NAND and SSD supplier Kioxia’s latest results show its multi-quarter revenue trough is has passed its low point.

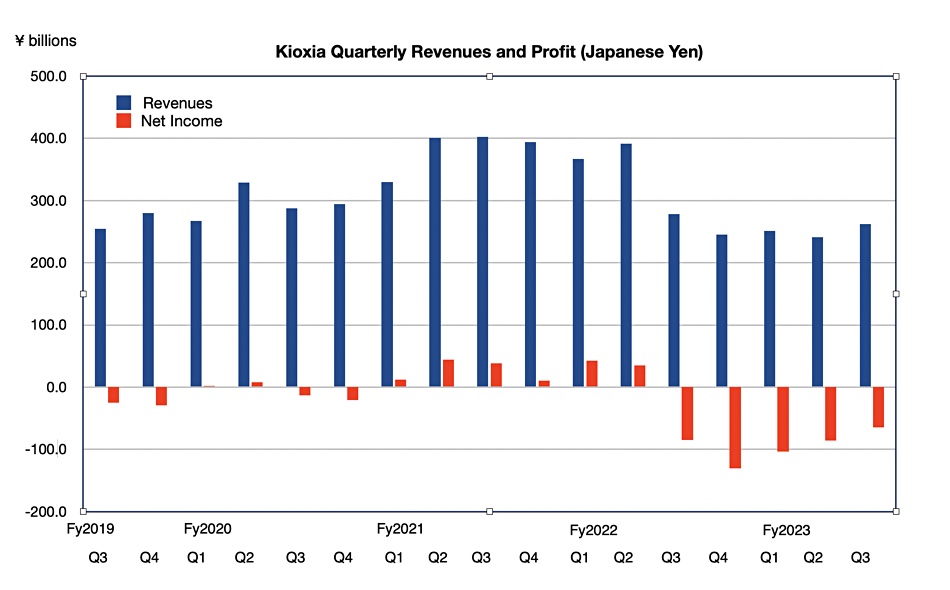

The Japanese foundry and flash drive manufacturer announced its third fiscal 2023 results with a year-on-year decline of 5.8 percent to ¥262 billion ($1.76 billion) and a loss of ¥64.9 billion ($430 million), worse than the year-ago ¥84.6 billion loss ($560 million). But two hopeful signs are that the Q3 revenue was 12.7 percent higher than the previous quarter and the loss was less than that quarter’s ¥86 billion ($570 million). This is the third successive quarter of decreasing losses for Kioxia:

If you look at Kioxia’s actual results announcement you might notice that its third fiscal 2023 quarter ends on December 31, 2023. Companies typically set their fiscal years as they wish where revenues and expenses best align. For US companies the fiscal year date is often, but not always, the calendar year in which the fourth quarter occurs.

Kioxia said there was no change in the number of flash bits it produced between this latest quarter and the previous one but average selling prices (ASPs) rose and that sent revenue up Q/Q. ASPs rose in the high single digit percents on a US dollar basis.

We can see from the quarterly revenue and profit loss chart above that Kioxia’s revenue picture appears to be improving. This concurs with the picture indicated by the recent Micron and Western Digital results. The DRAM market is strengthening faster than the NAND market, witness Micron’s results, with WD noting an improving NAND market.

Kioxia and its WD NAND foundry joint venture have been award an up to ¥150 billion ($1 billion) subsidy by the Japanese government for its Yokkaichi and Kitakami plants. The Kioxia losses have mounted up over the most recent five quarters and that subsidy will be welcome. The total loss for Kioxia’s fy2023’s three quarters is ¥245 billion ($1.7 billion) which compares to a loss of ¥7.2 billion ($48 million) for the first three fy2022 quarters.