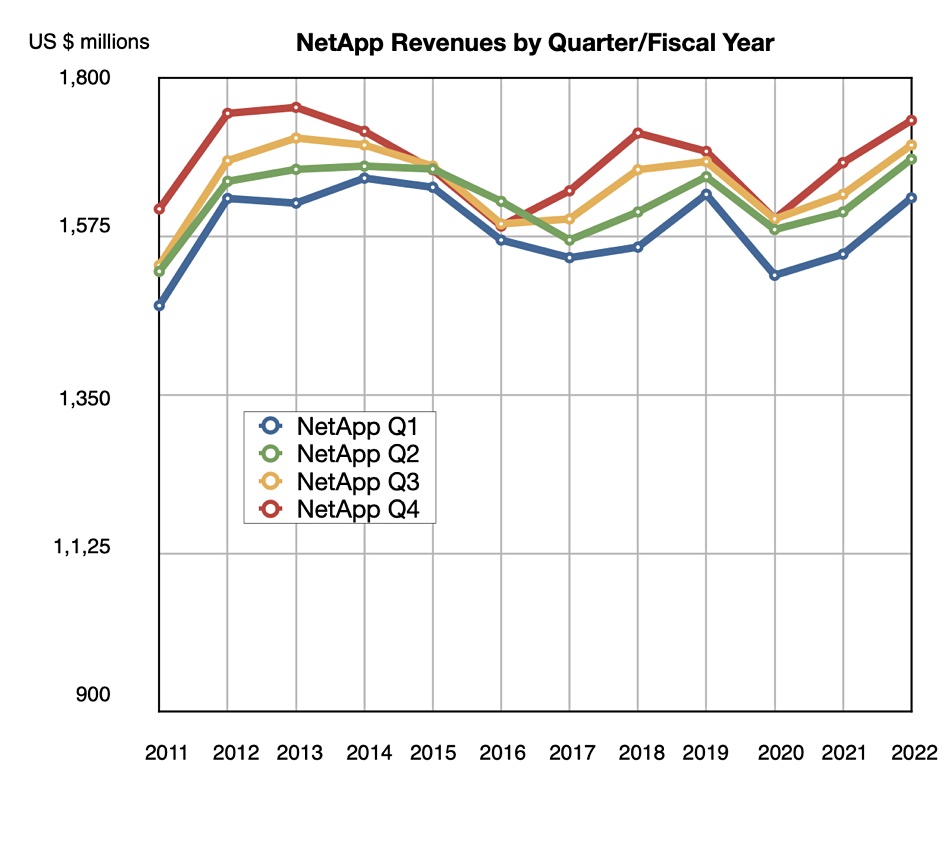

Consistency is valued at NetApp and it has grown revenues consistently for eight quarters in a row with its latest fourth fiscal 2022 quarter’s results. But public cloud growth let the side down as poorly integrated CloudOps acquisitions were hard to sell.

Revenues in the quarter ended April 29 were $1.68 billion, 8 percent more than a year ago, with a profit of $259 million, down 20 percent from the year-ago $324 million. Full fiscal 2022 revenues were up 10 percent to $6.32 billion with profits of $937 million, up 28.4 percent on the year.

CEO George Kurian’s results statement said: “Our solid fourth quarter results cap off a strong year. We made sustained progress against our strategic goals: gaining share in enterprise storage, expanding our public cloud business, and, most notably, delivering record levels of gross margin dollars, operating income, and earnings per share.” He talked of an our alignment to customer priorities, strong balance sheet, and prudent operational management.

Fourth quarter’s financial summary

- Hybrid Cloud segment revenue: $1.56 billion, compared to $1.49 billion a year ago

- Public Cloud segment revenue: $120 million, compared to $66 million last year, 99 percent higher

- Gross margin: 65.7 percent compared to prior quarter’s 67.3 percent and 68.3 percent before that

- Cash, cash equivalents, and investments: $4.13 billion at quarter end

- Cash provided by operations: $411 million, compared to $559 million 12 months ago

- Share repurchase and dividends: Returned $361 million to shareholders through share repurchases and cash dividends

Full-year summary

- Billings: $6.7 billion, 13 percent higher than a year ago

- Hybrid Cloud segment revenue: $5.92 billion, compared to last year’s $5.55 billion

- Public Cloud segment revenue: $396 million, about double the year-ago $199 million

- Cash provided by operations: $1.21 billion compared to $1.33 billion last year

- Share repurchase and dividends: Returned $1.05 billion to shareholders through share repurchases and cash dividends

In the Hybrid Cloud category, product revenues were $894 million, up 6 percent annually, with support and other services contributing $666 million. NetApp said it gained share in enterprise storage with strong growth in all-flash array (AFA) and object-storage products. The AFA run rate is $3.2 billion, the same as last quarter, and 12 percent more than a year ago. Actual AFA revenues were up 20 percent annually in the quarter. Object-storage revenues grew faster, at 49 percent.

Public Cloud annual recurring revenue (ARR) was $505 million, 68 percent more than 12 months ago, with strength in Cloud Storage, led by Azure NetApp Files, but it was lower than hoped for. That was due to shortfalls in the Cloud Insights and Spot areas, which grew less than expected, not helped by sales force attrition, particularly with Spot.

Kurian referred to this in the earnings call, saying: “Our Public Cloud ARR came short of our expectations. Demand for our cloud storage solutions was strong in Q4. We also saw a healthy number of new customer additions across both cloud storage and cloud operations services in the quarter. Unfortunately, these tailwinds were not enough to offset the lower than expected growth created by higher churn, lower expansion rates, and sales force turnover in our cloud operations portfolio.”

NetApp has made organizational changes to increase its focus on renewal and expansion motions, refreshed the sales team and strengthened the leadership ranks. CFO Mike Berry talked about improving the operational rigor across the CloudOps products and NetApp is speeding up the integration of its CloudOps product portfolio, particularly Instaclustr, so that it’s easier to buy. This should also help the sales force cross-sell and upsell NetApp products and services to its CloudOps customers.

It emerged on the call that since some point this year, sales reps cannot hit their numbers without selling cloud as part of their overall quotas.

Kurian admitted mistakes had been made: “I think where we could do better is learn from the mistakes we made around integration, and we’re going to – everybody learns from that and we’re going to own that.”

In general NetApp plans to slow the pace of CloudOps-related acquisitions and reprioritize its use of cash in FY 2023 to favor shareholder returns. It is convinced it can achieve $2 billion in ARR exiting fiscal year 2026.

In the Hybrid Cloud segment of its business, issues with supply chains hindered its ability to ship product. Product revenues grew 10 percent in the full year, but only 6 percent in the fourth quarter reflecting this. Berry mentioned supply-constrained shipments, elevated freight and logistical expense, and component cost headwinds.

The company’s revenue growth rate has declined during the year, starting at 11.9 percent in Q1 and passing through 10.6 percent and 9.8 percent to the latest quarter’s 8 percent. Gross margin has also declined, with Berry saying Q4 should be the trough with gross margin improving during fiscal 2023. Pricing changes – increases – will help it as will supply-chain improvements. It sees customer demand as being steady and its ability to satisfy that demand will be gated by supply-chain issues, as it has been for the past two quarters.

NetApp has not grown its revenues in the quarter anywhere near Pure’s 50 percent growth rate. Instead it’s nearly matched Dell’s 9 percent storage revenue growth rate. Pure’s run rate is $2.48 billion, which compares to NetApp’s AFA run rate of $3.2 billion, up as we have seen 12 percent annually. If Pure continues growing faster than NetApp’s AFA revenues then it could eventually overtake NetApp on the AFA front.

Neither has NetApp seen customers wanting to pull shipments forward as happened with Pure in its comparable quarter.

Asked about the competitive environment and if it had changed, Kurian answered: “I think it’s pretty much the same, Pure and NetApp taking share from Dell and HP and several other players. So I would characterize it as no fundamental change, to be honest.”

The outlook for NetApp’s next quarter (Q1 FY 2023) is for revenues between $1.475 billion and $1.625 billion, $1.55 billion at the mid-point which Berry said is 6 percent higher than the year-ago quarter. Full FY 2023 revenues are expected to be 6 to 8 percent higher than for FY 2022.

NetApp anticipates sustained demand for its AFA and object-storage products, and continued share gain momentum, which should lead to product revenue growth in the mid-single digits.