RackTop Systems is looking to grow the market for its line of NAS appliances featuring built-in encryption and compliance controls thanks to $15m in Series A financing.

Founded in 2010 by US intelligence community veterans, RackTop specialises in what it calls CyberConverged arrays that integrate data storage and advanced security and compliance into a single platform.

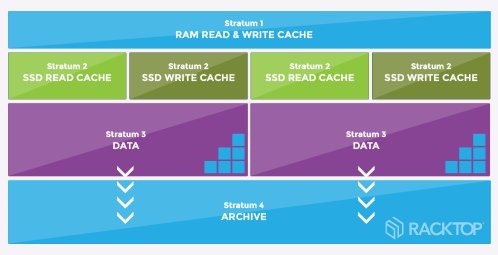

The firm’s BrickStor all-in-one data storage and management appliances come in a 2U rack-mount chassis with redundant power supplies and space for up to 12 3.5in SAS drives. There are two models: BrickStor Iron can be fitted with 12TB up to 168TB of disk capacity, while BrickStor Titanium has a capacity of 4.8TB of all Flash or up to 126TB of flash and disk. Both can be configured for dual 10Gbit Ethernet ports or 4 x 1Gbit Ethernet ports.

Eric Bednash, RackTop’s co-founder and CEO, claimed that BrickStor helps business with the problems of storing and managing large volumes of data, while at the same time protecting that data and addressing compliance requirements.

The built-in encryption appears to come from RackTop using Seagate FIPS certified self-encrypting drives. The advantage here is that there is no impact on performance as there would be if the array controller had to encrypt and decrypt everything writes and reads.

Another feature of BrickStor, Secure Global File Share (SecureGFS), is designed to allow users to collaborate and share files internally and externally without sacrificing security or compliance, thanks to encrypted file sharing over the LAN and WAN.

RackTop will use the new funds on product development and to expand its sales channel. It is targeting customers in industries such as the public sector, financial services, health care and life sciences and claims to have customers worldwide already using its platform to manage upwards of 50 petabytes of data.

Participants in the funding round including Razor’s Edge Ventures, Grotech Ventures and Blu Venture Investors.