Dell EMC this week posted its fourth consecutive quarter of storage growth and anticipates a revenue boost from the upcoming unified mid-range array.

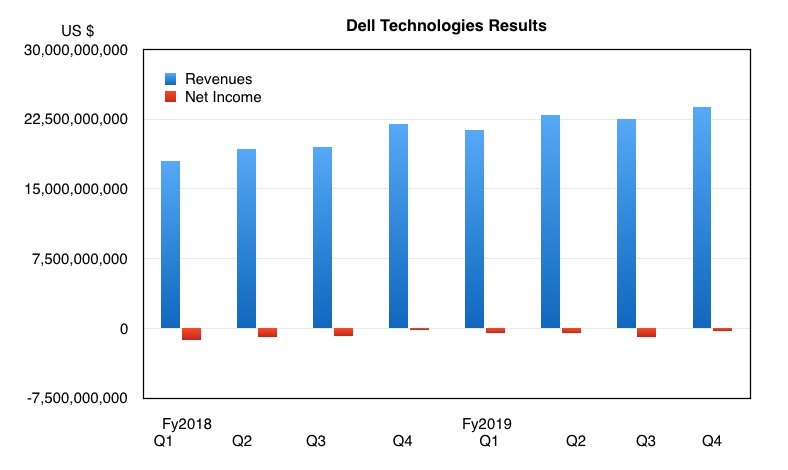

Revenues for Dell Technologies in the fourth fiscal 2019 quarter, ended February 1, were $23.84bn, up nine per cent y-o-y, with a loss of $287m (-$133m)

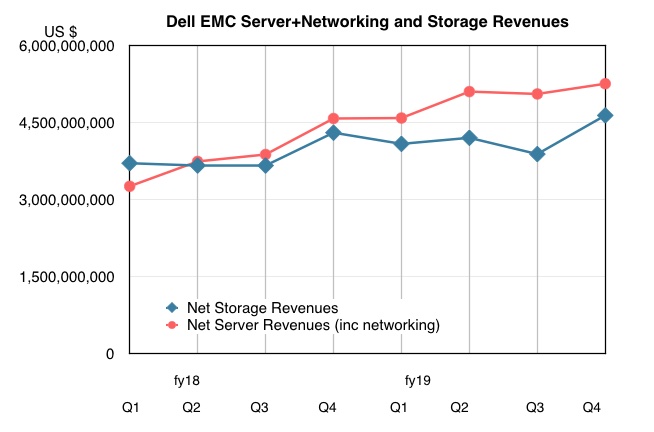

Storage is part of Dell’s Infrastructure Solutions Group (ISG) and brought in $4.6bn, up seven per cent y-o-y. That paled against the 14 per cent increase to $5.3bn for servers and networking. Two storage highlights: the hyperconverged VxRail appliance business has a $2bn annualised run rate and licensed bookings for VMware’s vSAN, which includes vSAN within VxRail, were up over 60 per cent y-o-y.

The storage line on the chart above shows a dip in revenues starting a year ago. There was growth using an annual compare but absolute numbers dipped overall from Q4 fy18 to Q3 fy18. Now they have accelerated.

The revenue decline shows that Dell EMC lost storage ground its multiple, overlapping products from the EMC and Dell sides of the house competed with each other and confused customers. The company is now sorting this out.

Earnings call

In the earnings call Vice Chairman Jeff Clarke said: “In storage we have now gained [market] share for three straight quarters and over 300 basis points more than anyone else in the marketplace through the first three quarters of 2018 according to IDC.”

He thinks Dell has gained share in the fourth quarter too and expects confirmation when IDC when brings out its storage supplier numbers later this month.

Clarke added: “We have plenty of work to do, but clearly we’ve stabilised the business. The investments that we’ve made in sales, capacity and coverage are yielding net new buyers, which is good to see. We continue to tune the sales compensation focus on storage, which is very important to us.”

He said Dell EMC has a leadership product in high-end storage [PowerMax] and is in good shape with unstructured data storage [Isilon.] But mid-range is a work-in-progress.

PowerTBD in mid-range

He declared: “While you’ve heard me talk about the need to simplify and consolidate the mid range, the products that we have in the mid-range today are more competitive than they were a year ago.”

Dell EMC has settled on PowerXxx as its storage array branding scheme, with PowerMax at the top, PowerVault at the low-end and Power-name-to-be-decided (PowerTBD?) in the mid-range. Currently the Unity, XtremIO, SC and ScaleIO products occupy that mid-range

The company is to merge these products into a single platform and aims to provide upgrade and /or migration paths for all legacy lines.

In November 2018, it revealed its plan to add storage class memory to this new mid-range product, which is expected before the end of this year.

The unified mid-range product is Dell’s “plenty of work to do”. When completed, the company will give its salesforce a simplified, better positioned mid-range product set to sell to less-confused customers. The result? Profit! If all goes to plan…