Cohesity grows nicely, SAP heads for the cloud and SIOS can save SAP in the cloud from disaster. Read on.

Cohesity has cracking fy 2019

Secondary storage converger Cohesity claimed a 100 per cent increase in software revenues in FY 2019, ended July 31, as it completed a transition to a software-led business model. As it is a privately owned US entity, the company revealed no meaningful numbers in its announcement – a so-called ‘momentum release’.

Now for the bragging. Cohesity booked its first $10m-plus software order and the number of seven-figure orders grew 350 per cent. Customer numbers doubled and more than half licensed Cohesity’s cloud services. In the second half of FY 2019, more than 50 per cent of new contracts were recurring, Cohesity said to emphasise the appeal of its subscription-based software.

Its channel had a good year too. In the fourth quarter, more than 30 per cent of Cohesity’s software sold was installed on certified hardware from technology partners, up from single digits in FY 2018.

SAP gets sappy happy in the cloud

SAP announced that its SAP HANA Cloud Services combines SAP Data Warehouse Cloud, HANA Cloud and Analytics Cloud.

Data Warehouse Cloud is, as its name suggests, a data warehouse in the cloud with users able to use it in a self-service way. SAP said customers can avoid the high up-front investment costs of a traditional data warehouse and easily and cost-effectively scale their data warehouse as data demands grow.

This Data Warehouse Cloud can be deployed either stand-alone or as an extension to customers’ existing on-premise SAP BW/4HANA system or SAP HANA software. More than 2,000 customers are registered for the beta program for SAP Data Warehouse Cloud.

SAP HANA Cloud is cloud-native software and offers one virtual interactive access layer across all data sources with a scalable query engine, decoupling data consumption from data management. Again it can be deployed stand-alone or as an extension to customers’ existing on-premise environments, allowing them to benefit from the cloud and the ability of SAP HANA to analyse live, transactional data.

SAP Analytics Cloud is d to be embedded in SAP SuccessFactors solutions as well as SAP S/4HANA. The embedded edition of SAP Analytics Cloud is planned to be offered as a service under the SAP Cloud Platform Enterprise Agreement. Developers can activate this analytics service to build and integrate analytics into their applications through live connectivity with SAP HANA.

General availability for SAP Data Warehouse Cloud. HANA Cloud and Analytics Cloud is planned for Q4/2019.

Blocks & Files notes this SAP cloudy data warehouse activity is taking place as Yellowbrick and Snowflake continue their cloud data warehouse service growth. This sector is hot.

SIOS saves SAP in the cloud

SIOS Technology Corp. announced LifeKeeper 9.4 and DataKeeper 9.4 to deliver high availability (HA) and disaster recovery (DR) for SAP clusters in physical, virtual and cloud environments.

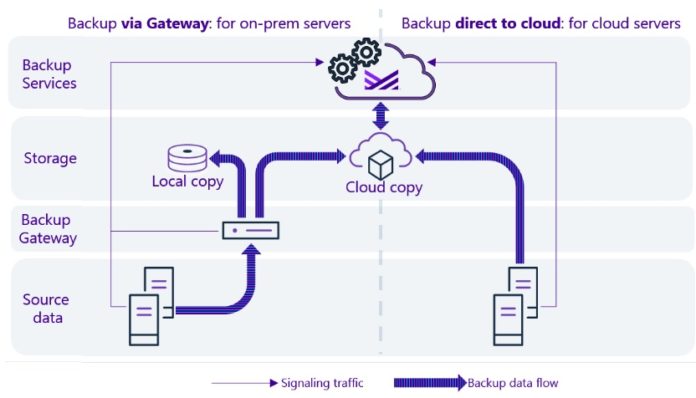

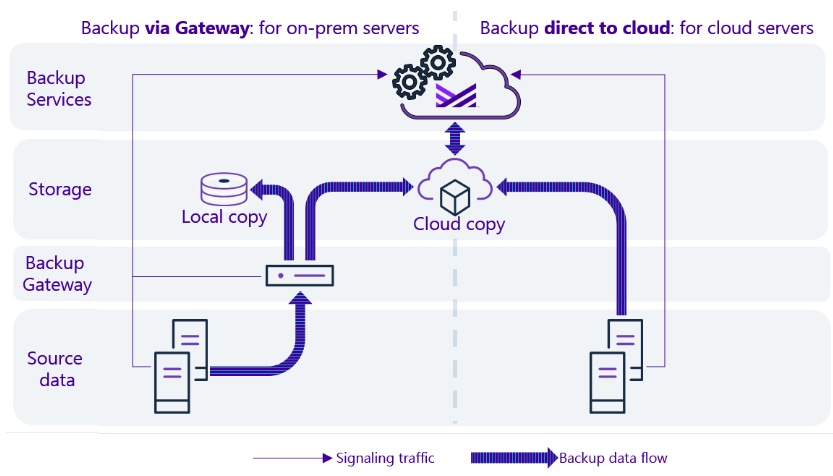

Typical clustering solutions use a shared storage cluster configuration to deliver high availability, which is not available in the cloud, according to SIOS. The company provides the ability to create a clustered HA solution in the cloud, without shared storage, ensuring data protection between two separate servers. It claims no other supplier can do this without using shared storage. Its alternative is simpler and cheaper.

SIOS DataKeeper continuously replicates changed data between systems in different cloud availability zones and regions, while LifeKeeper monitors SAP system services to ensure availability of SAP applications. If an outage occurs and the services cannot be recovered, SIOS LifeKeeper will automatically orchestrate a failover to the standby systems.

Shorts

Aparavi File Protect & Insight (FPI) provides backup of files from central storage devices and large numbers of endpoints, to any or multiple cloud destinations. It features Aparavi Data Awareness for intelligence and insight, along with global security, search, and access, for file protection and availability. Use cases for Aparavi FPI include file-by-file backup and retention for endpoints and servers, automation of governance policies at the source of data, and ransomware recovery.

Apple subsidiary Claris International has announced FileMaker Cloud and the initial rollout of Claris Connect. The company told us FileMaker Cloud is an expansion of the FileMaker platform that allows developers to build and deploy their FileMaker apps fully in the cloud or in hybrid environment.

The Evaluator Group has introduced a study of Storage as a Service (STaaS). You can download an abbreviated version from its website. It aims to guide enterprise STaaS users through the maze of approaches and issues they will encounter when evaluating a STaaS offering.

IBM Storage Insights has been redesigned with a new operations dashboard. Storage systems are listed in order of health status, and users can drill down to the components. Health status is based on the status that the storage system reports for itself and all its components. In previous versions the health status was based on Call Home events. The health status in IBM Storage Insights is closer now to what is shown in the storage system’s GUI and CLI.

Kingston Memory shipped more than 13.3m SSDs in the first half of 2019 – 11.3 per cent of the total number of SSDs shipped globally, according to TrendFocus research. That make Kingston the third-largest supplier of SSDs in the world, behind Samsung and Western Digital.

TrendFocus VP Don Jeanette said: “Our research finds that client SSDs make up the majority portion of units shipped while NVMe PCIe also saw gains due to demand in hyperscale environments. The storyline for the first half of 2019 is NAND shipments are increasing and pricing has bottomed out, thus driving SSD demand.”

According to Mellanox, lab tests by The Tolly Group prove its ConnectX 25GE Ethernet adapter outperforms the Broadcom NetXtreme E series adapter in terms of performance, scalability and efficiency. It has up to twice the throughput.

Violin Systems has formally announced it has moved to Colorado, merged with X-IO Storage, appointed Todd Oseth as President and CEO, and developed a flash storage product roadmap combining Violin and X-IO storage technologies. Oseth said: “We will soon be announcing our first step into the combined product line, which will deliver performance, reduced cost and enterprise features to the market.”

VMware has completed its acquisition of Carbon Black, in an all-cash transaction for $26 per share, representing an enterprise value of $2.1 billion.

WekaIO has been assigned a patent (10437675) for “distributed erasure coded virtual file system,” and has forty more patents pending. This fast file system supplier is a patent production powerhouse.

China’s Yangtze Memory Technology has improved its 64-Layer 3D NAND production yield, Digitimes reports. Expect the first products as early as the first 2020 quarter.