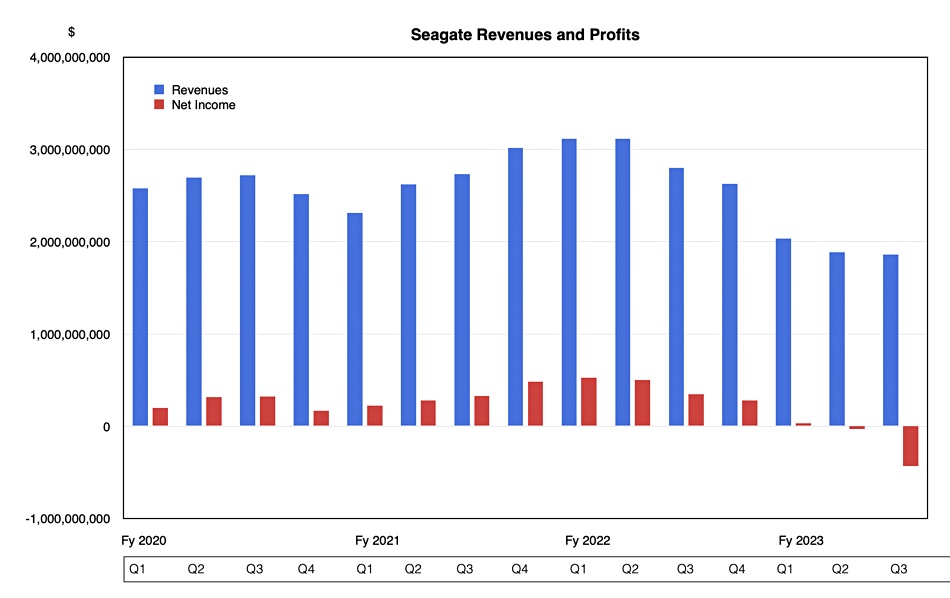

The disk drive downturn hit Seagate with a vengeance in Q3 of its fiscal 2023 ended March 31, marked by multimillion-dollar losses.

Update: Senior exec salary reductions. 20 April 2023.

Revenues of $1.86 billion came in at the low-end of prior guidance, and were 33.6 percent lower than a year ago. This was the third straight quarter of shrinking turnover. Seagate reported a loss of $433 million, contrasting sharply with profit of $346 million for the same period last year.

CEO Dave Mosley said: “We are seeing a more elongated customer inventory correction that led to weaker than expected nearline demand among a few large customers late in the quarter. Consequently, our March quarter revenue came in at the low end of our guidance range, which along with underutilization charges and other factors had a severe impact on our reported margins and profitability.”

He continued: “Looking ahead, we now expect demand recovery to begin towards the end of the calendar year. In response to this dynamic environment, we are taking aggressive actions to lower our cost structure while still positioning Seagate to thrive over the long-term and sustain our technology leadership. To that end, we continue to execute on our product roadmap, including our strategically vital HAMR platform that we launched in April, as anticipated.”

What cost structure reductions does Mosley have in mind? Employee terminations of course. A Seagate statement said the restructuring plan would be mostly complete by the end of fiscal 2023, and cost $150 million, primarily in cash payments for employee severance and other termination benefits. Seagate expects run rate savings of $200 million/year as a result.

Update

A Seagate SEC filing stated: “On April 16, 2023, the Board of Directors approved temporary salary reductions for the Company’s named executive officers. Effective beginning May 1, 2023, for a period of 6 months, the base salary of each of William D. Mosley, the Company’s Chief Executive Officer, and Gianluca Romano, the Company’s Executive Vice President and Chief Financial Officer, will be reduced by 100% and the base salary of Ban Seng Teh, the Company’s Executive Vice President and Chief Commercial Officer, will be reduced by 50%.”

Also: “On April 20, 2023, the Company announced that, in connection with the Plan, Jeffrey D. Nygaard, Executive Vice President of Operations and Technology, will leave the Company effective May 1, 2023.” Is he taking the can for the Huawei fiasco?

Financial summary

- Operating cash flow: $228 million

- Free cash flow: $174 million

- Gross margin: 17.2 percent vs 28.8 percent a year ago

- Operating expenses: $634 million contrasting with $377 million a year ago

- Dividends: $145 million

- Diluted EPS: -$2.09 compared to $1.56 a year ago

Hyperscalers stopped buying nearline drives and used up their existing inventories instead. Seagate said it shipped 30+TB HAMR drives to one CSP in April and expects volume manufacturing to start in early calendar 2024. Seagate is planning to ship its own CORVAULT arrays with HAMR drives in the third quarter of this year.

Seagate shipped 118EB of disk capacity in the quarter, lower than the 154EB shipped a year ago, but up on Q2’s 113EB, with the average capacity/drive shooting up to 8.2TB from last quarter’s 7.3TB – indicative of a slump in the units shipped number. It hasn’t disclosed how many HDDs it shipped in the quarter. Nearline capacity shipped was 87EB.

The company noted legacy drive revenues were down 12 percent quarter-on-quarter, and mission-critical drives (2.5-inch 10K rpm) shipments slowed due to weakening server demand and a cautious spending environment.

Seagate’s non-disk businesses, including SSDs, brought in $256 million, slightly up on the year-ago’s $237 million.

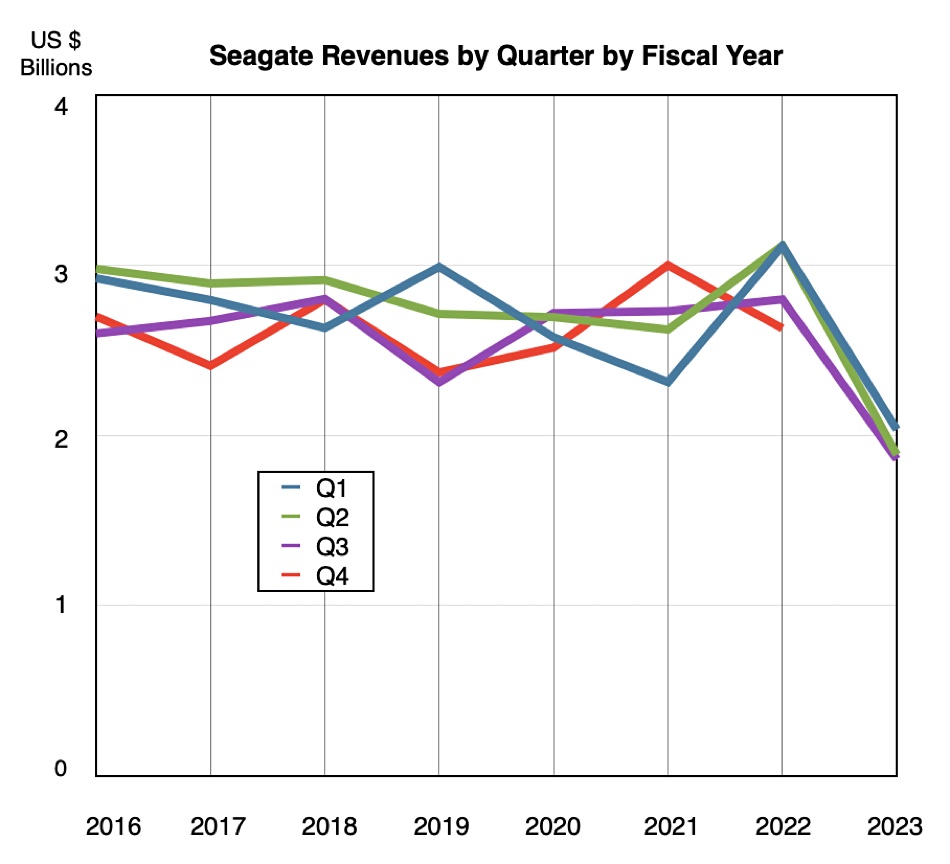

Next quarter’s revenue is expected to be $1.7 billion, plus/minus $150 million, which will be a 35.3 percent fall on Q4 last year. That would take full 2023 revenues to $7.5 billion, 35.8 percent down on 2022 – a rather large fall from grace and completing an annus horribilis for the company.

We expect Western Digital to report its revenue after the US stock market closes on May 8, and wouldn’t be surprised with a similar revenue downturn.

In other Seagate news, it was fined $300 million by the United States Department of Commerce for shipping disk drives to sanctioned Huawei. This helped to account for some of the jump in operating expenses number during the quarter.