Data protector Acronis has released its Cyber Protect 16 product with a new centralized dashboard. It features:

- Cyberthreat Protection using AI and ML to proactively secure data, applications, and systems from cyber attacks.

- Users can initiate one-click recovery capabilities of distributed endpoints, including bare-metal recovery of physical workloads.

- Broad, multi-generational OS support enables vendor consolidation while ensuring comprehensive protection.

- Centralized management includes local autonomy and seamless integration with existing third-party tools to provide a unified view of backup and recovery operations.

- Acronis’s network of global datacenters helps compliance with data sovereignty laws.

….

Cloud file services supplier CTERA has a new Total Cost of Ownership (TCO) tool available to infrastructure cost savings using CTERA, in comparison to other file storage systems. Open the calculator here.

…

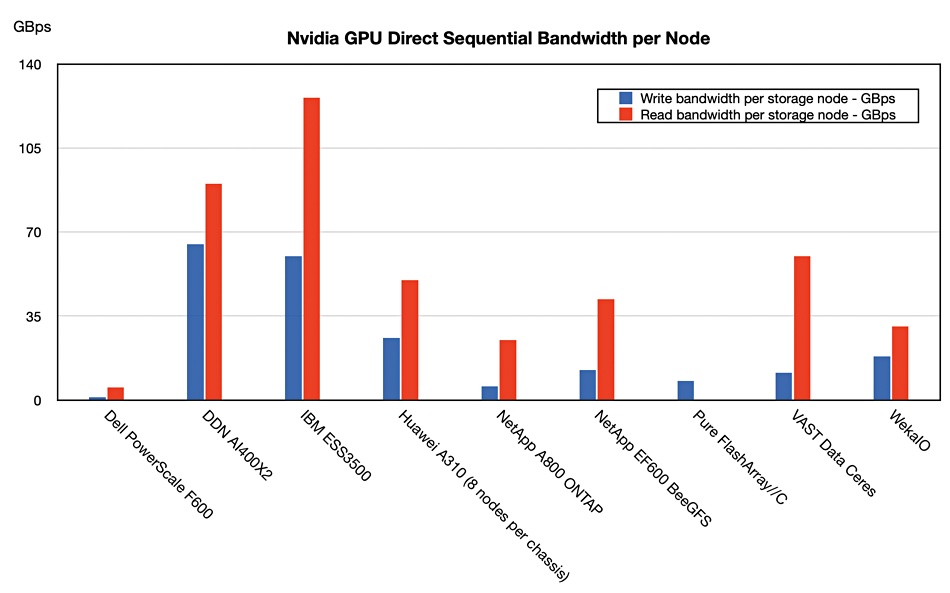

Dell founder and CEO Michael Dell tweeted a comment on the new PowerScale F210 and F710 systems, claiming PowerScale is: “the fastestAI storage in the world.” The F710 is approximately 2x the performance of the existing PowerScale F600, which is a laggard in the Nvidia GPUDirect speed stakes:

Doubling the F600’s speed would still leave the F710 a long way behind systems from DDN, IBM and others. We asked Dell what Michael’s comment meant and a spokesperson told us: “The post was a nod to our collaboration with Nvidia and its DGX SuperPOD. More to come soon!”

…

The 19-page Diamanti 2024 Kubernetes Adoption Survey shows that Kubernetes is now moving out of the dev/test world and into enterprise-scale production. It’s being deployed in both cloud and on-premises environments, supporting both stateless applications and performance-demanding stateful applications, and getting increased scrutiny over issues such as application availability and operational costs.

Get the survey report here.

…

Signs of business growth from FalconStor, a supplier of archive software supplier to IBM. It reported final 2023 quarter revenues of $3.6 million, a 42.3 percent uplift year on year, with a profit of $1 million – better than the year-ago profit of $20K. Revenues at FalconStor have now climbed for three quarters in a row. Full-year revenues were $11.6 million with a profit of $978,000 compared to the year-ago $10.1 million revenues and $1.8 million loss. Things are looking up. CEO Todd Brookes said: “Our growth and profitability are obviously very important to the FalconStor team and important validation of our focus on IBM Power customers.”

…

Data protector Keepit released the results from a new Total Economic Impact study attained by organizations leveraging Keepit SaaS data protection. Key findings include:

- A three-year 163 percent Return on Investment.

- $821,000 net present value over three years.

- A payback period of less than six months.

Additionally, the firm launched a Return On Investment calculator, designed to provide users with tailored insights into the projected financial benefits of Keepit’s offerings for their specific organizational needs.

…

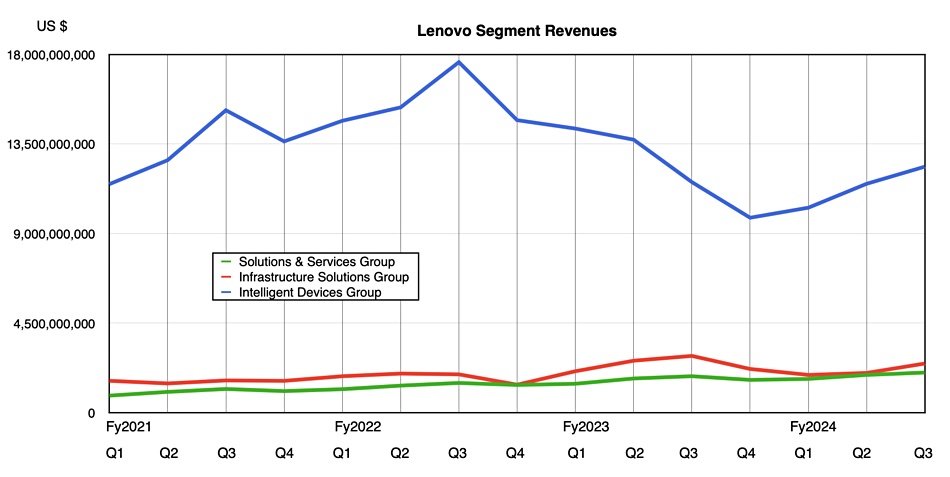

Lenovo reported solid results for its Q3 FY2024 quarter, ended Dec 31: revenues of $15.7 billion, up 3 percent year on year, driven by increased PC sales, and a profit of $357 million, 20 percent down year on year. Its three business segments had mixed results. The Intelligent Devices Group (PCs) brought in $12.4 billion, up 6.7 percent year on year. Solutions and Services reported $2 billion revenues, up 10.1 percent. The infrastructure Solutions Group (ISG – servers and storage) recorded $2.5 billion revenues, down 13 percent. But Lenovo said that, according to the latest third-party statistics, ISG’s share by revenue in the global storage market continued to increase year on year. ISG is developing a comprehensive hardware, software, and services portfolio in order to facilitate seamless AI application at the point of data creation and storage. ISG expects to remain a solid #3 globally for both storage and AI infrastructure.

…

Relational SQL database service and SaaS provider MariaDB could go private, according to TechCrunch, in a $37 million deal just 14 months after going public in a SPAC deal and attaining a $373.71 million market capitalization. California-based K1 Investment Management has made a non-binding offer for MariaDB. MariaDB is a separate entity from the MariaDB Foundation which runs the eponymous open source project. Since going public MariaDB has posted poor quarterly results, received NYSE warnings about its low market capitalization, laid off 28 percent of its staff, closed down its MariaDB Xpand and MariaDB SkySQL offerings, plus announced Azure Database for MariaDB would shut down in September 2025. A lender has threatened to claw back cash from its bank account. Q1 FY2024 (calendar Q4 2023) revenues were $13.6 million, up 6.3 percent, with an $8.8 million loss – better than the year-ago $12.7 million loss.

…

The Information reports Microsoft is developing a SmartNIC-like device equivalent to Nvidia’s ConnectX-7 400GbitE NIC, but maybe running at 800GbitE. The effort is being headed up by ex-CEO of Microsoft-acquired DPU-startup Fungible, Pradeep Sindhu, and focussed on moving data to AI systems which run Nvidia GPUs and/or Microsoft’s in-house Maia AI LLM processor. The card development time could be a year.

…

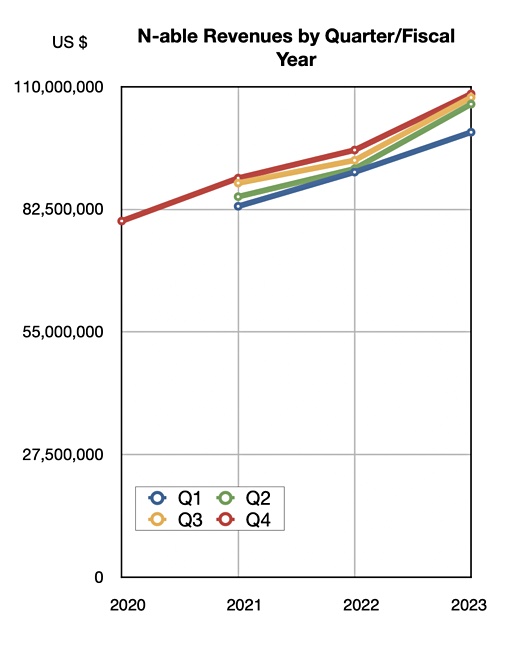

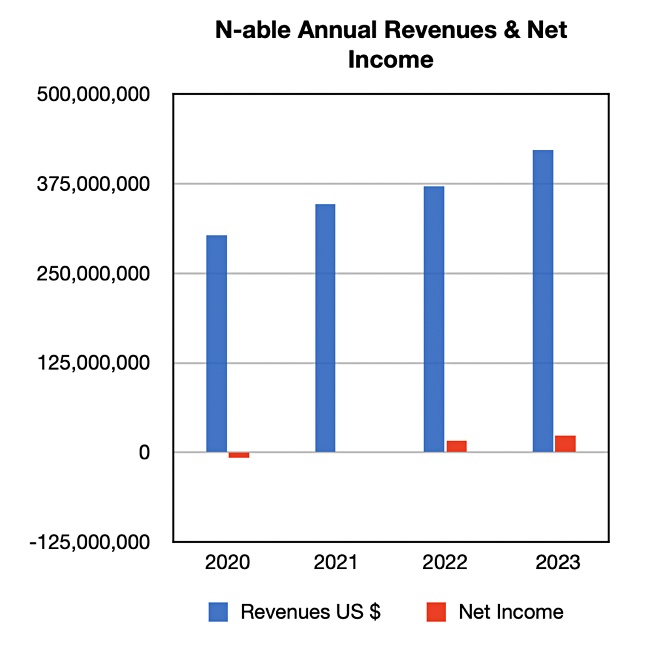

Data protector N-able, which provides its service through MSPs, reported final 2023 quarter revenues of $108.4 million, up 13 percent year on year, with a profit of $9.4 million, up 34.3 percent.

Full year revenues were $421.9 million, up 13.5 percent, and a profit of $23.4 million, up 40 percent. It’s turned into a dependable money-making machine.

…

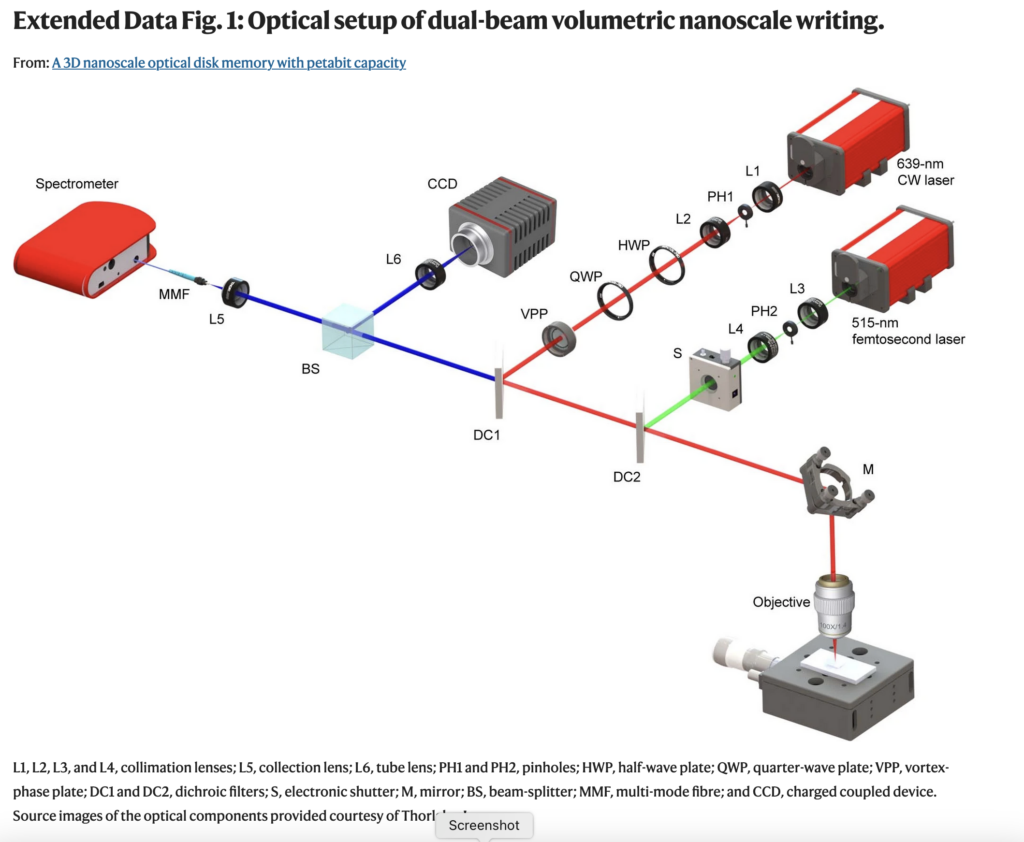

Chinese researchers have built a 3D nanoscale optical disk memory with 1.6 petabit capacity, Nature, the scientific magazine, has an article about “A 3D nanoscale optical disk memory with petabit capacity.” The abstract states: “High-capacity storage technologies are needed to meet our ever-growing data demands. However, datacenters based on major storage technologies such as semiconductor flash devices and hard disk drives have high energy burdens, high operation costs and short lifespans. Optical data storage (ODS) presents a promising solution for cost-effective long-term archival data storage. Nonetheless, ODS has been limited by its low capacity and the challenge of increasing its areal density.

“Here, to address these issues, we increase the capacity of ODS to the petabit level by extending the planar recording architecture to three dimensions with hundreds of layers, meanwhile breaking the optical diffraction limit barrier of the recorded spots. We develop an optical recording medium based on a photoresist film doped with aggregation-induced emission dye, which can be optically stimulated by femtosecond laser beams. This film is highly transparent and uniform, and the aggregation-induced emission phenomenon provides the storage mechanism. It can also be inhibited by another deactivating beam, resulting in a recording spot with a super-resolution scale. This technology makes it possible to achieve exabit-level storage by stacking nanoscale disks into arrays, which is essential in big datacenters with limited space.”

Their ODS reaches 1.6 petabit capacity by having 100 layers on both sides of a DVD-sized disk. Each layer is 100 micrometers distant from the next layer – imagine the laser beam focussing problems here. That means 800Pb/side and 8Pb per layer. A 1.6Pb disk holds 200TB. Put 500 of them in a rack and you’d get 100PB. The 1Pb ODS drive should last for between 50 and 100 years. We’ll see if it gets commercialized.

…

Data manager Quantum, which has delayed reporting its latest results, has received Nasdaq agreement to delay its SEC filings until May 15, 2024. It’s also received agreements from its lenders to temporarily waive financial covenants. It remains committed to be current with its SEC financial filings by May 7, 2024. Quantum has been prioritizing several financial and business projects targeting improvements to working capital, acceleration of new products and a more focused business.

Jamie Lerner, Quantum’s chairman and CEO, stated, “These amended agreements reflect the strong partnership we have with our Lenders in support of the Company’s path forward, as we work to complete the SSP re-evaluation process, resume timely filings of the Company’s financial statements and drive the business toward our long-term model. In addition, we are pursuing tangible strategic opportunities to pay-down debt as well as improve the Company’s operational and business outlook.”

…

Qumulo has a new SVP for North America Sales, Brian McCloskey, who comes from being CRO at DPU startup Fungible, bought by Microsoft. Before that he was Global VP for Unstructured Data Solutions at Pure Storage. McCloskey spent time at NetApp, SolidFire and EMC (Isilon) and way back to Data General before that.

…

Data protector Veeam has signed a partnership deal with services house Kyndryl for cyber-resiliency services. Kyndryl will now be a Veeam Accredited Service Partner (VASP). Debbie Nevin, VP of Global Alliances at Kyndryl, said: “With the ever-growing threat from cyber risks, maintaining cyber resiliency is a top priority for our customers.” She continued, “Our partnership with Veeam enables us to support our customers’ business continuity posture and ability to recover from increasingly more sophisticated cyber incidents.”