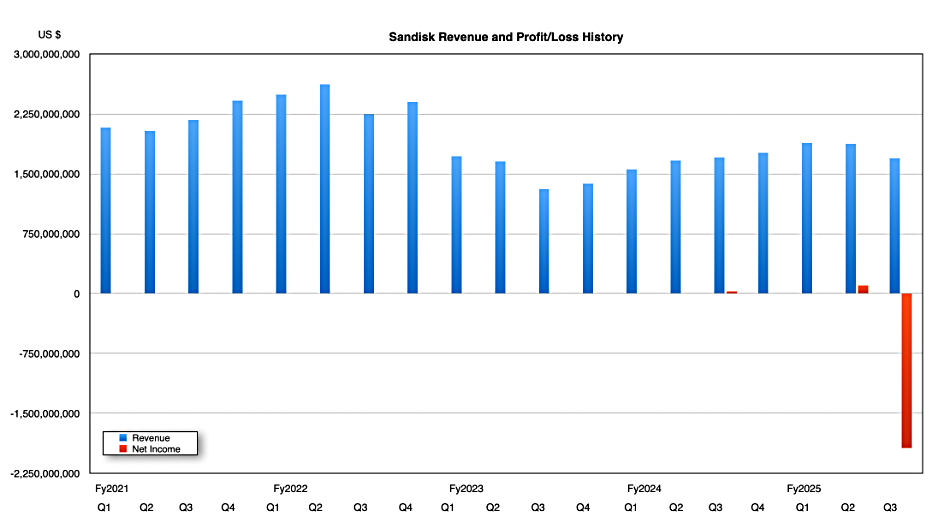

In its first reported results since being split off from Western Digital, Sandisk reported revenue and profit declines for its NAND and SSD business.

Revenues in the quarter ended March 28 were $1.7 billion, down 0.6 percent year-on-year and 10 percent sequentially. Sandisk said its revenues were above the guidance range. After a $1.83 billion goodwill impairment charge, there was a GAAP loss of $103 million, contrasting with the year-ago $27 million profit.

CEO David Goeckeler stated: “I’m pleased with our team’s execution in the first quarter as a standalone company. Sandisk’s innovation was reinforced, with a strong early ramp of BiCS 8, our latest technology engineered to deliver industry-leading performance, power efficiency, and density. We have taken actions to reduce supply to match demand and commenced price increases this quarter. Our investment, supply management, and pricing strategies will remain focused on maximizing returns.” We’re told bit shipments were down by low single digits.

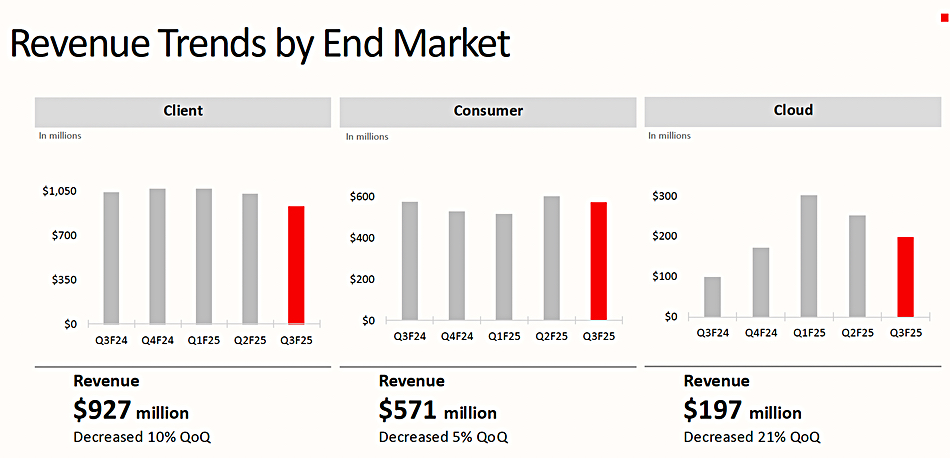

Cloud (datacenter) segment revenues were down 21 percent quarter-on-quarter to $197 million. Client (PC, notebook) segment revenues of $927 million were down 10 percent quarter-on-quarter while consumer (retail) revenues declined 5 percent quarter-on-quarter to $571 million.

Sandisk said it expanded its hyperscaler market share in the cloud segment, with 12 percent of its bit shipments going that way compared to 8 percent a year ago.

Client revenues declined despite expected demand drivers such as the Windows 10 end-of-life replacement cycle, a post-COVID refresh, and PCs requiring more storage.

Financial summary

- Gross margin: 22.7 percent vs year-ago 27.4 percent

- Operating cash flow: $26 million vs year-ago $-12 million

- Free cash flow: $220 million vs year-ago $87 million

- Cash & cash equivalents: $1.5 billion vs $377 million a year ago

- Diluted EPS: $-0.30 vs year-ago $0.57

CFO Luis Visoso discussed the impairment charge for Sandisk’s intangible goodwill asset, saying: “This quarter, we evaluated our goodwill for potential impairment following a quantitative test in accordance with accounting standards and the engagement of valuation specialists. We concluded that the goodwill balance was impaired and recorded a non-cash impairment charge of $1.83 billion. As a result, our quarter-end goodwill balance was reduced to $5 billion.”

A mini-NAND glut is affecting prices. Goeckeler said in the earnings call: “ASPs were down high-single digits, reflecting continued oversupply in the market. This was higher than our mid-single-digit decline expectation that we shared at our Analyst Day. To address this, we are extending our fab underutilization actions until supply and demand are balanced and we see a sustainable recovery in pricing.”

Sandisk actually raised its prices after the end of the third quarter.

Goeckeler said its BiCS 8 218-layer 3D NAND technology is producing 2 Tbit QLC chips and these are “in qualification with top cloud service providers for use in 128 terabyte and 256 terabyte capacity SSDs.” He mentioned PCIe Gen 5 and 6 connections for the QLC drives and thinks the 256 TB product could come over the next year, meaning 2026.

There is also a new SSD controller coming. “We have a new architecture coming out in the next couple of quarters that we call Stargate, new ASIC, clean sheet design and then, with BiCS 8 QLC … we just think that’s going to be a dynamite project,” Goeckeler said.

BiCS 8 “TLC products are being qualified by customers for high performance mobile and compute applications.” In the automotive market, “we shipped the industry’s first UFS 4.1 samples for autonomous driving, where performance, reliability and power efficiency are critical.”

Market adoption will be slow. “Development is underway with key partners, and early samples are being used in the next generation EV platforms in autonomous robotics. We expect to complete qualification in the coming months, paving the way for broader adoption in the next generation automotive compute platforms, including advanced driver assistance systems and robotics, beginning in the second half of calendar year 2026.”

Concluding, Goeckeler said: “We estimate that the NAND industry is poised for robust long term growth with demand expected to approach $100 billion by the end of the decade. We expect growth to be driven by the exponential expansion of data, fueled in part by the deployment of artificial intelligence in cloud and edge applications as well as refresh cycles in PCs and mobile devices. In data center, we continue to see strong capital investments in the emergence of new AI-driven workloads, which are fueling use cases for enterprise SSDs and expanding NAND’s addressable market.”

But what about US tariffs implemented under the Trump administration? Visoso said: “Our key assumption in our guidance is that the current tariffs remain unchanged throughout the quarter. At present, there are no tariffs on our products except for shipments from China to The US, which have tariffs of 27.5 percent. For perspective, approximately 20 percent of our products shipped to The United States and over 95 percent of that revenue is sourced from countries other than China.”

Goeckeler said R&D and fab costs for higher-layer counts were substantial. Each layer count advance enables higher bit output, which tends to drive down prices but doesn’t drive costs down as well. Goeckeler’s concern is “making sure we have the right profitability to drive all the capital investment required to support this demand.” This implies that NAND/SSD pricing relative to disk drives is not going to change that much. In the mid-term, Sandisk sees “an undersupplied market through the end of next year.”

Sandisk expects demand to strengthen throughout the year. Next quarter’s outlook is $1.8 billion ± $5 million in revenues, a 2.2 percent increase year-on-year at the midpoint.