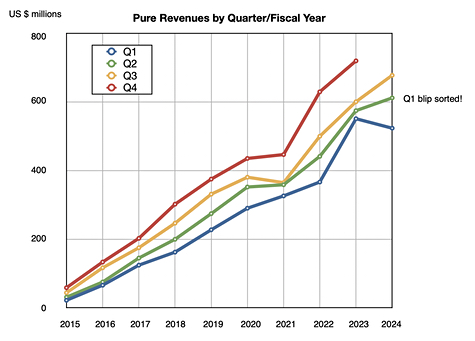

Unlike HPE and NetApp’s results, Pure Storage revenues grew in its latest quarter, but a massive telco order deliverable in 2025 and subscription sales growth sent its next quarter guidance down.

Revenues in its third fiscal 2024 quarter, ended November 5, were $762.8 million, up 13 percent year-on-year (Y/Y) with a profit of $70.4 million, the third profitable quarter in its history, and contrasting with the year-ago $787,000 loss. Product sales of $453.2 million were 5.1 percent up Y/Y, affected by the higher 26 percent growth in subscription services to $309.6 million. There was a consistent macroeconomic climate during the quarter and this is expected to continue.

CEO Charlie Giancarlo said in prepared remarks: “We are pleased with Pure’s Q3 financial results. We saw healthy demand for our portfolio throughout the quarter … Evergreen//One, our storage-as-a-service consumption offering, saw continued, extraordinary growth, more than doubling year-over-year.”

There’s downside to this high subscription sales growth: lower product purchases in the next few quarters. Giancarlo pointed out: “The outperformance of Evergreen//One this year has been significantly above our prior expectations, and we now expect this strong level of demand to continue through Q4. While this success is a long anticipated and welcome expansion of our business model, its over-performance will have an effect on near-term revenue.”

Financial summary

- Gross margin: 74 percent

- Operating cash flow: $158 million

- Free cash flow: $113 million

- Subscription ARR: $1.3 billion, up 26 percent Y/Y

- Remaining Performance Obligations: $2.1 billion, up 30 percent Y/Y

- Total cash and marketable securities: $1.35 billion

Pure reported a number of AI wins in the quarter across its portfolio, which included Portworx (container software) and FlashBlade sales. FlashBlade experienced record sales, helped by the QLC flash capacity-enhanced FlashBlade//E product shipping. Giancarlo said: “The early success of our //E family reinforces our belief that Flash is replacing disk, enlarging Pure’s opportunity in enterprise and eventually cloud storage.”

He elaborated on this in the earnings call: “We intend to be very aggressive in pricing and especially as we penetrate the lower price performance tiers of the disk market. It’s a new market for flash and the opportunity there is huge, more than half of the overall enterprise storage market, and we believe we have a special opportunity that ahead of every other player in the market. So our intention is the E family grows is to be very aggressive in that segment.”

CFO Kevan Krysler added: “We will be aggressive in our disk takeout strategy with our E family price performance solutions.”

Pure’s all-flash array (AFA) product line grows revenues by taking business away from competitors’ hybrid disk drive arrays. Both HPE and NetApp have large installed bases of such arrays and much of their AFA business lies in converting them to all-flash arrays and not so much in gaining new customers. Pure, with no installed disk array base, is hungrier for new customers to fuel its growth, and gained 353 in the quarter, taking the total to nearly 13,000.

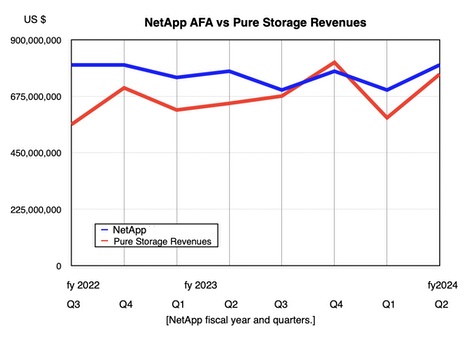

Pure only sells flash storage and its AFA run rate, based in this quarter, is $3.1 billion. NetApp reported a $3.2 billion AFA run rate yesterday.

Having overtaken NetApp’s AFA run rate a couple of quarters ago but then fallen back, can Pure overtake NetApp in AFA sales and stay ahead? In the short term, it does not look like it as Pure’s guidance for its next quarter is $782 million, 3.5 percent lower than a year ago. Its guidance for the full fiscal 2023 is $2.82 billion, a 2.5 percent Y/Y rise.

This low guidance was explained by Krysler: “During Q3 we closed a large non-cancelable product order with a large telco customer totaling $41 million that is included in the RPO balance at the end of Q3. Based on the timing of the shipment schedule for this order, product revenue is not expected until next year which impacts our revenue outlook this year.”

The order is for a 5G system and Pure’s product will ship in calendar 2024.

This, together with product sales being replaced by subscription sales, “creates a short-term impact on revenue growth,” Krysler said. He reckons annual revenue growth would be 7 percent, and not 2.5 percent, if the higher-than-expected shift to subscription sales and telco order are taken out of the equation.

The stock market reflected some short-term investor disquiet about this, with Pure’s stock price falling 14 percent in after hours trading.