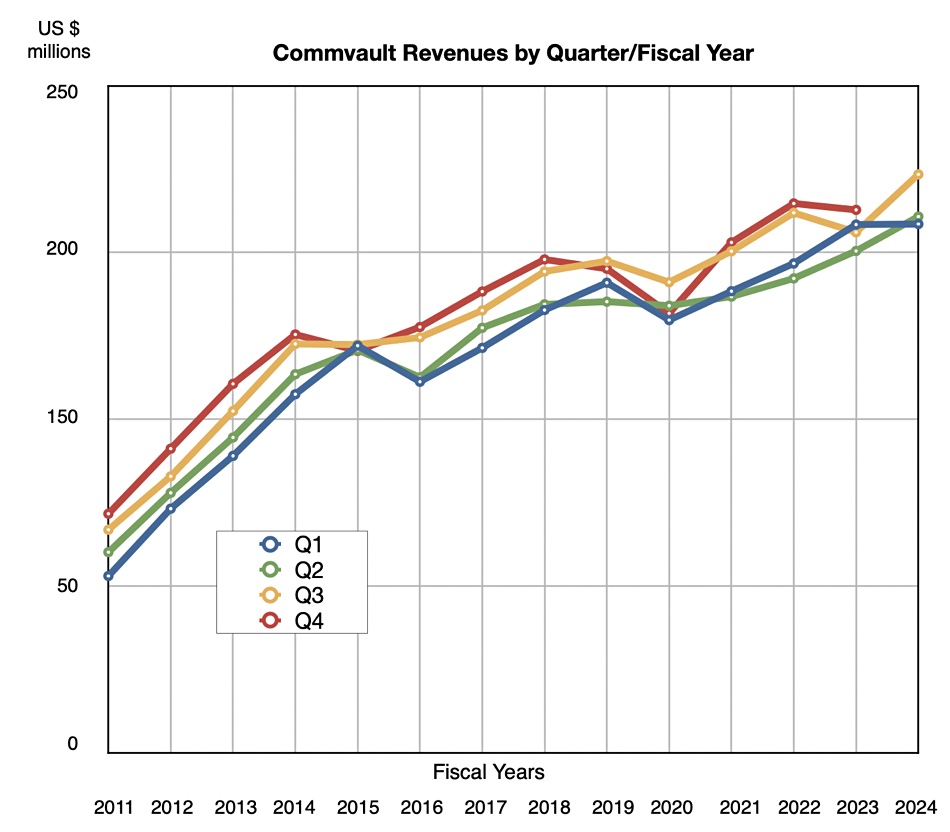

Commvault earned $216.8 million in its third fiscal quarter ended December 31, a record amount for the biz, yet a quarter-on-quarter downturn has been forecast.

Revenues for the data protector were $216.8 million – up 11 percent year-on-year driven by a 31 percent increase in subscription revenue. There was a $17.1 million profit – a world away from the year-ago $310,000 loss, and representing 7.9 percent of revenues.

CEO and president Sanjay Mirchandani noted in prepared remarks: “Our Q3 results exceeded expectations, including double-digit year-over-year growth across our most important KPIs. By our own metrics, this was an exceptional quarter. We also set the stage for the future, by introducing market-leading innovation with Commvault Cloud, our revolutionary platform for cyber resilience.”

He added: “We’re two months away from closing our fiscal year, and I couldn’t be more excited about our momentum as we approach FY 25.”

Wells Fargo analyst Aaron Rakers observed that Commvault “sees an ‘amazing opportunity to accelerate growth’ in FY 2025.”

Financial summary

- Operating cash flow: $44.4 million

- Free cash flow: $42.6 million

- Gross Margin: 82.9 percent up 0.1 percent on the year

- Cash and cash equivalents: $284.3 million and no debt

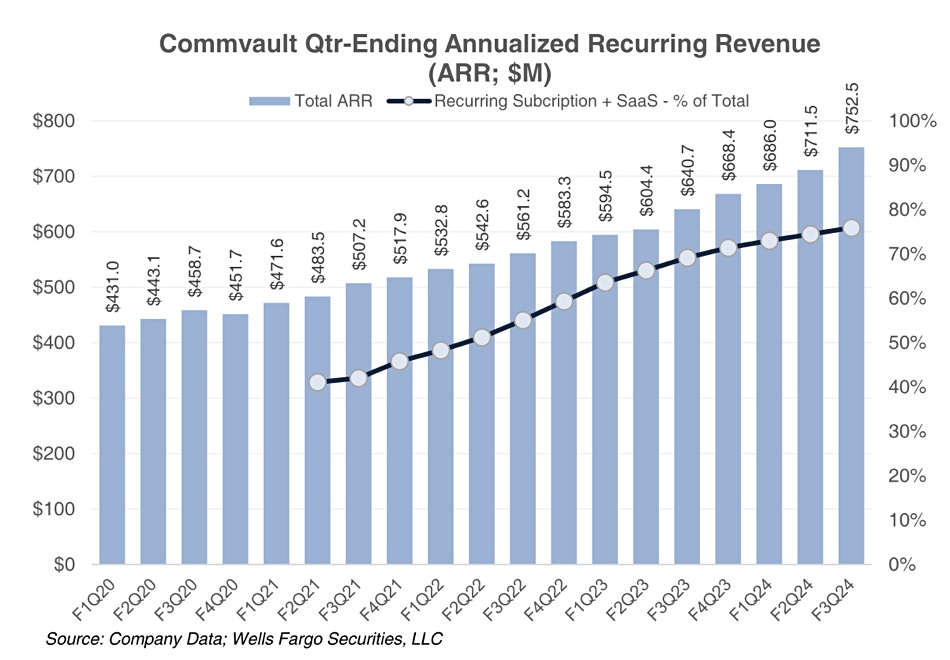

- Total ARR grew 17 percent year on year to $752 million

- Subscription ARR grew 29 percent year on year to $571 million

- SaaS ARR increased 77 percent year on year to $152 million

CFO Gary Merrill declared in the earnings call: “Our execution was strong as large software deal close rates improved sequentially and we delivered against our largest term subscription renewal quarter of the fiscal year.”

Commvault introduced Commvault Cloud powered by Metallic AI in November to unify all its SaaS and software offerings on one platform, with single pane of glass management, threat prediction and recovery features, and an Arlie – short for “Autonomous Resilience” – generative AI copilot using Azure OpenAI.

Mirchandani claimed this was “the most important pivot in our 27-year history,” and Commvault reckons it now has a strong SaaS offering in a dynamic growth market. Subscription revenues were $114 million in the quarter – up 31 percent year on year. It added 500 new subscription customers in the quarter, taking its customer count total to 8,800.

The outlook for the fourth quarter is for revenues of $212 million give or take $2 million – growth of just 4.2 percent at the midpoint and a sequential decline on the latest quarter. The reasons for this anticipated slowdown in growth are not immediately clear. It doesn’t appear to be seasonal as there has been a third-to-fourth quarter revenue increase in six of the last eight financial years.

Merrill discussed the outlook: “For fiscal Q4, we expect subscription revenue, which includes both the software portion of term-based licenses and SaaS, to be $111 to $115 million. This represents 20 percent year-over-year growth at the midpoint. This Q4 subscription revenue outlook reflects continued momentum in our new customer and expansion business, but a smaller renewal pull in fiscal Q4 relative to Q3.”

William Blair analyst Jason Ader told subscribers: “Revenue guidance for the fourth fiscal quarter was above consensus by $1.8 million at the midpoint (up 4.2 percent year-over-year). Though the renewals base is sequentially lower in the fourth quarter, subscription revenue was guided above consensus by $5.8 million at the midpoint (up 20 percent year-over-year), driven by strong SaaS momentum and an improving pipeline.” He mentioned that “fiscal Q3 had the largest renewal pool we’ve ever had in our history.”

In other words, the annual comparison is more important than the sequential comparison and it’s the lower renewals number that drags the outlook down.

The full 2024 outlook is for revenues of $828 million up or down $2 million – a 5.5 percent increase at the midpoint on fiscal 2023. There was no outlook for fiscal 2025, but Merrill opined: “We have an amazing opportunity to accelerate as we move forward. Obviously we have not given guidance for FY 2025 yet. Clearly our expectation [is] that FY 2025 growth will be higher than FY 2024.”