NetApp’s annual Insight opens in at Las Vegas today, and sees the company having had two quarters of declining revenues and facing a third. The business faces the prospect of reinventing itself as its business is experiencing a downturn.

The company is the industry’s largest standalone supplier of unified SAN and file arrays, the all-flash AFF and FAS arrays both running the ONTAP operating system. Alongside these are the E-Series stripped-down arrays, the SolidFire Elements all-flash arrays, the Elements near-hyper-converged systems, StorageGRID object storage and its DataFabric with NetApp storage having fast connections to, or running in, the AWS and Azure public clouds.

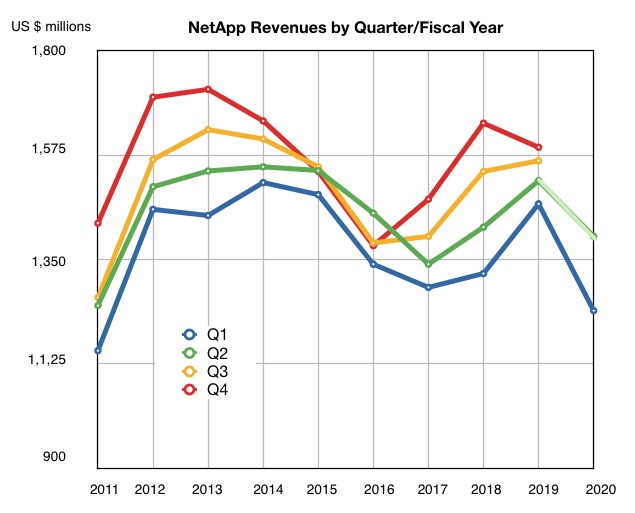

A chart showing its quarterly revenues organised by fiscal year lays bare the problem the company is facing; customers aren’t buying enough of its equipment and services and revenues have dipped since the third fiscal 2019 quarter.

We can see a roller coaster pattern overall with revenues generally rising strongly from fy2011 to fy2012, then more gently to fy2013 after which there was a 3-year dip. George Kurian became NetApp’s CEO in June, 2015 and turned things around.

The revenue dip bottomed out in fy2017 when revenues started rising again in fy2018 only to have growth slacken off in fy2019, starting to fall in the fourth quarter and then fall quite steeply in the first fiscal 2020 quarter with another decline expected to occur in the second quarter.

The Q1 fy2020 revenue slump was attributed to an enterprise customer buying slowdown due to macro-economic factors such as the trade war between China and the USA. HPE also registered a buying slowdown. IBM shows a pattern of declining revenues but this has been ongoing for some years. Neither Dell-EMC nor Pure Storage experienced what NetApp is going through, which suggests that the macro-economic factors are not affecting these suppliers equally.

Is this a short-term dip for NetApp or is history repeating itself?

The chart above shows a general overall downward trend over a six year period from the peak of fy2013. If NetApp can’t pull out of its three quarter revenue decline then, yes, we might conclude it’s not a short-term issue. But, whatever the dip’s longevity, it needs to find ways to grow its revenues.

Where could NetApp turn for growth? The main growth areas Blocks & Files can see are hyper-converged systems, data protection and management, multi-cloud data access, and high-performance file storage.

HCI market facing duopoly

The hyper-converged infrastructure (HCI) appliance business is booming, as Dell-EMC and Nutanix revenue growth illustrates. NetApp was late to this party and joined in with a semi-HCI system, one sold as a single system but having servers getting storage form a shared Elements array rather than from an aggregated virtual SAN using HCI node’s direct-attached storage.This is the HCI model used by Dell EMC and Nutanix, also by HPE and Cisco. NetApp’s quasi-HCI system is an outlier, like Datrium’s, and facing an uphill struggle as a lot of market education is needed to explain exactly what is is and how it does what it does.

Dell EMC and Nutanix own more than two thirds of the HCI market and the ability of NetApp to grow into a strong third player is, Blocks & Files thinks, questionable.

Object and multi-cloud storage

The object storage market is a relatively slow-growth one, compared to the HCI market and is anyway maturing into a way of storing files and commoditising into the storage of S3-accessed objects, limiting the opportunity for break out growth.

Object storage is not fast growing but there are no overwhelming incumbents as there is with HCI.

The hybrid multi-cloud data storage and access market is being pursued by all the main storage players. NetApp was early into this area with its Data Fabric approach but, so far this has not enabled it to avoid being in the situation it is in.

Subscriptions and the edge

Also, if its customers demand a general move to subscription revenues them NetApp may have to take a multi-quarter hit as perpetual licence income moves to lower, but longer-lived subscription sales. No short term growth opportunity here.

The Internet of Things and the general edge computing area is nascent. The AI area is a focus for every single one of its competitors and NetApp has no obvious edge here. These competitors are also all into storage for containers, NVMe over Fabrics and Optane SSDs and storage class memory. Although NetApp appears to have had an advantage with its MAX Data technology, significantly speeding data access speeds by servers, there is little evidence that it is making headway here.

Data Management and fast file access

The backup business is booming, witness Veeam passing a billion dollar run rate. And backup vendors are going into the public cloud and data management.

The data management area; aggregating and using unstructured data for test/dev, analytics, compliance and so forth, looks promising, with startups Actifio, Cohesity, Delphix and Rubrik established and growing. Blocks & Files would suggest that an acquisition here would bolster NetApp’s ability to enter this market. Acquisition could be a quick way to up its backup and data management game,

We would also suggest that very high-speed access to high-performance computing-type file data, as espoused by startups Qumulo and WekaIO, might be worth a look by NetApp’s potential acquisitions team.