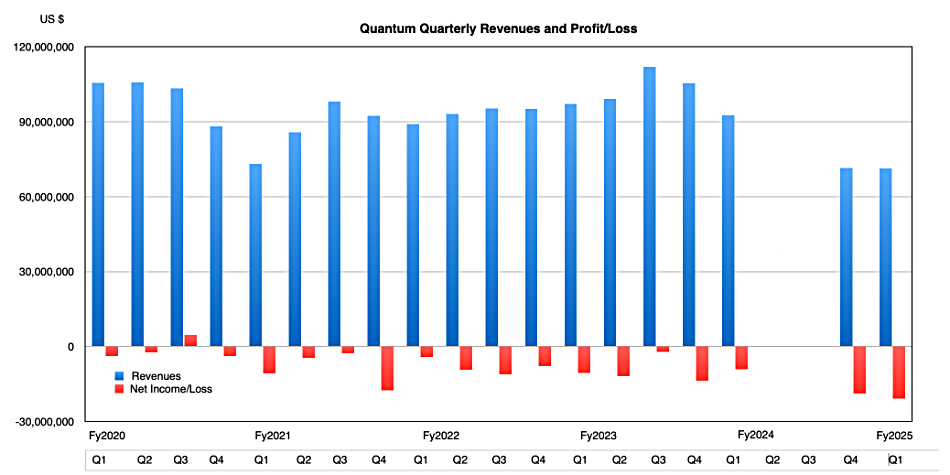

Quantum’s latest results show that the collapse of its hypescaler tape business caused a significant revenue dip. The biz has also performed some finance restructuring.

The company has been grappling with an accounting issue around recalculating standalone selling prices of products combined in a package. This forced it to restate a couple of years of results up to the end of fiscal 2023 – 31 March 2023 – hence not being able to file results with the SEC for the first, second and third quarters of fiscal 2024. The fourth quarter and full year fy2024 results were filed, though, and showed a dramatic revenue plunge, with a 23 percent year-on-year fall in quarterly revenues. Quantum said this “primarily” reflected “lower revenue contribution from hyperscale customers combined with lower tape media and royalty business.”

Its latest, first quarter fy2025 filing includes comparisons, meaning it finally reveals the first quarter fy2024 revenues from one year ago. They were, at $92.5 million, 4.7 percent down Y/Y. Now its latest quarter, Q1 2025, with revenues of $71.3 million, is 22.9 percent below that, and missed Quantum’s $72 million guidance. It reported a net loss for the quarter of $20.8 million, much worse than the year-ago $9.1 million loss. The revenue downturn was largely due to the loss of a single hyperscaler customer.

CEO and chairman Jamie Lerner said in a prepared statement: “Results for the quarter were largely in-line with our expectations, reflecting further rotation of our business toward our long-term initiatives. We are also seeing improving traction for Myriad and ActiveScale products.”

That was the good news: “However, during the quarter we experienced a temporary headwind to gross margin caused by product mix and supply constraints of certain hardware that prevented us from shipping a portion of our higher margin deals. This also resulted in an increase to our current order backlog to above normal levels.”

Quantum has had to restructure its debt to get more readily available cash, $25 million, with Lerner saying: “As part of our ongoing strategic and financial initiatives, we have reached an agreement with our current lenders that significantly improves our liquidity, allows us to take action on improving our operational initiatives and focus on driving Myriad, ActiveScale and the rest of our businesses to the next level. With this newly restructured financing in place, we have improved our overall capital structure and balance sheet. Additionally, we continue to maintain strong cost and discretionary spending controls as we execute toward profitable growth.”

The company is, like many other storage businesses, moving to subscription-based sales. Its subscription annual recurring revenue (ARR) rose 29 percent annually to $18.8 million and the subscription customer count rose 26 percent to 975.

The firm made its last quarterly profit back in 2019 and that was a one quarter wonder following ten consecutive loss-making quarters, and followed by more loss-making quarters.

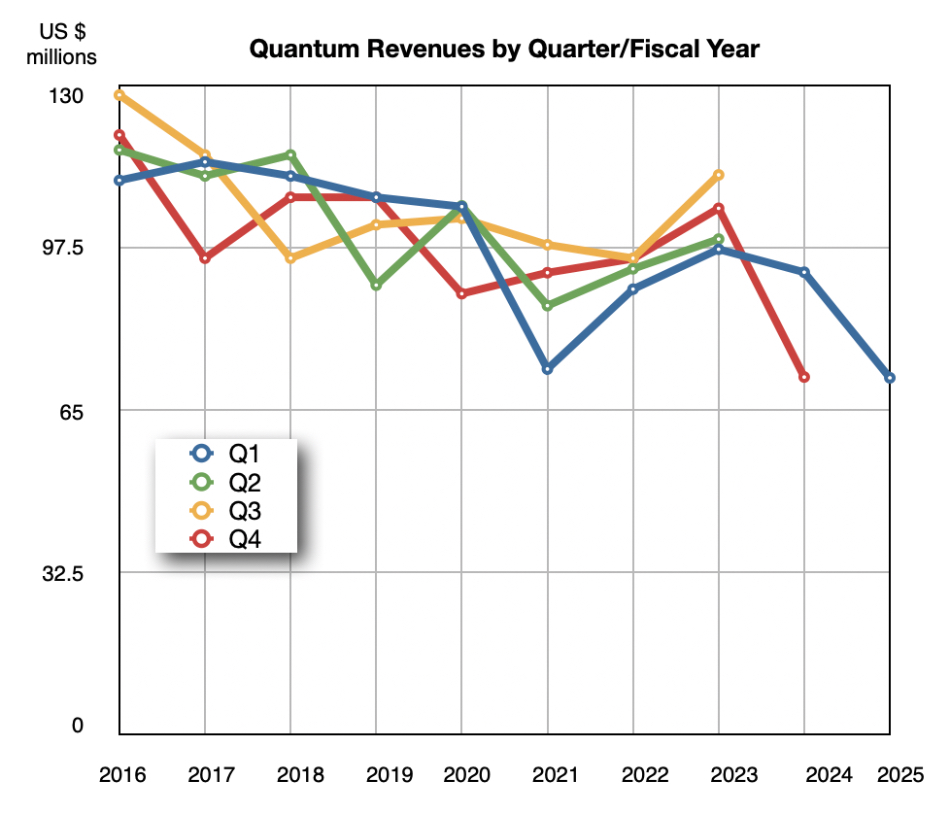

The underlying issue is that Quantum had not been able to develop profitable replacement products to make up for long-term declining tape system and media sales. A chart of revenues by quarter by fiscal year since 2016 shows a long term decline that had been reversed in fy2022 and fy2023, but is now falling back again:

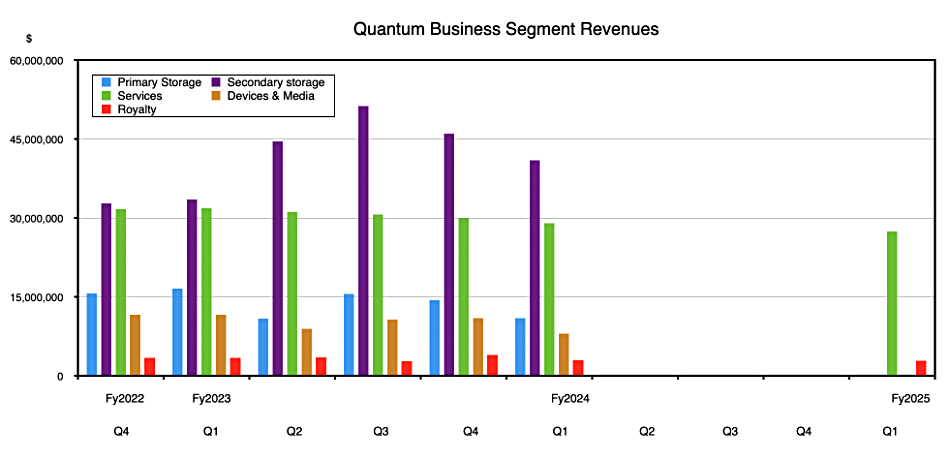

Tape library system sales to hyperscalers drove revenues higher over that period, as a chart of business segment revenues shows:

Tape system sales are in the secondary storage category and they show a pronounced rise in Q2 and Q3 of fy 2023 and then fall off in the next two quarters. This drop was compounded by a fall in primary storage revenues – StorNext and Pivot3 video surveillance – as well over the same couple of quarters. The segment numbers for fy2024’s Q2, 3 and 4 are not available and we only have partial numbers for the latest quarter.

Quantum is pinning its hopes on growing its ActiveScale object storage, all-flash DXi deduping backup appliance and Myriad storage OS revenues, particularly relating to unstructured data storage for AI.

Lerner and his CFO Ken Gianella are looking to cut costs, making operational efficiency improvements, with Lerner saying in the earnings call that: “We did have OPEX last quarter of over $35 million and this quarter was $30.8 million. So that’s $5 million annualized savings.”

He praised Myriad: ”We’ve been getting a lot of independent testing validation that shows the [Myriad] product is outperforming even… what are viewed today as the world’s fastest file systems. We’re outperforming those, in some cases, by 250 percent, just two and a half times faster than our next closest competitor.”

It’s early days but some Myriad trials are converting to sales. However there is a lot of sales and channel training to be done, with Lerner saying: “We’re putting a lot more energy into training and education around the Myriad product.”

Gianella pointed to: “Several new MPI launches that we’re doing in the back half of the year,” which is encouraging. He also said the new DXi appliance has started well: “What I’m really proud of is the DXi launch that went out and was a couple days out in public GA and we won two big deals away from one of our key competitors.”

Lerner added his two cents on DXi prospects: “We plan on aggressively targeting the enterprise backup market with our superior technology, delivering an all-flash format, DXi immutability and the 1U form factor at one of the best total cost of ownership in the market.”

The revenue guidance for next quarter is $73 million +/- $2 million.