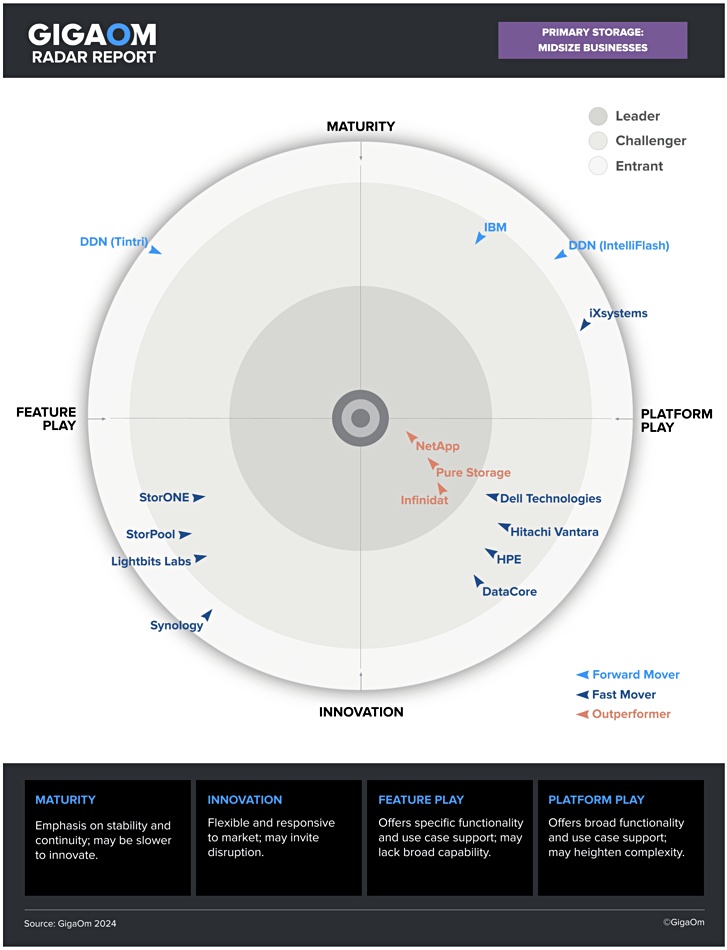

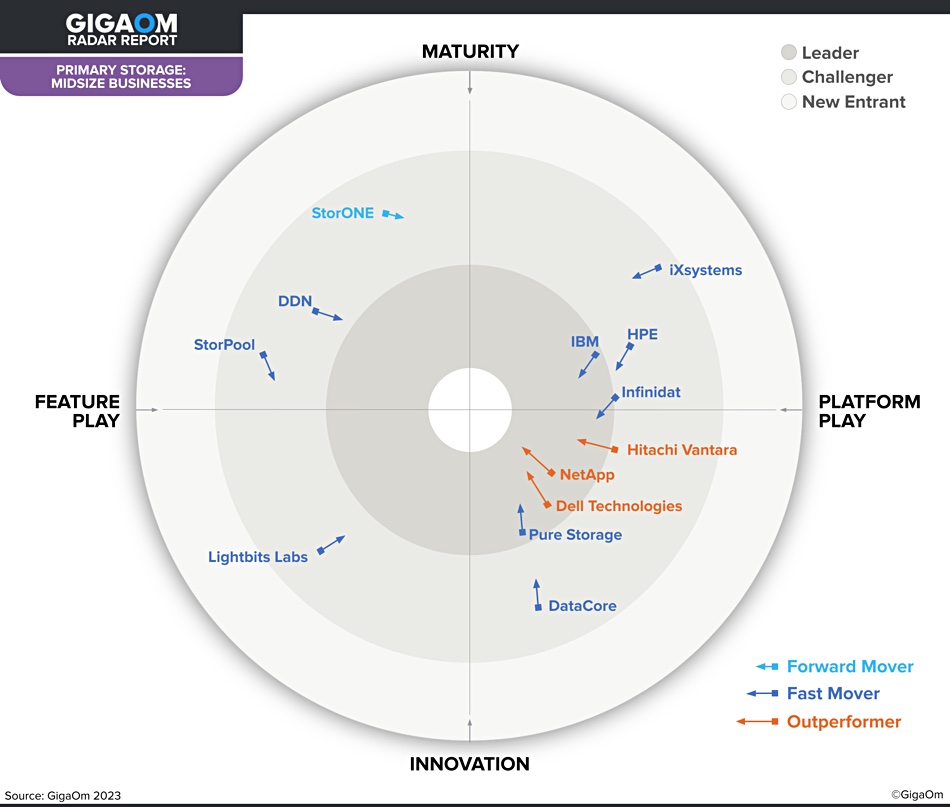

As in the enterprise storage Radar NetApp, Pure and Infinidat are the clear and only leaders and outperformers in GigaOm’s mid-size enterprise storage Radar report and chart.

The Radar report looks at suppliers’ products for a market sector based on key and emerging functional features beyond table stakes and business criteria, such as upgrability and efficiency, from a value point of view. The Radar diagram features a series of concentric rings, with those set closer to the center judged to be of higher overall value. The chart characterizes each vendor on two axes – balancing Maturity versus Innovation and Feature Play versus Platform Play – with a prediction of the supplier’s development speed over the coming 12 to 18 months, from Forward Mover, through Fast Mover to Outperformer.

A companion Key Criteria report looks at functional items in more detail. This Radar report also includes consideration of departmental needs in large enterprises. This year’s edition of the primary storage for mid-size enterprises Radar examines 14 vendors and 15 products – both IntelliFlash and Tintri arrays from DDN are evaluated. Last year’s edition looked at 13 vendors.

Overall, the analysts, Max Mortillaro and Arjan Timmerman, note that AI-based analytics, helping to defend against ransomware attacks, and STaaS are development areas in this mature mid-size enterprise primary storage market. Electricity price increases have caused a renewed emphasis on energy efficiency and carbon footprints.

Compared to last year’s report, Synology has entered the arena, and Dell, Hitachi Vantara, and IBM have all been demoted from the Leaders circle to the Challenger ring. The bulk of the suppliers – 11 of the 13 – are in the bottom half circle in three quite tight groups. The other three are classed as more nature and spread around the outer entrants’ ring or very close to it.

StorOne, StorPool and Lightbits Labs (NVMe/TCP-based storage) are classed as Challengers in the innovation-feature play quadrant, with Synology rated as a new entrant. Dell (PowerStore), Hitachi Vantara (VSP E-Series), HPE (Alletra 5000 and 6000) and DataCore (SANsymphony) are Challengers in the Innovative-Platform Play quadrant. All eight are fast movers – not developing as fast as the three Leaders. The report authors call out Lightbits’s blisteringly fast technology.

DDN (IntelliFlash), IBM (Spectrum Virtualize, FlashSystem 7300), and iXSystems (TrueNAS) are placed in the Maturity-Platform Play quadrant and judge to be forward movers. DDN (Tintri) is an outlier, a forward mover, all on its own in the Maturity-Feature Play quadrant.

The report authors point out that DDN’s NexentaStor, evaluated in the 2023 edition, is no longer actively developed – existing customers get only maintenance releases. DDN’s Tintri is now very mature and stable and there has been little development from its core design center of presenting VMware-specific storage features with no file or block abstractions. The authors observe that it was architected to solve a niche use case and has little potential for evolution.

A glance at the 2023 edition’s Radar chart shows a more evenly distributed set of suppliers in the Challengers ring.There has been a substantial rise in innovation since then causing the clumping into two supplier groups in the bottom half of the 2024 chart.

We are left with the impression that this mature market has seen renewed development because of ransomware encouraging AI analytics, and a cost efficiency focus helping STaaS offers proliferate. That has also meant green agenda items – such as energy efficiency and a lower carbon footprint – gain a stronger emphasis.

It may be that DDN’s Tintri and IntelliFlash products will enjoy renewed development this year, as might IBM’s FlashSystem/Spectrum Virtualize product, and not be outliers in the 2025 edition of this report. GigaOm subscribers receive a copy of the report. If you are not a subscriber then its detailed contents are not available.