Worldwide revenue for enterprise external OEM storage systems declined 2.1 per cent Y/Y to $7.8bn in Q4 2020. The market for the full year 2020 fell 4 per cent.

Capacity shipped grew 11.3 per cent year over year to 23.8 exabytes. Revenue from original design manufacturers (ODMs) selling directly to hyperscale data centres grew 2.0 per cent Y/Y to $6.6bn.

The figures are gleaned from IDC’s latest quarterly tracker. But there are no vendor breakouts by market share or revenues, alas, as the analyst firm has put those supplier numbers behind a paywall.

Last quarter, IDC stopped revealing vendor revenues in the total enterprise storage systems market, revealing only vendor numbers and market share in the external enterprise OEM storage systems market subset. It is now revealing only whole external enterprise OEM market revenue and capacity shipped numbers, together with a top five supplier share chart.

Total capacity shipments for the external OEM + ODM Direct + server-based storage market increased 8.3 per cent to 135.1 exabytes. IDC doesn’t reveal the total revenue for this market.

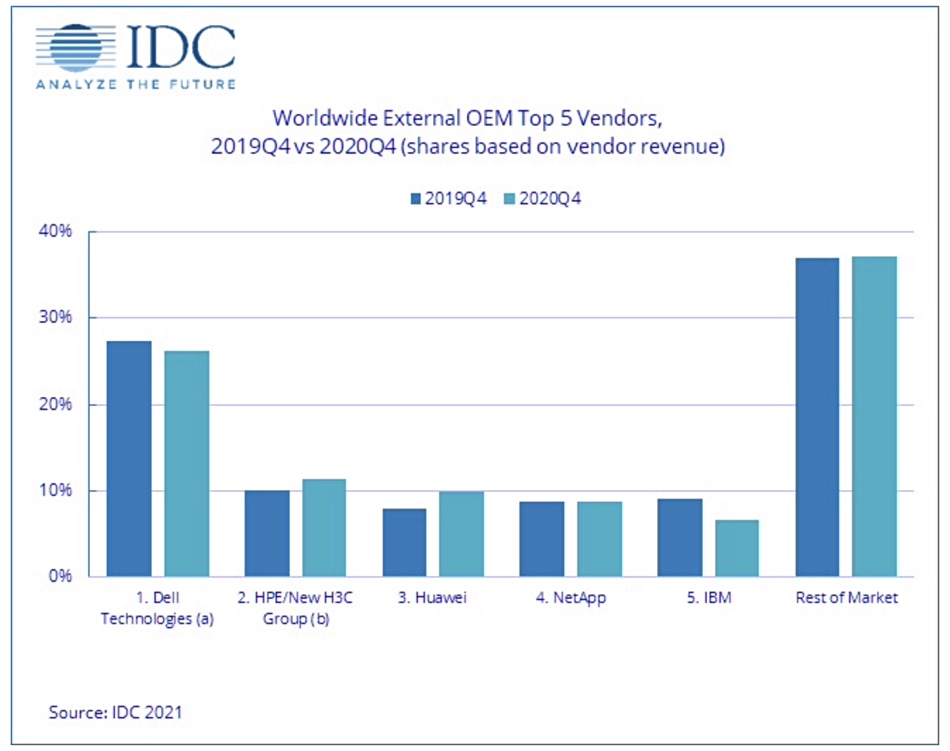

The chart above shows Dell was the largest supplier in the quarter, followed by HPE, Huawei, NetApp and IBM. We can see that Dell lost market revenue share Y/Y as did IBM. NetApp appears flat while HPE and Huawei gained share. The Rest of Market gained share slightly.

Greg Macatee, IDC research analyst for Infrastructure Platforms and Technologies Group, noted that China was the sole region to “experience growth during the quarter … nearly 30 per cent year over year … bolstered by strong performances from a series of locally headquartered vendors. Another of the overall enterprise storage systems market bright spots was the ODM Direct segment, which grew this quarter at a rate of 2.0 per cent annually.”

Happy HPE and Huawei

HPE pushed out a statement in response to the latest tracker. “HPE continues to grow and take share in the Storage market. In Q4CY’20, when the overall storage market declined and Dell/EMC, NetApp, and Pure Storage declined.” Any NetApp decline in revenue share looks infinitesimal on IDC’s chart.

HPE said revenues grew 10.8 per cent Y/Y and it increased its market share by 1.3 percentage points. Re-reading our earlier reports, we know IDC pegged HPE’s external storage revenue at $802.5m and market share at 10.1 per cent. On this entirely scientific basis, we deduce HPE’s revenues in Q4 2020 were $889.5m and revenue market share was 11.4 per cent.

NetApp’s external storage revenue looks flat on IDC’s chart. The company clocked up $704.8m in Q4 2019, according to IDC. IBM Q4 2019 storage revs were $721.8m with a 9.1 per cent share. Judging from the IDC chart, IBM’s market share fell in Q4 2020 to a 6.5 to 7 per cent revenue share range, and appear to be lower than Huawei’s Q4 2019 revenue ($616.2m).

Pure Storage’s IDC storage tracker statement said: “2020 was a tough market for everyone but there were many bright spots. We are pleased with our performance in EMEA, where we were one of only two major vendors to show growth. While the US market shrank quite a bit and was tough for all of us, we are happy with our growth in the USA, where we outperformed all of our major competitors. Japan was especially strong as we grew more than 13 per cent YoY in a market that contracted 5.4 per cent – and Latin America where we grew 5.6 per cent in a market that contracted 8.1 per cent.”

Stop the cannibals

According to IDC, the total all-flash array (AFA) market generated $3.0bn in revenue in the quarter, down 6.9 per cent Y/Y. The hybrid flash/disk array market was worth nearly $3.2bn, increasing 5.8 per cent Y/Y. That indicates that nearline disk capacity sales are rising faster than enterprise SSD sales. Disk cannibalisation by SSDs in enterprise storage is on the way down. This is a surprise to us.

To conclude, Dell and IBM gave up market share and HPE and Huawei grew their market share.