The latest quarterly results for NetApp were lifted again by record all-flash array sales.

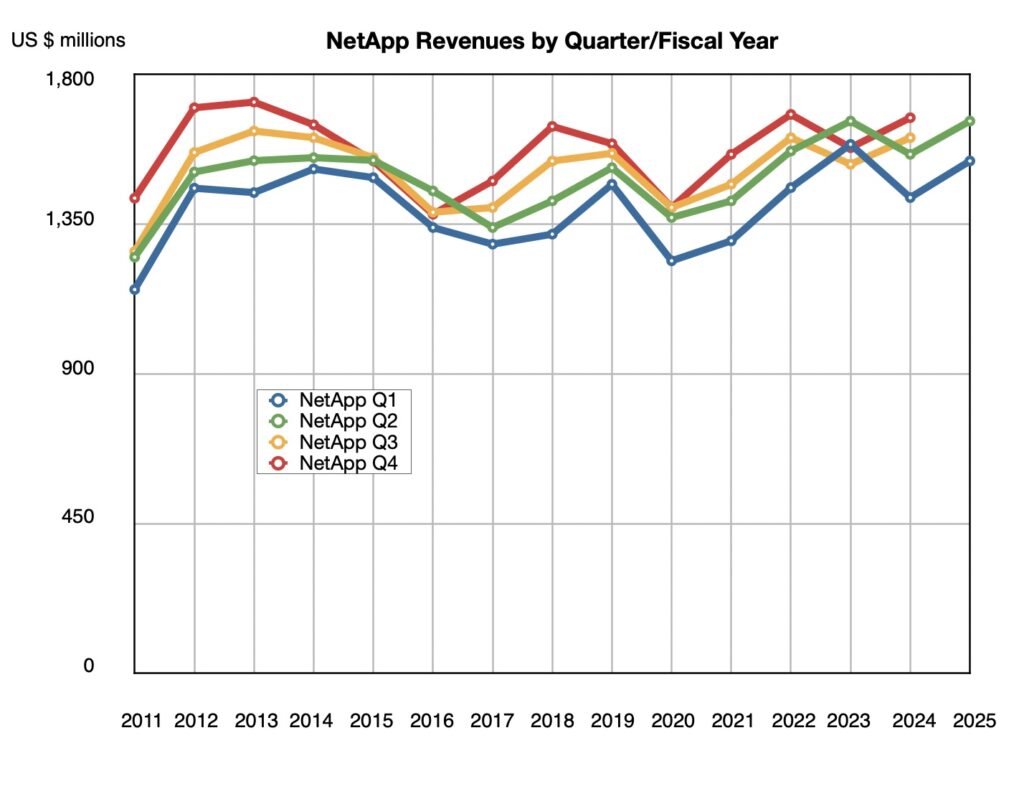

Revenues in its Q2, ended October 25, 2024, were $1.66 billion, up 6.1 percent year-over-year and beating its $1.64 billion mid-point guidance, with a GAAP profit of $299 million, 22 percent more than a year ago. It was the company’s fourth successive growth quarter with annual recurring revenue from all-flash arrays reaching a record-high $3.8 billion. The company promptly updated its full year revenue forecast to $6.64 billion +/- $100 million from the prior $6.58 billion +/- $100 million.

CEO George Kurian stated: “I am extremely pleased with our Q2 performance. Revenue growth was driven by a 19 percent year-over-year increase in all-flash storage and strong performance in first party and marketplace cloud storage services. We achieved record Q2 operating margin and EPS, ahead of our expectations.”

Quarterly financial summary:

- Consolidated gross margin: 72 percent vs 72 percent a year ago

- Operating cash flow: $105 million vs $135 million a year ago

- Free cash flow: $60 million vs $97 million last year

- Cash, cash equivalents, and investments: $2.22 billion vs $3.02 billion last quarter

- EPS: $1.42 vs $1.10 a year ago

- Share repurchases and dividends: $406 million in stock repurchases

The free cash flow number was much lower than last quarter’s $300 million, and CFO Mike Berry said: “Our lower year-over-year cash flow results in Q2 were primarily driven by upfront payments for strategic SSD purchases which are forecast to be predominantly utilized during fiscal year ’25.”

NetApp pulled in $1.49 billion from its hybrid cloud segment revenue, 5.4 percent more than the year-ago $1.41 billion. The public cloud segment revenues rose 8.3 percent to $168 million, compared to $154 million a year ago. Billings rose 9 percent to $1.59 billion from last year’s $1.45 billion. Product sales were $768 million, up 8.1 percent.

Kurian said NetApp sales in the flash, block, cloud storage, and AI markets were “bolstered by both secular and company-specific tailwinds.” He pointed out that NetApp has “broadened our all-flash storage portfolio substantially with updated high-performance flash, capacity flash, and block-optimized products.”

He said: “This is clearly outpacing the market and all of the competitors.” It has certainly helped NetApp’s flash revenues.

Some 40 percent of NetApp’s installed base has converted to flash, with Kurian saying: “So even if flash is growing fast, the total installed-base is growing, and it is very large … We are outperforming the market and all of our competitors quite substantially. So it is clear that we are winning new wallet within existing customers as well as … net new to NetApp customers.”

He added more color in the earnings call: “The majority of net new logos to NetApp come from smaller … commercial market [customers], but the high-end products are enabling us to win wallet share within existing customers. [ASA] Block wallet share is entirely new to NetApp. We’ve never sold a block-optimized product before. So it’s all net new wallet for us.”

Matt Bryson, a Wedbush analyst, gave his insights into NetApp’s upside, mentioning strength in the Americas, saying: “We believe key leadership changes NetApp has made in this geography are helping drive superior results. We would also note that NetApp did not show any signs of the slowdown in Fed spending other vendors encountered that were attributed to the lack of a new budget.”

He also cited a public cloud rebound and low-cost SSD media due to NetApp’s buying “largely in C2H23, when NAND pricing had cratered.”

Analyst Jason Ader told subscribers this was “another beat-and-raise quarter,” calling out NetApp’s billings, which “continued to surprise to the upside,” increasing 9 percent year-over-year, marking the company’s fourth consecutive quarter of year-over-year growth. He also pointed to NetApp’s Remaining Performance Obligations (RPO), the total value of contracted products and services that NetApp has yet to deliver to its customers.

He told subscribers that NetApp’s RPOs, “which the company started disclosing last quarter, came in at $4.4 billion (with unbilled RPO up 9 percent sequentially), driven by the company’s Keystone storage-as-a-service offering becoming a more meaningful part of the business.” NetApp says its RPO value is a “leading indicator of future growth in our business.”

As for Keystone, Kurian said: “We have yet to see a single customer churn on Keystone. So it has been an incredibly rock-solid product.”

There were no red flags raised in the earnings call, with Kurian saying a hundred or so on-prem sales wins across vertical markets and geographic regions in the quarter were “leading indicators of future large-scale inferencing deployments.”

He added: “We also have had some strong momentum with Google, with their distributed cloud for AI deployments in the public sector. And so we’re encouraged at the prospects of our AI business going forward.”

Again Kurian added detail when answering an analyst’s question: “There were a good number of them that were building GPU clusters, both SuperPODs and kind of BasePODs that we saw where they were essentially running the GPUs against high-performance file systems from NetApp and some that were building data lakes because their data was so scattered that they wanted to bring it together and they chose our infrastructure to power the data lake. So a mix of them. Interesting, it’s early in the cycle. We just brought to general availability our full stack with Lenovo, for example, with OVX, and we’re doing creative work with NVIDIA around some of their software.”

He also said he expects the developing disaggregated ONTAP Data Platform for AI product to be “deployed in customers by the end of next calendar year.”

NetApp has a strong installed base which isn’t going to buy more of its on-prem and public cloud products and services in the future.

Next quarter’s revenue outlook is $1.68 billion +/- $75 million, a 4 percent year-over-year increase at the midpoint, less than Q2’s 6.1 percent rise, but still a rise.