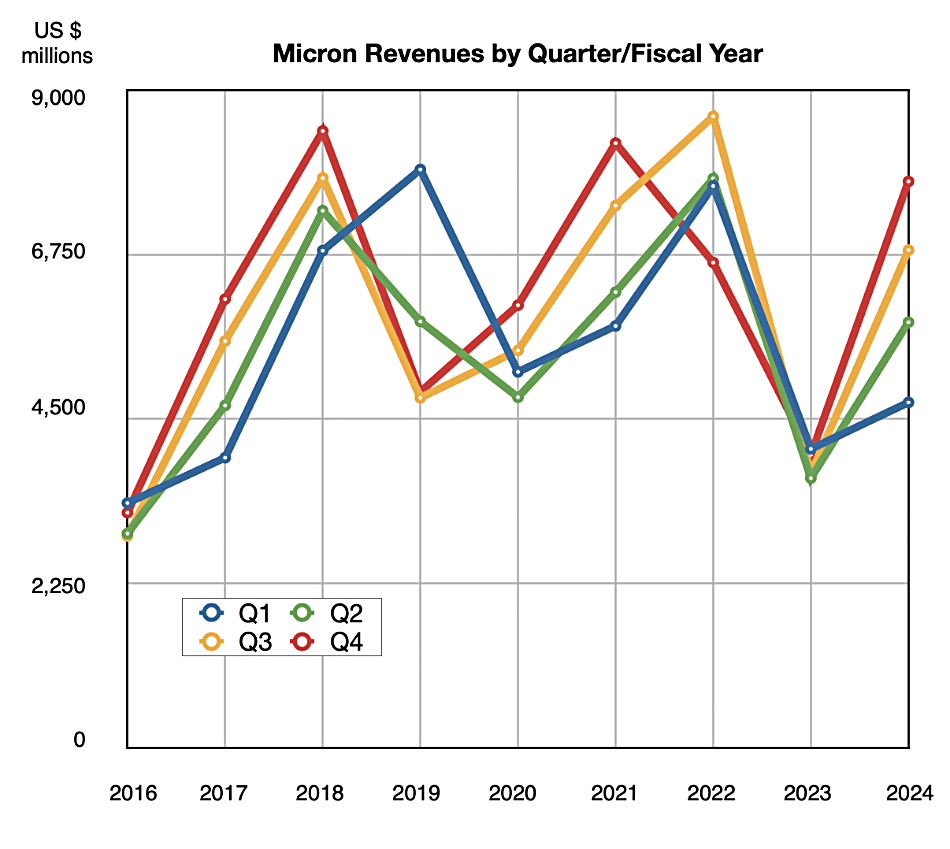

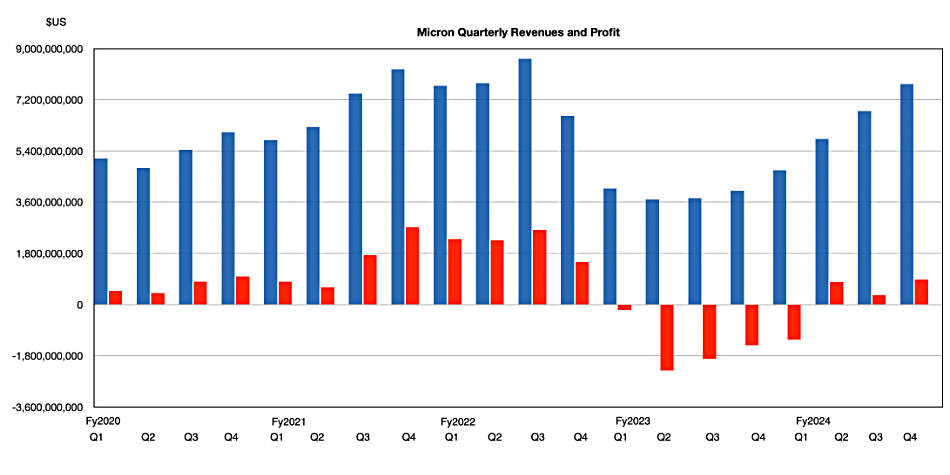

AI-driven server memory, particularly GPU high-bandwidth memory (HBM), and SSD demand sent Micron revenues in its final FY 2024 quarter to $7.75 billion, 93 percent higher year-on-year.

It made a net profit of $887 million in the quarter ended August 29, contrasting with the $1.4 billion loss a year ago. Full FY 2024 revenue was $25.1 billion, 62 percent higher year-over-year, with a $778 million net profit, versus FY 2023’s $5.83 billion loss.

President and CEO Sanjay Mehrotra stated: ”Micron delivered a strong finish to fiscal year 2024, with fiscal Q4 revenue at the high end of our guidance range and gross margins and earnings per share (EPS) above the high end of our guidance ranges. In fiscal Q4, we achieved record-high revenues in NAND and in our storage business unit. Micron’s fiscal 2024 revenue grew over 60 percent; we expanded company gross margins by over 30 percentage points and achieved revenue records in datacenter and in automotive.”

He added: “Our NAND revenue record was led by datacenter SSD sales, which exceeded $1 billion in quarterly revenue for the first time. We are entering fiscal 2025 with the best competitive positioning in Micron’s history. We forecast record revenue in fiscal Q1 and a substantial revenue growth with significantly improved profitability in fiscal 2025.”

Financial summary

- Gross margin: 36.5 percent vs -9 percent a year ago

- Free cash flow: $323 million vs -$758 million last year

- Cash, marketable investments, and restricted cash: $9.2 billion vs $10.5 billion a year ago

- Diluted EPS: $1.18 vs -$1.07 a year ago.

Micron makes two products for SSDs, DRAM and NAND, with DRAM revenues in the quarter rising 93 percent year-over-year to $5.33 billion and NAND up 96.3 percent to $2.4 billion. These products are sold into four markets, where the rosy revenue picture is:

- Compute and networking: $3 billion, up 152 percent year-over-year

- Mobile: $1.9 billion, up 55 percent

- Storage: $1.7 billion, up 127 percent

- Embedded: $1.2 billion, up 36 percent

The compute and networking business unit is growing fastest, followed by storage. The key demand driver is generative AI. Micron said multiple vectors will drive AI memory demand over the coming years: Growing model sizes and input token requirements, multi-modality, multi-agent solutions, continuous training, and the proliferation of inference workloads from the cloud to the edge. It sees no sign of any AI bubble with customers turning away from the tech.

In end-market terms, the strongest DRAM sector is HBM, needed for GPUs, and Micron expects the total addressable HBM market “to grow from approximately $4 billion in calendar 2023 to over $25 billion in calendar 2025. As a percent of overall industry DRAM bits, we expect HBM to grow from 1.5 percent in calendar 2023 to around 6 percent in calendar 2025.”

Mehrotra said: “We have a robust roadmap for HBM and are confident we will maintain our time-to-market, technology and power efficiency leadership with HBM4 and HBM4E.” In the earnings call, he commented: “We look forward to delivering multiple billions of dollars in revenue from HBM in fiscal year ’25.”

Micron is also seeing “a recovery in traditional compute and storage” and has “gained substantial share in datacenter SSDs” where it “achieved a quarterly revenue record with over a billion dollars in revenue in datacenter SSDs in fiscal Q4, and our fiscal 2024 datacenter SSD revenues more than tripled from a year ago.”

The company expects that “PC unit volumes remain on track to grow in the low single-digit range for calendar 2024. We expect unit growth to continue in 2025 and accelerate into the second half of calendar 2025, as the PC replacement cycle gathers momentum with the rollout of next-gen AI PCs, end of support for Windows 10 and the launch of Windows 12.”

Smartphones are being affected by AI as well, with Micron saying: “Recently, leading Android smartphone OEMs have announced AI-enabled smartphones with 12 to 16 GB of DRAM, versus an average of 8 GB in flagship phones last year … Smartphone unit volumes in calendar 2024 are on track to grow in the low-to-mid single-digit percentage range, and we expect unit growth to continue in 2025.”

Micron achieved a fiscal year record for automotive revenue in 2024 where infotainment and ADAS are driving long-term memory and storage content growth. Its automotive demand is being constrained as the industry adjusts the mix of EV, hybrid, and traditional vehicles to meet changing customer demand. It expects “a resumption in our automotive growth in the second half of fiscal 2025.”

Western Digital reckons that the 3D NAND layer count race is over as each layer count addition adds a diminishing return. This will lengthen the period between layer count transitions. Micron agrees with this view, saying: “NAND technology transitions generally provide more growth in annualized bits per wafer compared to the NAND bit demand CAGR expectation of high-teens … We anticipate longer periods between industry technology transitions and moderating capital investment over time to align industry supply with demand.”

Micron invested $8.1 billion in capex in FY 2024 and expects to increase this by something like 35 percent in fiscal 2025, driven mostly by greenfield fab construction and HBM manufacturing facilities. Its investments in facilities and construction in Idaho and New York will support its long-term demand outlook for DRAM and will not contribute to bit supply in fiscal 2025 and 2026.

Outlook

Mehrotra said: “We are entering fiscal 2025 with the strongest competitive positioning in Micron’s history … We look forward to delivering a substantial revenue record with significantly improved profitability in fiscal 2025, beginning with our guidance for record quarterly revenue in fiscal Q1.”

HBM will contribute to this: “We expect to ramp our HBM3E 12-high output in early calendar 2025 and increase the 12-high mix in our shipments throughout 2025 … Our HBM is sold out for calendar 2024 and 2025, with pricing already determined for this time frame.”

The revenue outlook for the next quarter (Q1 FY 2025) is $8.7 billion +/- $200 million, an 84 percent increase at the midpoint on the year-ago number. The full-year outlook was not given.

Generative AI training and inference is set to boost Micron’s revenues. Let Mehrotra have the final words: “With the advent of AI, we are in the most exciting period that I have seen for memory and storage in my career.”