Korean DRAM and NAND maker SK hynix had a record first 2022 quarter with income boosted by Solidigm SDD earnings and a slower decline in DRAM prices than it expected.

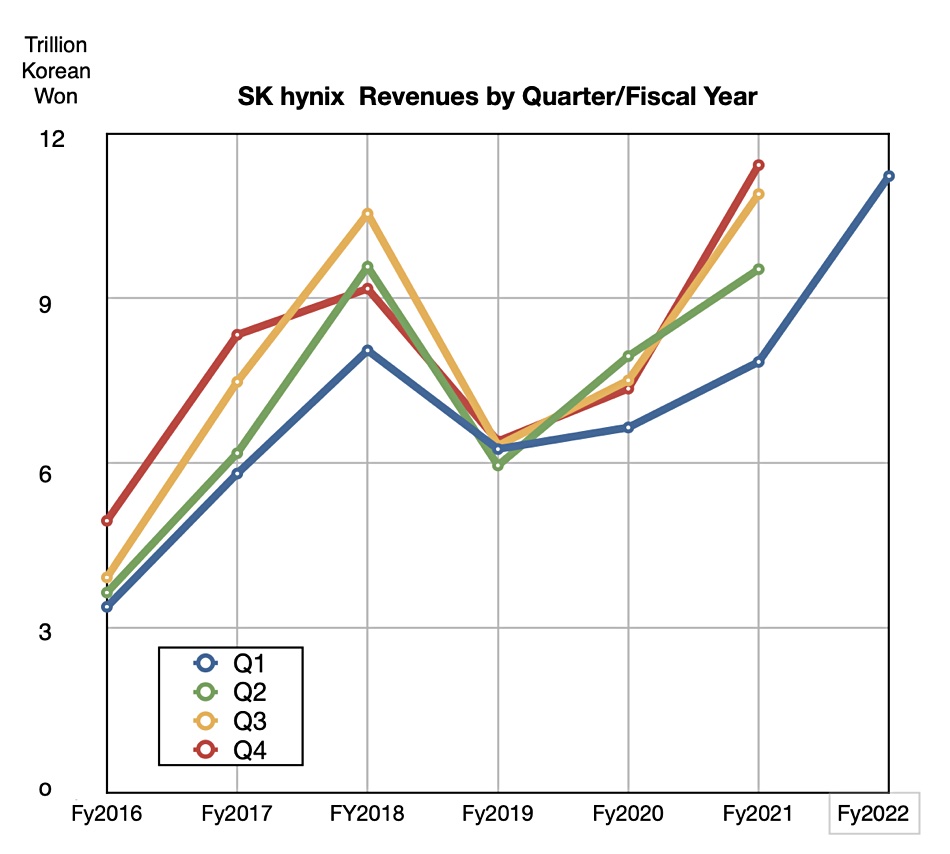

The company reported ₩12.16 trillion ($9.6 billion) in revenues for 2022’s Q1, a seasonally low quarter, up 43.2 per cent on the year, with a profit of ₩1.98 trillion ($1.56 billion), a rise of 99.4 per cent. Solidigm, the acquired Intel SSD business, was incorporated as SK hynix’s subsidiary at the end of 2021.

Kevin (Jongwon) Noh, SK hynix CMO, said: “I think we’ve accomplished meaningful performance despite the seasonality issue. As demand for server chips is on the rise, the memory business will improve into the second half.”

DRAM demand should rise in the second half of the year as new server CPUs, such as Intel’s Sapphire Rapids and AMD’s Genoa EPYC, trigger buying activity.

The stellar results were still affected by customer supply chain issues and a company statement said: “SK hynix responded to customer demand in a flexible way, while focusing on profitability management, resulting in handsome earnings.” There was also a ₩380 billion ($3 million) provision for compensation, including product exchange, to a customer after it found a performance weakness in some DRAM products supplied by SK hynix.

SK hynix said it had improved the yield rate of its advanced 1anm DRAM products (the fourth generation of the 10nm node) and 176-layer 4D NAND. The company said it is on track to develop the next-generation products, which include 238-layer 3D NAND.

This is the highest number of layers yet revealed by a 3D NAND manufacturer. We understand Solidigm is developing 196 layers and Samsung 200. Micron is producing a 176-layer product and hasn’t said what’s next, and YMTC is at the 128-layer level, some way behind.

SK hynix’s NAND revenue was helped by Solidigm’s contribution. There was weak demand in China for mobile device NAND. NAND shipments in the second quarter should rise due to enterprise SSD demand. Coincidentally, Solidigm recently announced two new enterprise SSDs.

Equipment shipment delays may well affect SK hynix’s mass-production timeline, according to Aaron Rakers, managing director and technology analyst at Wells Fargo Se.