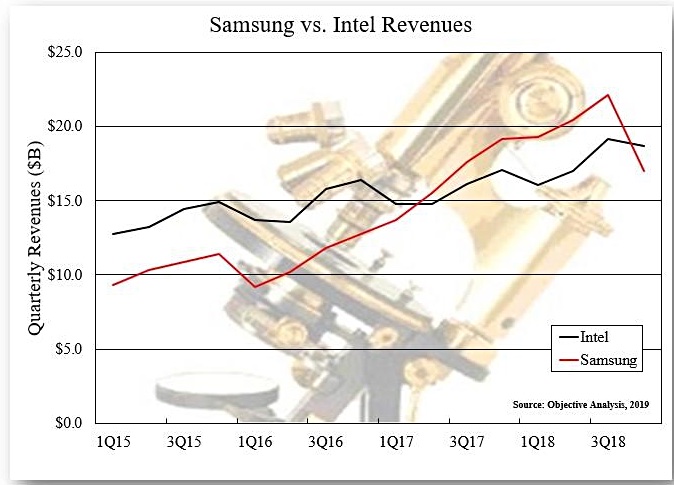

Intel has regained the semiconductor revenue lead, re-overtaking Samsung.

Fourth quarter Intel revenues were $18.66bn while Samsung’s semiconductor revenues were KRW18.5 trillion, which converts to $16.686bn; below the Intel number.

Objective Analysis’ Jim Handy says; “When Samsung’s semiconductor revenues rose above Intel’s that was big news.”

He’s charted the trend in their comparable revenues to show Samsung passing Intel some six quarters ago and now Intel regaining the lead;

Samsung said its fourth quarter earnings were affected by a drop in demand for memory chips used in data centres and smartphones.

It stated; “The Memory Business saw overall market demand for NAND and DRAM drop due to macroeconomic uncertainties and adjustments in inventory levels by customers including datacenter companies and smartphone makers. For NAND, overall demand was low, as major customers opted to hold back on orders in anticipation of further reduction in price.

“Amid the lackluster sale of smartphones, a trend toward high-density in mobile persisted, and the All-Flash-Array portion increased in the fourth quarter. In the case of DRAM, server demand declined due to inventory adjustments by datacenter companies. For mobile, while mobile set demand reduced due to weak sales of new smartphones by major customers, growing orders of high-density products over 6GB content partly eased the negative trend.”

Samsung thinks: “Demand for memory is seen gradually recovering from the second quarter.”

Handy says: “This all has to do with the price collapses first in NAND flash, and then in DRAM. I see no reason to expect a price recovery for quite some time. There’s an oversupply that has to be slowly worked off.”

He suggests that; “This is one of those times when it’s a lot more fun to watch the semiconductor market than to participate in it!”