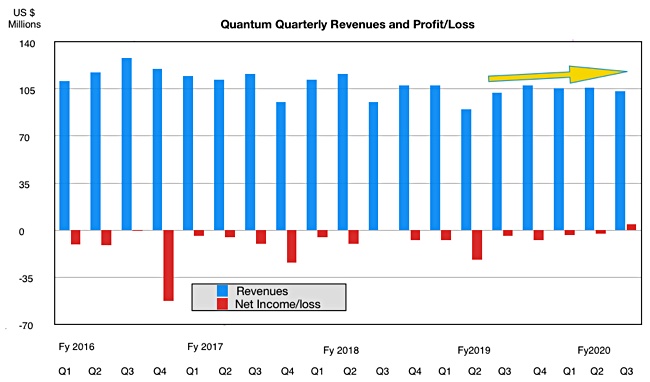

As well as becoming a listed company again, Quantum has made its first profit in 18 quarters; that’s four-and-a-half years.

Revenues in its third fiscal 2020 quarter were $103.3m, up just 1 per cent on a year ago. But profits were $4.7m, compared to a year-ago loss of $4.3m.

CEO Jamie Lerner emitted this quote: “This return to profitability validates the success of our transformation and provides us momentum as we uplist to the Nasdaq.”

The revenue was lower than expected, due to a tape library sales miss in its hyperscalar business, as a large order or orders were delayed.

Lerner said: “The long-term business opportunity in the archive tape storage market remains significant, so while we expect our hyperscaler business in the short term to continue to be volatile, longer term we anticipate adding new hyperscaler customers, which will help address non-linear purchasing patterns from a concentrated customer base.”

Because of this Quantum has lowered its full year guidance to $410m from around $430m. Lerner also said: “Our offerings in the video and video-like data portion of our business remained strong, and we continue to see growing demand … Our focus is to increase the contribution from these products, which maintain a better margin profile, which should mitigate the timing of hyperscaler revenue over time.”

Gross profit in the third quarter of fiscal 2020 was $47.1m or 45.6 per cent gross margin, compared to $43.1m, or 42.2 per cent gross margin, in the year ago quarter.

Selling, general and administrative expenses declined 15 per cent to $26.1m compared to $30.5m 12 months before. Research and development expenses were $9.3m, up 18 per cent compared to $7.9m a year ago.

There was cash and cash equivalents of $7.5m at quarter end compared to $10.8m as of March 31, 2019.

Quantum expects revenues of $95m plus or minus $5m in its fourth quarter. Can it squeeze a profit out of that? We’ll see.