Following another low revenue quarter at Seagate, Western Digital disk sales were also depressed but flash bucked the downcycle trend, and WD thinks the disk market is bottoming out.

Western Digital revenue for Q1 of its fiscal 2024 ended September 29 was $2.75 billion, down 26 percent year-on-year, with a net loss of $685 million compared to a $27 million net profit a year earlier.

CEO David Goeckeler said: “Western Digital’s fiscal first quarter results exceeded our expectations [with] sequential margin improvement across flash and HDD businesses. Our Consumer and Client end markets continue to perform well and we now expect our Cloud end market to grow going forward.”

Looking at the revenues by media type, disk revenues were $1.19 billion, down 30.8 percent annually, while flash revenues came in at $1.56 billion, up 9.6 percent.

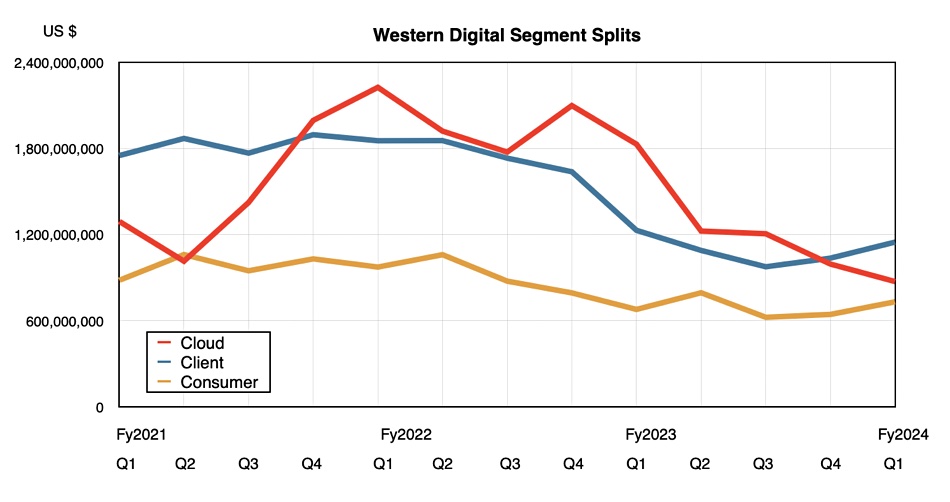

Cloud media revenues have fallen so much for five quarters in a row that they are now below client device sales and risk sliding below consumer device sales:

Financial summary

- Gross margin: 3.6 percent vs 26.3 percent a year ago

- Free cash flow: -$544 million

- Cash & Cash equivalents: $2.03 billion

Cloud revenues were depressed due to lower nearline hard drive shipments to datacenter customers than last quarter and declines in both disk and SSD datacenter shipments year-over-year.

Disk business

WD shipped 10.4 million drives, 29.3 percent down year-over-year, and exabyte shipments declined 5 percent from last quarter. Cloud market buyers bought 5.3 million units, down 38.4 percent year-over-year; client buyers 2.6 million, down 23.5 percent annually; and consumer buyers 2.5 million drives, just 7.4 percent down. The Chinese market was also subdued.

The average selling price per drive was $112 vs $125 a year ago, and higher than in each of the preceding three quarters.

The 26TB UltraSMR drive accounted for nearly half of Western Digital nearline exabyte shipments. WD says it’s on track with qualification of its 28TB UltraSMR drive and has a road map into the 40TB capacity range, without transitioning to HAMR technology.

Goeckeler said: “HAMR is in development. It’s going well, and we’ll be able to fold that into our road map at the appropriate time. But for now, we’ve got a great road map … We’re leading the adoption of SMR into the cloud data center. And we have many more generations to go on our current road map, and then we’ll move to HAMR at the appropriate time when it’s mature and we can build it at scale.”

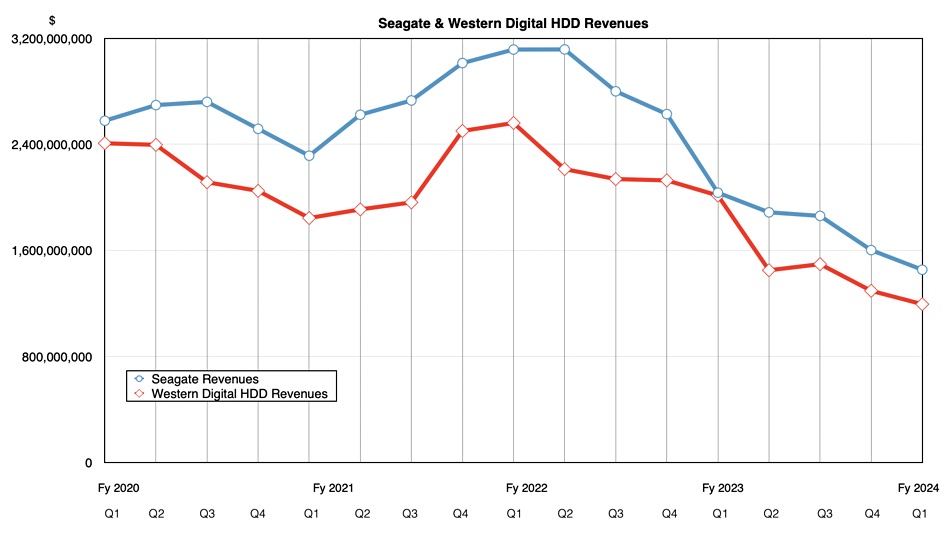

A comparison of Seagate and Western Digital HDD revenues over the past few quarters show WD is a near-permanent second placed player:

In the earnings call, Gockeler said: “Industry analysts estimate the HDD addressable market to grow at approximately 12 percent compound annual growth rate to $25 billion over the next three years, with cloud representing over 90 percent of the total addressable market.” This is quite different from the Pure Storage view that no new disk drives will be sold after 2028.

Flash business

WD says it had record flash bit shipments, up 49 percent annually, and is ramping a set of client SSD products using 172-layer, QLC (4bits/cell) NAND for shipment in calendar 2024, with a 232-layer NAND product set to follow that.

Goeckeler said: “Industry analysts forecast the flash market to grow at approximately 15 percent compounded annual growth rate over the next three years to $89 billion in calendar year 2025. We believe content increases in the consumer and client end markets, as well as explosive growth of data created in the cloud by emerging applications such as generative AI, virtual reality, and autonomous driving, are driving a faster growth in flash versus HDD.”

He pointed to the strength of the SanDisk consumer flash brand and WD’s gaming market presence (Black brand SSDs), but did not mention enterprise and cloud (hyperscaler) flash drives, a weak area for WD flash.

An analyst asked: “What is the team doing to improve its competitiveness in its enterprise and cloud SSD portfolio?”

Goeckeler responded: “Well, we like the portfolio we have. We qualified our NVMe-based enterprise SSD at multiple cloud providers. And unfortunately, we qualified right into a significant downturn in cloud consumption of enterprise SSDs. So, as that starts to come back over the next several quarters and as we go through ’24, we expect our position to improve as those vendors start consuming again. I mean, the reality is there’s just not a lot of buying in that market going on right now.”

He said the enterprise SSD market is relatively depressed and “we had qualifications at multiple hyperscalers. Those products are still active. We’re migrating them forward to future nodes, and we expect those to ramp as that market recovers.”

He noted that flash pricing is beginning to rise, a signal that the flash recession may be ending, supported by consumer and client SSD sales.

The flash business results were overshadowed by WD’s declaration it is set to spin off its flash business next year.

Outlook

Goeckeler said: “We are now emerging from a historic storage cyclical downturn … As we progress through fiscal year ’24, we see an improving market environment in both businesses,” meaning HDD and NAND/SSD. Specifically for disk, he said: “We think this past quarter was the bottom … And we see improving demand as we move throughout the fiscal year on a quarter-over-quarter basis.”

The outlook for the WD’s Q2 is revenues of $2.95 billion +/- $100 million, a 5.1 percent fall from a year ago at the mid-point – a much lower revenue decline rate than we have become used to over the past few quarters. Things are looking up.