Western Digital is undertaking a huge project – to own and integrate the entire stack from silicon, glass and sand to arrays and composable systems software.

Originally a disk drive manufacturer, the company has made at least 14 acquisitions in recent years. These include the purchase of HGST in 2012, which helped consolidate the hard drive industry and took WD in to archiving. In 2015 the company got into object storage by buying Amplidata and in 2016 it bought its way into NAND manufacture and SSDs with the SanDisk takeover. In 2017 WD entered the drive array market by buying Tegile.

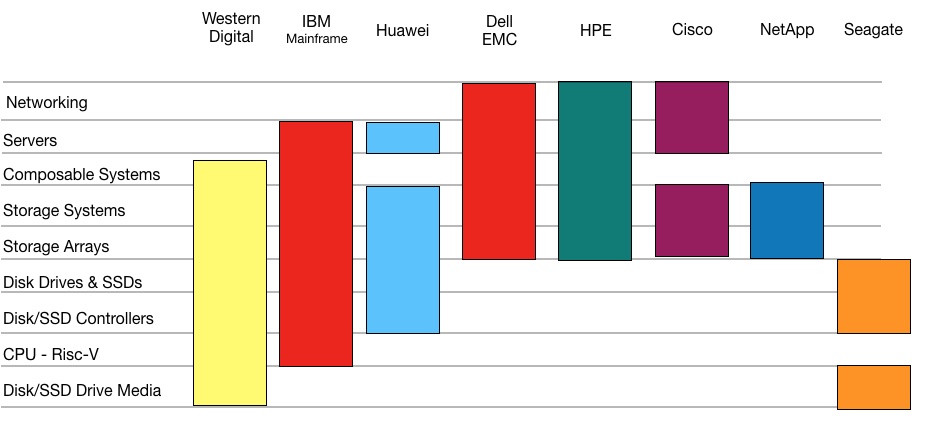

Let’s graphically relate the biggest enterprise storage players to each other:

In comparison to legacy disk drive competitor Seagate, WD’s business stretches further down the stack, into media and drive controller CPUs – RISC-V, and up the stack through drive arrays into system software.

WD now sells disk drives and SSDs to storage array and server-based hyperconverged infrastructure companies. It also competes with these companies.

This is a much more determined attempt to move up-stack than Seagate, which has also tried to build drive array revenues. For example, it bought Dot Hill in 2015, but that business has languished, and in 2017 it offloaded ClusterStor to Cray.

As well as competing with storage array customers WD has to manage sales at drive and systems levels. Drives mainly go to OEMs – storage array and server vendors – and to consumers. Storage systems go to enterprises and also hyperscale customers.

WD can, and does, use channels to sell to consumers, OEMs and enterprises. But hyperscalers need direct sales and custom products and the different sets of channel customers need different handling, marketing, product offers and so forth.

Channel flannel

OEMs could prefer to deal with Seagate and Toshiba for disk drives, which don’t compete with their customers for storage array systems business.

WD’s channel may also find selling storage systems to enterprises is an uphill struggle against established suppliers. WD is a relative newbie trying to enter an external drive array market with entrenched major players and facing competition from HCI suppliers and the public cloud.

Can WD win its great game? No-one else has done such a thing since IBM in its mainframe heyday. It’s a big ask – and probably no other company could do such a thing. It will be fascinating to see how Western Digital fares.