This is the last article I will post until the new year. It has been a fascinating 2024 with storage dominated by SSD, HDD, and array developments, the need for faster file access and better unstructured data management, the rise of cyber-resilience issues and the onrush of GenAI. I hope all the readers of these articles, and all the suppliers mentioned in them, have an excellent Christmas break, and look forward to learning more about suppliers and their developments in 2025.

…

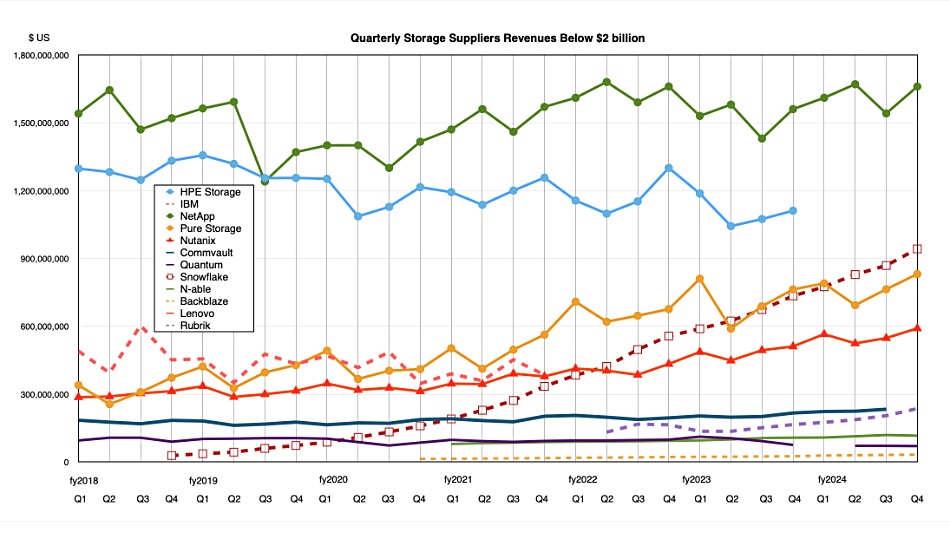

We record quarterly revenue numbers for publicly owned storage suppliers and here is a chart, normalized to HPE fiscal quarters, showing them up until now, nearly the end of 2024:

We can immediately see that the big money is being made by the flash+SSD suppliers, followed by the hard disk drive suppliers and Dell. The rise from the depths of the revenue trough in fiscal 2023 is clearly apparent.

It is quite crowded in the sub-$2 billion/quarter area and we have created a second chart showing only the vendors in this category:

NetApp dominates, and HPE would be in second place if it actually revealed its storage numbers, which it stopped doing a year ago. Rapidly growing Snowflake is in third place, followed by Pure Storage. Nutanix has a very respectable fifth place. Then we enter the data protection suppliers’ segment with Rubrik and Commvault in close company followed by N-able, Quantum, and Backblaze. Lenovo’s presence in the chart key is a historical oddity as it once reported its storage revenues and then stopped doing so.

…

Data management supplier Datadobi told us more about its GenAI plans.

B&F: Datadobi offers tools to manage unstructured data. How will GenAI’s LLMs influence these tools?

Datadobi: The more enterprises adopt GenAI, the more they will try to select the proper data to refine models or to feed to RAG

B&F: Will you be able to set unstructured data management policies and have a Datadobi ‘agentic AI’ operate the policies and identify mismatches between the current state and the policies?

Datadobi: It’s a roadmap item to provide APIs to execute data filtering and assert if a certain file satisfies a certain filter (= policy).

B&F: Could the agentic AI initiate actions to fulfill the policies? Could Datadobi have a number of agentic AIs? A data tiering one? A security one? An AI pipeline one? Would Datadobi develop its own agentic AI tools?

Datadobi: Yes, to all three. Datadobi will offer APIs to execute actions. Data deletion, archival, moving, copying, quarantining, changing security permissions … are all possible actions, next to data tagging.

…

Hitachi Vantara said La Molisana, a leading Italian pasta company, selected its Virtual Storage Platform One Block array, equipped with NVMe flash drives, to support its growth. The implementation included the integration of Veeam backup and Hitachi’s immutable snapshot functionality, providing La Molisana with data protection and business continuity.

…

Infinidat says GigaOm has recognized it as a Leader in the Dec 13, 2024 GigaOm Radar Report for Primary Storage. Analyst Whit Walters reviewed 21 suppliers of block and file primary storage arrays and SW-only products. In early 2024, and with different analysts, GigaOm reviewed primary storage for large enterprises and mid-sized businesses separately.

The earlier reports had substantially different supplier positioning;

The January large enterprise report covered Dell, Fujitsu, Hitachi Vantara, HPE, IBM, Infinidat, NetApp, Pure Storage, Seagate and Synology. The Feb mid-size report looked at DataCore, Dell, DDN, Hitachi Vantara, HPE, IBM, Infinidat, iXsystems, Lightbits Labs, NetApp, Pure Storage, StorONE, StorPool and Synology. The new report includes all of these plus Cohesity, Nutanix, VAST Data, WEKA and Zadara. Many of the 21 are in the top right Maturity-Platform Play quartile which was under-populated in the earlier reports in comparison. Also, the Feature Play-Innovation segment is now empty whereas before it had some suppliers located there. The change of analyst has been accompanied by a change of analysis.

12 vendors, 57 percent of the suppliers included, did not actively participate, meaning the analyst only read their documentation. Infinidat has made the report available here.

…

Kioxia IPO’d on Dec 17 and, on the third day of trading, the stock is up 18 percent. Wedbush analyst Matt Bryson said: “Despite a tough earnings report for Micron, where NAND was highlighted as a primary point of weakness … this highlights the fact that Kioxia (and WDC’s SanDisk division by proxy) are likely being already valued at trough levels.”

…

Data manager Komprise discussed its views on the data management needs of organizations adopting Gen AI, making several points. Gen AI adopters need data management more than faster storage and AI LLM responses are only as good as the data made available to the LLM. Retrieval Augmented Generation (RAG) provides proprietary data to generically-trained LLMs, and Komprise’s software can deliver securely-accessed and appropriately selected real-time data, not old backup data, and from an organization’s entire unstructured data estate, to such LLMs. It provided an 11-slide deck to make its points and you can download the slide deck here.

….

PEAK:AIO claims it has a new Power-Optimized solution that reduces energy consumption of large scale NVMe drives by between 50 – 70% while maintaining full performance. See more on a YouTube video.

…

SK hynix has been awarded $458 million to build a HBM chip packaging facility as part of its $3.87 billion HBM manufacturing in West Lafayette, Indiana and also for AI-related R&D activities there, under the CHIPS and Science Act. The US Commerce department also plans to make available $500 million in government loans for the SK hynix project. SK hynix CEO Kwak Noh-Jung said: “SK hynix looks forward to collaborating with the US government, the state of Indiana, Purdue University and our US business partners to build a robust and resilient AI semiconductor supply chain in the United States.”

The Korea Herald says Samsung Electronics is in discussions with Washington for a subsidy worth $6.4 billion in direct funding.

…

The Elec reports SK hynix has won a large order to supply high-bandwidth memory (HBM) to Broadcom, to install on the AI computing chip of a big tech company. Broadcom manufactures application specific ICs (ASICs) designed by its big tech customers. It said earlier this month that it was developing AI chips with three large cloud service providers – likely Google, Meta, and ByteDance.

…

UniFabriX is planning to support CXL3.1 features like Dynamic Memory Allocation (DCD) now, even though the CXL Consortium’s official target is 2027.