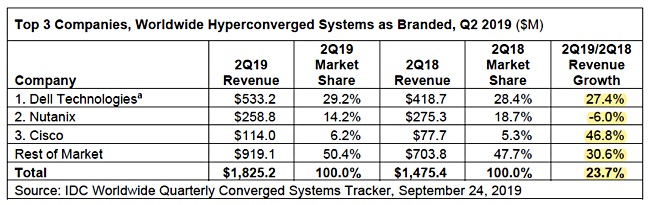

Nutanix is a more distant number two to hyperconverged infrastructure leader Dell Technologies while Cisco has overtaken HPE to become the number three player. Cisco’s 46.8 per cent growth rate was almost twice the rest of the market.

This is according to IDC’s Worldwide Quarterly Converged Systems Tracker for the second 2019 quarter. IDC tracks three kinds of system; Certified reference systems and integrated infrastructure (sucha as Dell EMC VxBlock), integrated platforms (e.g. Oracle Exadata), and hyperconverged systems (e.g. Dell EMC VxRail).

The category revenue numbers for the quarter are:

- CRS & IS – almost $1.5bn (10.5% y-o-y) – 37.5% of market

- IP – $626m (-14.4% y-o-y) – 16% of market

- HCI – $1.8bn (23.7% y-o-y) – 46.6% of market

- TOTAL – $3.82bn – we calculate this is 13.2% growth

HCI is the fastest-growing category, with CRS and IS growing strongly too.

HCI stats

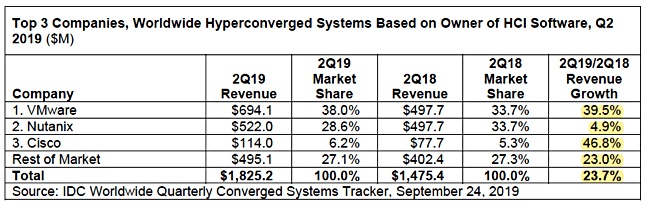

IDC tracks suppliers in the HCI market by branded system and by software owner. This reveals the extent of VMware’s penetration as many HCI brands use VMware’s software.

The analyst publishes figures for the top three branded suppliers:

As expected Dell is top of the table, Nutanix’s six per cent revenue fall reflects poor performance in the first half of 2019. But the main standout is that Cisco overtook HPE in the second quarter to take third place. HPE ranked third in the first 2019 quarter.

Cisco revenues were $114m in the second quarter and HPE’s were $83.5m in the first quarter. We can deduce HPE’s revenues did not grow to $114m in Q2. However, HPE reported 25 per cent SimpliVity HCI sales growth in the second 2019 quarter, slowing to four per cent in Q3.

Nutanix software strength

The HCI software owners’ table shows Nutanix has a far stronger claim to the number two spot than branded HCI sales on their own indicate:

Nutanix’s second spot comes from its 28.6 per cent revenue share. Its revenues grew 4.9 per cent, a long way behind top dog Dell’s 39.5 per cent and its 38 per cent market share.

This table reveals the real distance between Cisco and Nutanix. While Cisco’s 46.8 per cent growth rate is impressive, the company will have to grow at a lick for many more quarters to make an impact on Nutanix. Hurdlers don’t win marathons.