Startup Observe has raised a $115 million B-round for its SaaS-based observability service following 171 percent ARR growth in its latest fiscal year.

Observability and application performance monitoring (APM) software looks at applications – particularly cloud-native applications – and collects events and log data, activity metrics, component service invocations, and results. Observe adds meaningful business context to the raw basic data – such as customers and users, a shopping cart, a Kubernetes pod, a software build identifier, a problem ticket, and so forth. It brings this data to a single Snowflake repository and uses elastic cloud features for its analysis compute and capacity, helping issues get identified, understood, and fixed faster.

CEO Jeremy Burton explained: “Legacy monitoring and APM players, shackled by outdated architectures, are dead companies walking. As private equity or strategic acquirers strip them down for parts, Observe is taking a new approach designed for today’s modern distributed applications and massive data volumes. We’re thrilled to have investors who are thinking big and validating Observe’s approach in one of the fastest-growing segments in tech.”

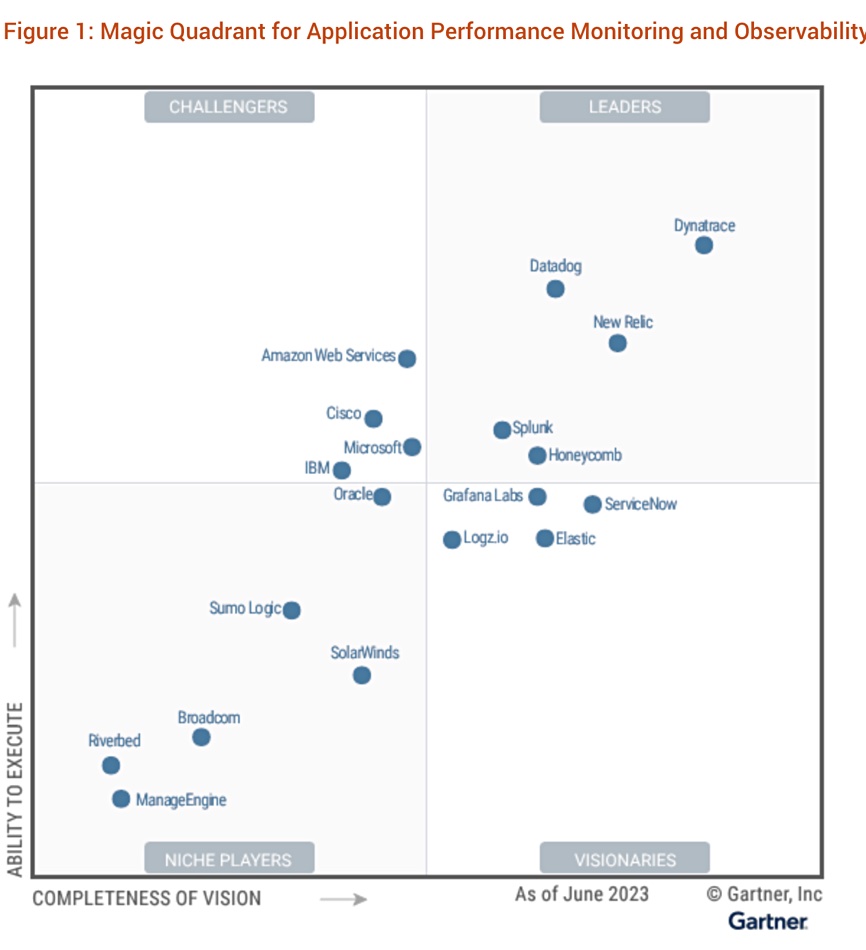

A Gartner magic quadrant named the leading observability and APM vendors in 2023 as Dynatrace, Datadog, New Relic, Splunk, and Honeycomb. There were 14 other vendors mentioned in the MQ, but not startup Observe – it hadn’t registered with the Gartner analysts. Cisco has acquired Splunk while private equity buyers took Sumo Logic and also New Relic. The latter was bought by Francisco Partners and TPG at an equity valuation of about $6.5 billion.

Observe’s new investors include Sutter Hill Ventures, which led the round, and existing investors Capital One Ventures and Madrona plus a marquee new investor: Snowflake Ventures. They all put in the cash valuing Observe ten times higher – $325 million as we understand it – than the company’s $35 million Series A round four years ago. That included contributions from Michael Dell, Snowflake CEO Frank Slootman, and Pure CEO Scott Dietzen.

Observe funding history:

- 2017 – founded

- 2020 – $35 million A-round

- 2021 – $7 million venture round

- 2022 – $70 million A2 round

- 2024 – $115 million B-round

- Total funding: $227 million

Recent growth stats are what pleased investors:

- New average contract value (ACV) increased 176 percent year-over-year in FY24

- Total Contract Value (TCV) increased 194 percent in FY24

- Net Retention Revenue (NRR), which indicates stickiness of product, is 174 percent (industry-leading is considered 130 percent)

Mike Speiser, MD at Sutter Hill Ventures and a founder of Observe, elaborated: “Observe has … delivered a product that is architecturally different to everyone else. The incredible growth in ARR and NRR is testament to the fact that this new architecture is now paying off for their customers.”

Customers include Capital One, Reveal, and Top Golf. Mark Cauwels, managing VP, enterprise platforms technology at Capital One, provided a canned blurb: “Like many cloud-first organizations, our data volume continues to expand. Observe provides a centralized and pre-correlated data layer that meaningfully organizes telemetry data from many sources at scale, helping drive faster response times.”

Observe’s headcount increased more than 50 percent year-over-year and the biz is growing its sales organization, planning to expand its market presence in North America over the coming year. It expects to more than double the size of its business.