HDD maker Seagate wants us to understand three truths about the myth of SSDs replacing disk drives: SSD prices will not match spinning disk prices, SSD fab capacity won’t match HDD fab capacity, and SSDs are a bad fit for nearline disk workloads.

The points are made in Seagate presentation deck that is effectively a response to Pure Storage CEO Charlie Giancarlo’s assertion that “there won’t be any new disk systems sold in five years,” meaning by the end of 2028. In other words, disk and hybrid array customers could still be buying disk drives after that to replenish existing HDD storage but new storage systems will be flash-based.

We note that Pure is not a commercial SSD supplier, buying in raw NAND chips and building its own Direct Flash Module (DFM) drives. SSD suppliers and NAND manufacturers are not supporting Pure Storage in its claims, at least not publicly.

The disk drive manufacturers – Western Digital, Toshiba and Seagate – think this is wrong. Although SSDs are replacing disk drives in notebooks and desktop computers and also in the enterprise 10.2K 2.5-inch market, they are not replacing high-capacity, 7,200 rpm nearline drives in the enterprise and hyperscaler markets. That’s because the total cost of ownership of SSDs is significantly higher than that of HDDs and will remain so.

Seagate’s pitch deck explains why they think this is true. It identifies three claims:

- SSD pricing will soon match the pricing of disk drives

- NAND supply can increase to replace all disk drive exabytes

- Only all-flash arrays (AFAs) can meet modern enterprise workload performance needs

The Seagate slide deck then rebuts each argument.

Price point

Seagate believes that disk drives will retain a greater than 6:1 $/TB advantage over SSDs through to 2027. The average for the period is 6.6:1, with dips below that happening, but the price differential then recovering.

This is based on its analysis and three reports:

- Forward Insights Q323 SSD Insights, August 2023

- IDC Worldwide Hard Disk Drive Forecast 2022-2027, April 2023, Doc. #US50568323,

- TrendFocus SDAS Long-Term Forecast, August 2023

Partly this is based on Seagate extrapolating disk capacity growth, and that depends upon the HDD makers being able to increase areal density. Equally it depends upon NAND suppliers increasing 3D NAND layer counts and manufacturing capacity. Here’s the chart from Seagate’s deck:

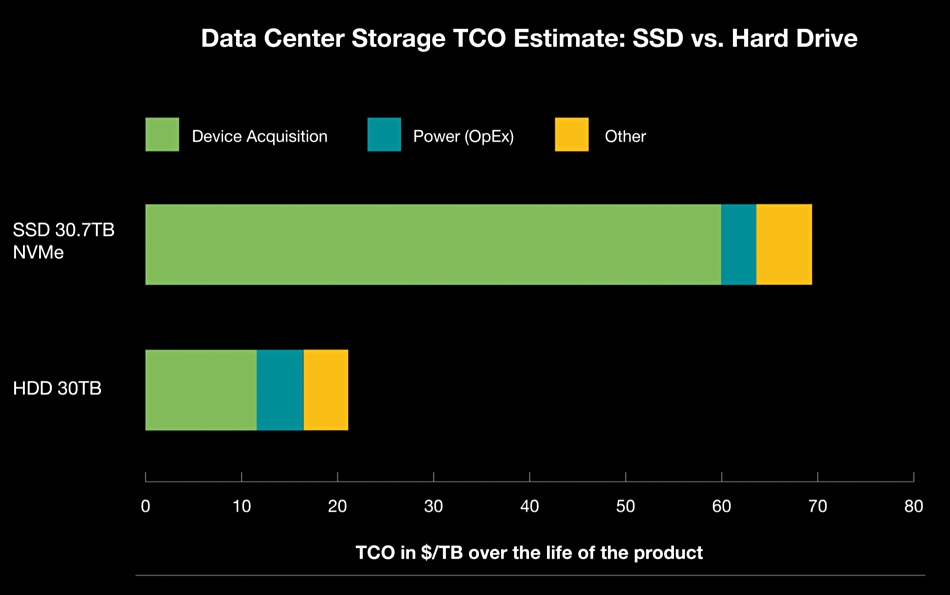

The TCO of HDDs and SSDs is composed of acquisition costs and then running costs, basically meaning power for operation and cooling, and other minor costs. Seagate asserts that SSD TCO is greater than HDD in $/TB terms over the product’s lifetime, saying the disk “price advantage is magnified at scale, where device acquisition cost is by far the most significant element of TCO.”

NAND manufacturing capacity

A NAND fab costs a great deal of money. For example, a coming SK hynix M15X DRAM fab in Korea will cost ₩5.3 trillion ($3.86 billion) and be ready in November 2025. There were 333 EB of NAND manufactured in 2023. TrendForce and IDC analyses predict that 3,686 EB of combined NAND and HDD capacity will be needed in 2027. The NAND industry could build 963 EB of that with HDDs contributing 2,723 EB.

Were that disk contribution to be replaced by NAND, the projected cost would be $206 billion, and Seagate says this makes SSD replacement of HDDs cost-prohibitive, as its chart indicates:

But Pure is not saying no more HDDs will be sold after 2028. Its pitch is that “there won’t be any new disk systems sold in five years,” which is different. There is no distinction in Seagate’s argument between new disk-based storage systems and replacement disk storage systems.

This gives Pure wiggle room for its claim as all it needs to show is that new systems are using SSDs instead of disk, and it will be darn near impossible for analysts and research houses to differentiate between old and new storage systems.

For example, if a hyperscaler expands capacity in an existing HDD-based system in 2029, adding 1,000 EB of disk to a storage tier, is that a new system sale? Clearly not, in the strict sense of a “new system.” Yet disk capacity ships will go up that year, apparently disproving Pure’s claim.

Seeing disk capacity shipments or, even better, unit shipments go down from 2029 onward would be the clearest indication that Pure’s claim is correct. Seagate might say that the gulf between projected NAND manufacturing capacity in 2027 and the overall SDD+HDD exabyte need is so vast that distinctions like this don’t matter.

Also, NAND capacity manufacturing limitations are just one of three planks in its argument and the third one will make this argument even stronger.

Enterprise workload performance needs

A Seagate analysis of IDC’s May 2023 Global DataSphere report superimposes streaming and real-time data on IDC’s numbers, mapping enterprise workloads to EBs stored:

It shows types of enterprise storage workload: nominal-time (disk response time), real-time and ultra real-time (SSD response time), and plots the scope of these against a low to high capacity axis. The bulk of the workloads, 90 percent, is in the medium to high capacity and nominal data transfer time area, meaning disks are suitable and SSDs not because they are over-performant and their capacity costs too much.

Ten percent of the workloads are low capacity and need real-time data transfer with 1 percent being even lower capacity and needing ultra real-time transfer, meaning SSDs are best for both.

In this view, Seagate is saying that HDDs and SSDs are not mutually exclusive. They are additive.

Thus, because SSDs have a 6:1 price premium over HDDs, NAND manufacturing capacity is limited, and the bulk of enterprise workloads don’t need SSD speed, there will be no wholesale replacement of HDDs by SSDs.

This leads to its final slide in the deck, the three Seagate truths:

Comment

It seems to B&F that, were SSD prices to tumble, such that the SSD premium reduced to 4:1 or less, and were SSD capacity supply not to be as limited as Seagate supposes, then enterprises and hyperscalers would adopt SSDs in preference to disk. After all, who does not want access to their data faster given the opportunity?

We think Seagate and the HDD industry’s pitch relies mainly on SSDs having a 6:1 price premium and, were that diminished, NAND fabs would be unable to make enough EBs of flash after 2028 for HDDs to start being replaced.

If the NAND fabbers saw a clear and stable market need for more NAND, due perhaps to the price premium dropping, then they would build more fabs, as night follows day. It would take time, probably extending into the 2030s and beyond.

In our view, price is the key to this. Adding another bit to flash cells with PLC (5 bits/cell) would boost capacity beyond QLC (4 bits/cell) flash but the technology looks unproven and impractical. Adding more flash layers is another capacity increase factor, but unless the HDD manufacturers stumble with HAMR and fail to get to the 4- or 5TB/platter areas, it looks as if we are facing a continuing status quo – and Pure Storage is wrong in its assertion.