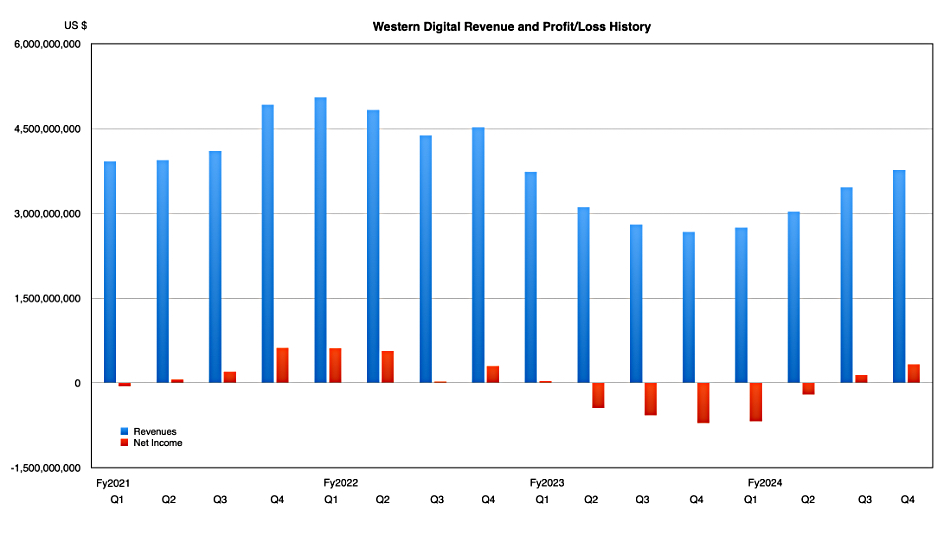

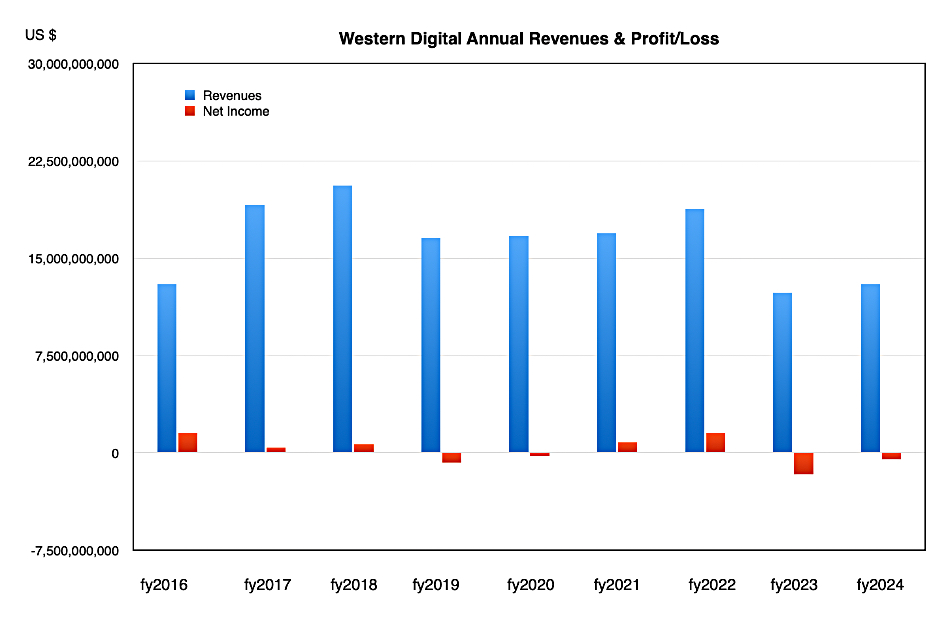

Revenues in Western Digital’s fourth fiscal 2024 quarter, ended July 341, were $3.76 billion, 41 percent higher year-on-year and beating its $33 billion outlook, with a $330 million profit contrasting vividly with the year-ago loss of $715 million. Full fy2024 revenues rose 6 percent to $13 billion.

The 41 percent revenue growth was more than last quarter’s 29 percent increase as the firm’s exit from the flash/HDD sales trough quickened.

A statement from David Goeckeler, Western Digital CEO said: “Together, with the structural changes we have made to strengthen our operations, we are benefitting from the broad recovery we are seeing across our end markets and structurally improving through-cycle profitability for both Flash and HDD.”

He believes: “The emergence of the AI Data Cycle marks a transformational period within our industry that will drive fundamental shifts across our end markets, increasing the need for storage and creating new demand drivers.”

Financial Summary

- Gross margin: 35.9 percent vs year-ago 36.3 percent

- Operating cash flow: $366 million

- Free cash flow: $282 million

- Cash & cash equivalents: $1.9 billion

- EPS: $0.88

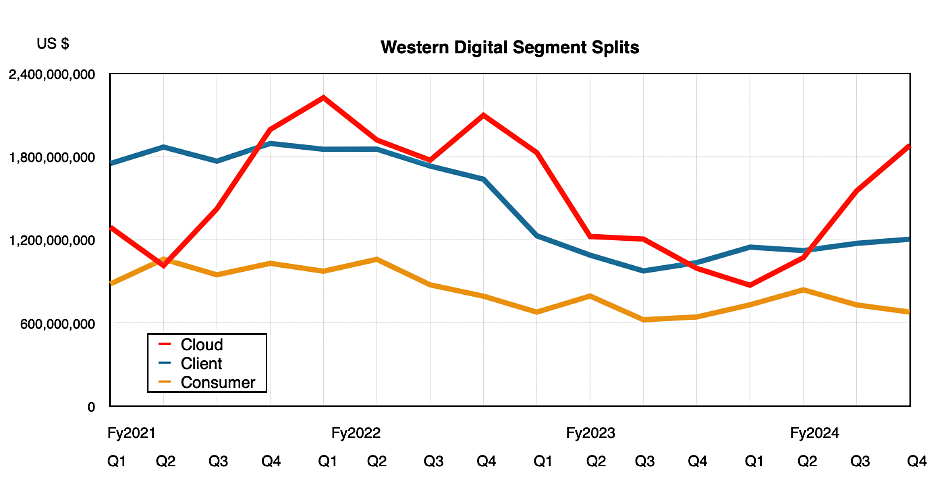

WD sells into the cloud (enterprise and CSP), client (PC and notebook) and consumer (reail) segments. Cloud, 50 percent of its revenues at $1.88 billion, was up 89 percent year-on-year due to”higher nearline shipments and pricing in HDD, coupled with increased bit shipments and pricing in enterprise SSDs.”

Client was 32 percent of its revenues at $1.2 billion; a 16 percent increase, attributed to an “increase in flash ASPs offsetting a decline in flash bit shipments while HDD revenue decreased slightly.”

The consumer segment brought in 18 percent of total revenues and was up just 5 percent Y/Y from “improved flash ASPs and bit shipments.” Sequentially it was down 7 percent because of “lower flash and HDD bit shipments partially offset by higher ASPs in both flash and HDD.”

Overall flash (SSD) revenues were $1.76 billion; a rise of 27.9 percent Y/Y, while disk (HDD) revenues rose 27.9 percent to $2 billion, up 54.7 percent, as cloud buyers bought many more nearline drives.

WD noted QLC-based client SSDs grew 50 percent on a sequential exabyte basis. It’s sampling a 64 TB eSSD with plans for volume shipment later this calendar year, and it’s qualifying a PCIe Gen 5 based eSSD at a hyperscaler with ramp expected in the second half of this calendar year. This SSD has “the best read performance and really good power efficiency.”

Goeckeler said in the earnings call that the race for layer-count increase-driven SSD capacity had ended: “The layers focus race is behind us. The emphasis is now shifting toward strategically timing the economic introduction of new longer-lasting nodes. Innovation now means enhancing power efficiency, performance, and capacity within these nodes, while capital decisions increasingly prioritize opportunities for margin expansion and revenue growth.”

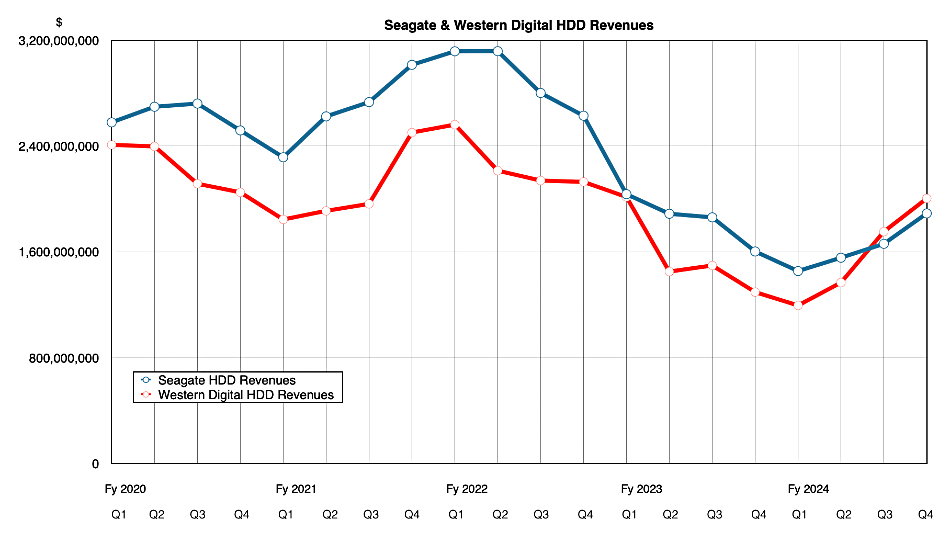

It saw more disk-based revenues than Seagate for the second consecutive quarter, as Seagate’s delayed HAMR transition let WD keep its lead:

WD has shipped samples of a 32 TB UltraSMR ePMR nearline hard drive to select customers. HDD unit ships increased for the third successive quarter to 12.1 million with the disk ASP rising to $163.00 from last quarter’s $145.00 and the year-ago $99.00. Goeckeler said that, with the 32 TB drive, this is the “first time anybody’s crossed the 30 TB at scale” point, alluding to Seagate’s inability to ship its Mozaic 3+ drives at scale.

HDD revenue growth depends upon capacity increases, with Goeckleler observing: “The HDD business has undergone a remarkable transformation in recent quarters, marked by strategic initiatives aimed at introducing the most innovative, high-capacity products to market. …we are well-positioned to deliver the industry’s highest-capacity hard drives and the best TCO. …Our cloud customers continue to transition to SMR, and we anticipate a third major cloud vendor to begin the ramp of adopting SMR in the fiscal first quarter.”

He added: ”We’ve got good supply demand balance that’s giving us good visibility throughout the rest of the calendar year, we pretty much know where every drive is going to go at this point. We made a really significant transition this past quarter, in that we moved up our request to our customers to give us visibility 52 weeks ahead, so a 52-week lead time on HDDs. Now, the reason that’s so important is the cycle time on a net to build an HDD is about 50 weeks.”

“Our customers have responded well to that request, and we now have visibility for the entire fiscal year from a number of our biggest customers.” WD is working on the rest of its customers to do the same.

It noted a legal defeat with cost implications, saying “On July 26, 2024, a jury awarded a lump sum of $262 million against a subsidiary of the company in a patent infringement action. …In addition to the lump sum amount, the company anticipates that the plaintiff will request costs, attorney’s fees and interest.” It will appeal the judgement.

The revenue number in next quarter’s outlook is $4.1 billion +/- $0.1 billion, a 49 percent Y/Y increase at the mid-point.

Goeckeler emphasized WD’s AI-driven growth outlook: ”As we enter fiscal year 2025, we are well-positioned to capture the long-term growth opportunities in data storage and believe the AI Data Cycle will be a significant incremental growth driver for the storage industry.”

In the flash market: “We still see demand outstripping supply through the second half of the year. And quite frankly, our modeling shows throughout next calendar year as well.”

WD is progressing its coming split into separate HDD and NAND/SSD businesses. It anticipates “beginning to incur separation dis-synergy costs in the second half of the calendar year.” These will be operating expense costs, not expenses in the cost-of goods area.