A generative AI-driven rise in DRAM sales sent Micron revenues sharply higher with still more to come as its HBM sales are predicted to take off.

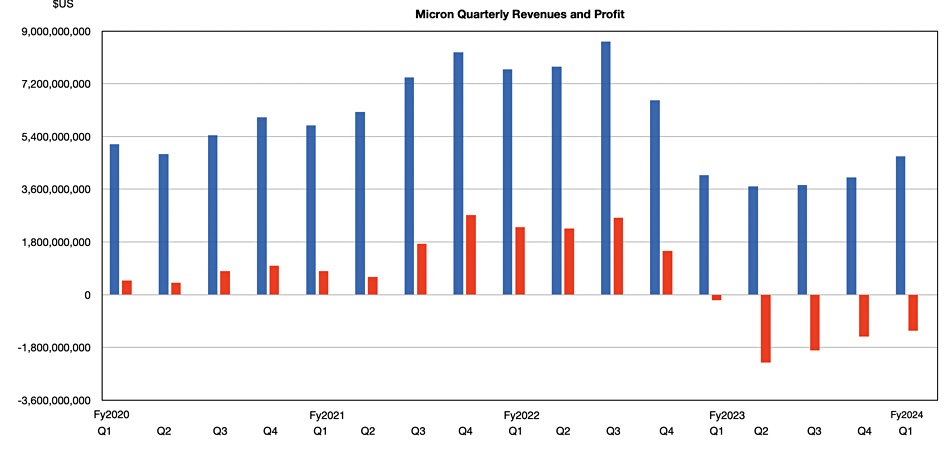

Revenues in the quarter ended November 30 were $4.73 billion, 15.7 percent up on the year-ago number, with a loss of $1.23 billion, far, far deeper than the year-ago loss of $195 million. But Micron has now had three successive quarters of increased revenues and its outlook is for a 43.5 percent annual rise in the fiscal second 2023 quarter, signalling an accelerating recession exit.

Sanjay Mehrotra, Micron’s CEO and president, stated: “Micron delivered revenue, gross margin and EPS above the high end of the guidance ranges we provided at the last earnings call, reflecting Micron’s strong execution combined with improved pricing.”

In his view: “We are in the very early stages of a multi-year growth phase catalyzed and driven by generative AI, and this disruptive technology will eventually transform every aspect of business and society. Memory is at the heart of GPU-enabled AI servers, and we are already seeing strong demand driven by early deployment of AI solutions, which will only accelerate over time.”

A chart of Micron’s quarterly revenues shows the impact of the memory recession on its revenues and profits;

Financial summary

- Gross margin: -0.7% vs 21.9% a year ago

- Diluted EPS: -$1.12 vs -$0.18 a year ago

- Free cash flow: -$333 million vs -$758 million a year ago

- Cash, cash equivalents & restricted cash: $8.15 billion vs $9.6 billion a year ago.

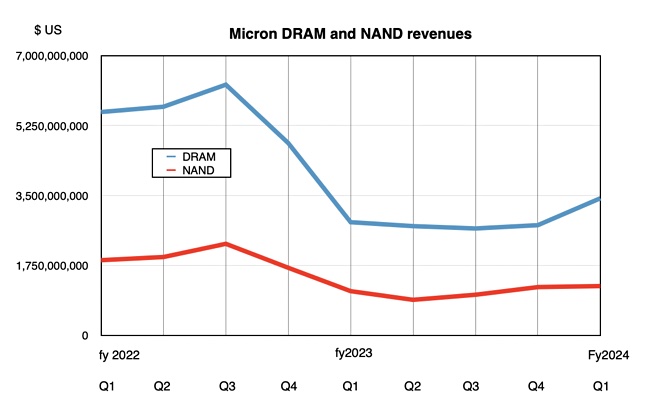

Micron has two basic product lines, DRAM and NAND. A chart shows how the DRAM curve has turned significantly upwards after three quarters spent in a revenue trough;

DRAM revenues in the quarter were $3.43 billion, up 21 percent year-on-year and 24 percent quarter-on-quarter. NAND revenues of $1.23 billion were up 11.5 percent annually.

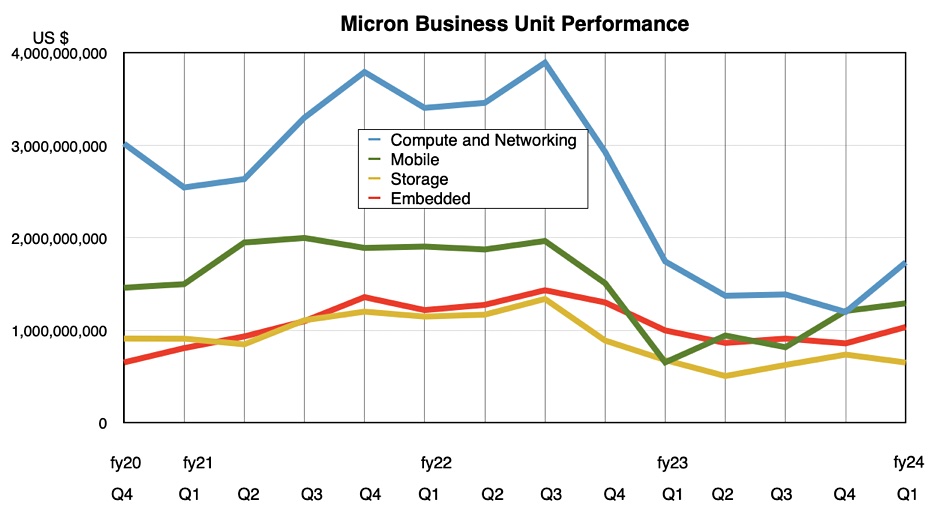

NAND and DRAM are sold to customers through four business units, and their fortunes reflected the dominance of server DRAM demand in the quarter;

BU results

- Compute and Networking revenues were $1.74 billion, down 1 percent annually but up 45 percent quarterly.

- Mobile revenues of $1.3 billion were up 97 percent annually and 7 percent quarterly.

- Embedded revenues were $1.04 billion, up 4 percent annually and 21 percent quarterly.

- Storage revenues languished at $653 million, down 4 percent annually and down 12 percent quarterly.

CFO Mark Murphy said storage revenue was down: “due to sharply lower consumer component sales, partially offset by strong growth in SSD revenue.”

Mehrotra was bullish about SSDs: ”Micron ended the third calendar quarter with record-high revenue share in data center SSDs, based on independent industry assessments. This marks the second consecutive quarter of record revenue share in data center SSDs, and we look to build on this revenue momentum through fiscal 2024.”

He noted: “record bit shipments in both client and consumer SSDs, as customers adopted our industry-leading solutions. Building upon our QLC leadership, our client SSD QLC bit shipments also reached a new record in fiscal Q1. QLC now comprises the majority of our bit shipment mix for both client and consumer SSD.”

Turning to AI he said: “Generative artificial intelligence (AI) use cases are expanding from the data center to the edge, with several recent announcements of AI-enabled PCs, smartphones with on-device AI capabilities, as well as embedded AI in the auto and industrial end markets. … We expect to increasingly benefit from content growth as these trends in AI gain momentum.”

He is enthused by demand for HBM3e which is needed by GPUs, and a market in which Micron has developed new product technology: “We have received very positive customer feedback on our HBM3e, which has approximately 10 percent better performance and about 30 percent lower power consumption compared to competitive offerings of HBM3e. In fiscal Q1, we shipped samples of HBM3e to a number of key partners and are making good progress in our qualifications. Micron is in the final stages of qualifying our industry-leading HBM3e to be used in NVIDIA’s next generation Grace Hopper GH200 and H200 platforms.”

Then he said: “We are on track to begin our HBM3e volume production ramp in early calendar 2024 and to generate several hundred millions of dollars of HBM revenue in fiscal 2024. We expect continued HBM revenue growth in 2025.” Several hundred millions of dollars should boost Micron’s revenues nicely.

Some of it has apparently arrived already. Wells Fargo analyst Aaron Raklers noted: “Micron disclosed that during F1Q24 it received $600 million in customer prepayments to secure supply of leading-edge memory products – we expect largely driven by HBM.”

The genAI surge is having a positive impact on PCs, with Mehrotra saying: “In PCs, we forecast unit volumes to grow by a low to mid-single-digit percentage in calendar 2024, after two years of double-digit percentage PC unit volume declines. We expect PC OEMs to start ramping AI-on-device PCs in the second half of calendar 2024, with an additional capacity of 4 to 8GB of DRAM per unit, and we see average SSD capacities increasing as well.”

Micron has updated its DRAM and NANd technology, with Mehrotra noting: “The vast majority of our bits are on leading-edge nodes: 1α (1-alpha) and 1β (1-beta) in DRAiM and 176-layer and 232-layer in NAND. … both 1β DRAM and 232-layer NAND nodes have reached mature yields faster than the prior nodes. We expect fiscal 2024 front-end cost reductions to track in line with our long-term expectations of mid-to-high single digits in DRAM and low teens in NAND. We are on track for volume production in 1γ (1-gamma) DRAM using extreme ultraviolet lithography (EUV) in calendar 2025.”

MIcron’s outlook for the next quarter is for revenues of $5.3 billion +/- $200 million, which is a 43.5 percent year-on-year rise at the mid-pont as we noted above. This will be driven more by price rises than bit shipment increases. Recovery from recession is picking up and may well accelerate.