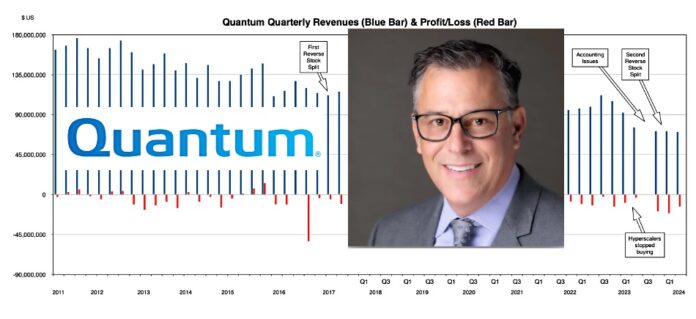

Analysis. Quantum has been wading through the mire. After two reverse stock splits, a hyperscaler tape system buying stop, a second set of financial reporting problems, and an abrupt end to CEO Jamie Lerner’s run of six revenue-raising quarters, the business is down in the dumps again.

Quarterly revenues have dropped to their lowest level for more than 13 years. Back in 2011 Quantum was a $160 million-plus a quarter supplier, but it has steadily dropped since then. Jamie Lerner became the CEO in 2018 and arrested the revenue decline for a few quarters, before it resumed in 2020 to a $73.1 million low point in FY2021’s first quarter.

He clawed it back, over ten quarters, to $112 million in the third FY2023 quarter – but then hyperscaler customers started to stop buying Quantum’s Scaler tape libraries as Quantum would not lower the price below its own profitability level, and revenues collapsed. They were $105.3 million the next quarter, then $92.5 million and then vanished in puffs of financial reporting smoke. Quantum found it necessary to recalculate and restate its accounts in a massive snafu that caused its stock price to fall, making a reverse stock split necessary to retain its Nasdaq listing.

Its latest quarter, Q2 FY2025, saw $70.5 million in revenues, with a $13.5 million loss. It’s carrying $133 million in total debt. It last made a profit four years ago, in FY2020: $4.7 million in Q3. The last profit before that was $12.9 million in Q4 FY2015. This is a persistently loss-making concern that has been in a recovery state ever since Lerner became CEO.

It’s ironic that Lerner’s climb out of revenue misery was partially fuelled by selling tape library systems – the old, old technology that Quantum has not been able either to profit from, like Spectra Logic, or leave behind as it grew new product revenues.

Taking a cold look at its non-tape products, we see that none of them are leaders in their market niches. Or, if they are, the niche seems too small to sustain the whole enterprise. For example, we might say:

- StorNext has great features, buttressed by allied ActiveScale and CatDV media asset management systems, but it appears it cannot support or grow Quantum on its own.

- The DXi deduping backup appliance line lags behind Dell’s PowerProtect and the ExaGrid products.

- The ActiveScale object storage line is another object storage product.

- The USP video surveillance products, however well they’re doing, cannot rescue Quantum either.

Its latest technology – the Myriad storage operating system – is entering a crowded market and will need continued investment to make progress before it starts to generate a return.

Storage Architect consultant Chris Evans tells us: “I agree that the company needs some kind of drastic intervention. Quantum is definitely one of many companies selling products that still have some legacy value to a niche set of customers, yet at the same time, the revenue from them is not enough to invest in R&D to move them on to better solutions. Quantum is stuck in a scenario of multiple issues:

- The demand for its existing products is waning.

- There’s no money for R&D to make them better (and little justification for improvement).

- There is little or no asset value to the IP.

- The money required for a pivot is more than the business justifies.

His conclusion: “It’s an interesting dilemma that has no obvious solution.”

Blocks & Files asked Quantum CEO Jamie Lerner if Quantum could ever return to the $150 million-plus revenue quarters of 2011? He provided a detailed and open answer.

“I think we can, but I have to walk you through what we’ve had to do when I came here. We had $225 million in debt. We had an SEC investigation for a lot of practices that weren’t good. We had a very aged product portfolio that had not been invested in, and a lot of aging infrastructure. And when I looked at that, I made the bet then, and I still think it’s the right bet, that the only way we could get to that $150 million plus quarters again – there’s no fancy marketing that could do that, there was no financial trickery – was going to take engineering execution. We were simply going to have to innovate, create things that either matched or leapfrogged our competition.

“But we hadn’t done that in a long time. I couldn’t just say: ‘Hey, let’s go build Myriad.’ We had to start with walking a walk.

“We had to just take StorNext to all-flash. We had to build user interfaces that were modern. So we had to start looking at StorNext and ActiveScale. We had to fill in holes we didn’t have, like object storage. We had to learn about the cloud. We had to figure out how to do cloud-based analytics and the platform we built in the cloud. We had to learn about data services, sync, rep, compression, dedupe, inline compression and dedupe – things that we just had to get better at. We had to acquire things like better metadata management.

“Now during that period, COVID-19 hit and wiped out our Media and Entertainment business, and I had to take more loans. Then we had an extremely unfortunate supply chain crisis, especially as it related to tape drives. Tough again.

“Then, who would have ever believed our auditor would have to quit, and the new auditor says: ‘Redo your financials for ten million.’ And the result after we redid them? Effectively the same.

“And so this reorganization of the company; what we’ve had to do has taken us financially to the very edge. I’ve had to build a new ERP system. Ours was 25 years old. We had to do it with our buildings and laboratories. The air conditioning, light was failing, and I had to build that new laboratory that you visited.

“But now, if you look at us today, after taking us to the very edge, we have a new ERP system, we have a new laboratory. We have an entirely new product portfolio that we’re now reducing really into Myriad and ActiveScale, right? That’s been the whole reducing it down so that we have a very high speed file system and then a flash disk and tape data lake.

“And I think there’s elements of these that are architecturally very unique. And it’s taken us to the brink, but now I’ve got a fresh portfolio, including the i7 Raptor, including Myriad, and with Myriad, we’re going to be announcing GPU direct. We’re going to be announcing a parallel client. We’re going to be announcing much more scale.

“ActiveScale runs on flash; it runs on disk; it runs two dimensionally, erasure coded tape. The i7 Raptor is shipping this month, and we already have multi-million dollar orders from cloud companies and enterprises.

“So you look at this: after taking us to the brink, we have resolved the financial problems and these restatements to the point were so clean now, it’s ridiculous. We have new labs, new systems, a whole new product portfolio.

“And what I like about this most recent quarter, we said, our negative EBITDA days are behind us. We’ve now done the cost-cutting we had to do because of all this spending. We’re now break-even – and going forward, we’re generating cash that we are going to use to start cranking up the sales and marketing effort.

“So yes, it’s been a long and difficult road, but I think most people are shocked that, with our situation, we’ve been able to do this kind of innovation, build these kind of products, without hundreds of millions of dollars of venture capital investment, without the infrastructure of a Dell or Hewlett Packard. We’ve been able to do this, and it’s been small teams of very, very advanced engineers who’ve been very efficient and been able to build these products like Myriad.

“So I think we’re poised to begin that clawback. I think we’ve gone through all this shit, and it’s been a lot of shit that we’ve had to slog through, but we’ve slogged through it, and I think we’re coming out the other side.”

He continued: “It’s been the hardest six years of my life. It’s been the hardest thing I’ve ever taken on and what I just told you is the honest, just the damn honest truth of what we’ve been slogging through. And I’m only doing it because I do think in the end, it’ll be worth it.”

I asked a question about whether Quantum will be better taken into private ownership?

Lerner replied: “That’s a fair question. Doing this as a public company is the hardest way to do this, right? I’m putting out [SEC] 8Ks and having to do all these filings that customers go: ‘My God, what is this?’ And every time I re-organize the debt, it’s visbile. And every piece of our financial structure is visible and confusing. And the way we deal with adjusted EBITDA … there’s such technical accounting.

“The other thing is, we are fragile, right? I mean, one or two 18-wheelers don’t ship, and I miss my revenue. Like, does it matter? I mean, to a public company that matters. To a private company, you’d be like, ‘Okay, I didn’t get the revenue in June. I got it in July.’ But to a public company that could be crisis. So I definitely think that many CEOs do this kind of work privately, the kind of surgery we’re doing, and I don’t think that’s off the table.

“We’re looking at every way to get this completed, but I think it’s a fair question, and I do think this kind of work is easier when you’re you’re private.”

We asked: “Would it be equally fair to suggest that you already accomplished what you would have done if you were privately owned four or five years ago?”

Lerner agreed: “I think that’s a fair statement. I mean, at this point we’ve done all the slogging. We’ve dragged our investors through all this muck already – you know, we’ve kind of gone through it – so, you know, it may be water under the bridge.”

It most probably is water under the bridge. Let’s wish Quantum freedom from any more accounting snafus, pandemics and supply chain hiccups and let it get on with selling its refreshed product portfolio.