VAST Data has raised $118 million in new funding for a $9.1 billion valuation, with total cash raised hitting $381 million.

The company provides parallel, scale-out access to file and object data with disaggregated controllers and storage nodes using a single tier of QLC (4 bits/cell) flash and metadata access accelerated by storage-class memory SSDs. This platform, certified for Nvidia GPUDirect access, has a data catalog and database built on it with a data engine coming that promises to enable AI processes to discover new insights about the data it analyzes. With the ongoing supercharged generative AI hype, it’s a great time to raise VC money.

VAST said the funding will advance its mission to deliver a new category of infrastructure that puts data at the center of how systems work. There are no details on how the cash will actually be spent. In fact, co-founder Jeff Denworth said: “This funding is simply being used to raise awareness of VAST and our mission … VAST operates its business on a cash-flow positive basis. We’ve managed to build a company which can triple its business annually while not burning through mountains of venture capital … This new Series E funding will sit in the bank and collect interest alongside the funding we received from Series B, Series C, and Series D.”

Renen Hallak, CEO and co-founder, added: “To be truly impactful in this era of AI and deep learning, you not only want to have a lot of data, but also high-quality data that is correctly organized and available at the right place, at the right time. The VAST Data Platform delivers AI infrastructure that opens the door to automated discovery that can solve some of humanity’s most complex challenges.”

Denworth elaborated in a blog: “As machines become more capable, they will also be able to reason about the natural world and create new discoveries in the areas of math, science, and even the arts. AI-discovered advancements for clean energy, food abundance, and human health are on the immediate horizon.”

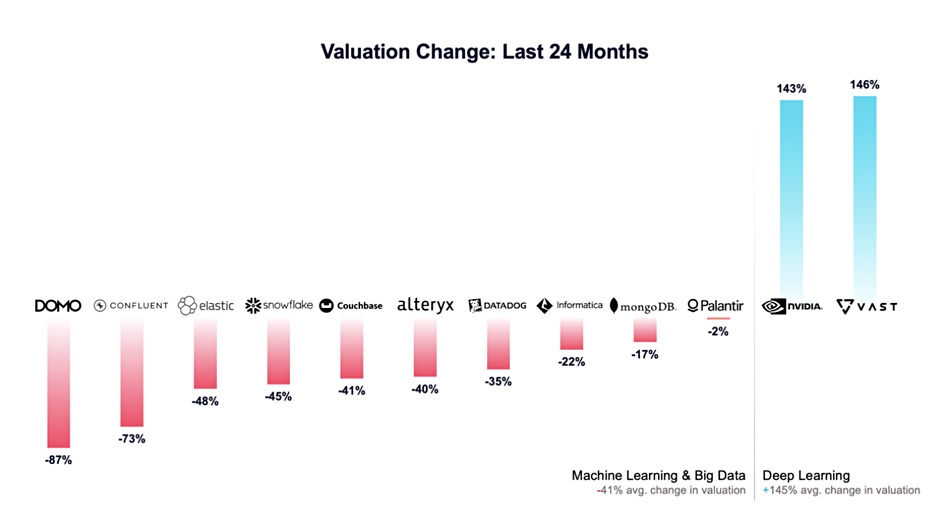

It says its valuation increase parallels that of Nvidia, as a chart indicates:

The company claimed its growth rate means that it will surpass $1 billion in cumulative software bookings. It says it has achieved 3.3x year-over-year growth and maintained positive cash flow for the last 12 quarters with a gross margin of nearly 90 percent.

VAST now has more than 700 employees worldwide, and is actively broadening its business footprint, penetrating new regions in Asia-Pacific, the Middle East, and Europe. That involves a lot of spending.

The valuation of $9.1 billion is a more than 2x raise on the $3.7 billion valuation at the time of VAST’s last funding round for $83 million in 2021. Since then the company has pulled in partnership deals with GPU-as-a-Service cloud providers CoreWeave and Lambda Labs, secured the Texas Advanced Computing Center (TACC) as a customer, and landed an OEM deal with HPE for its GreenLake File Services software. With this growth, VAST Data is a prime VC funding target, even though it doesn’t need the cash.

The new round was led by Fidelity Management & Research Company accompanied by New Enterprise Associates (NEA), BOND Capital, and Drive Capital. Even though VAST is not a public company, it’s thought that VAST may use some of the cash for share buybacks so employee stock options could be turned into cash.

Looking ahead, Denworth said: “Over the next 12 months you’ll see a lot more focus on cloud, zero-trust, [and] the AI computational layer.”