Data protection biz Commvault is morphing into a cyber-resilience supplier following a second consecutive growth quarter helped by its Metallic SaaS product and 500 additional customers.

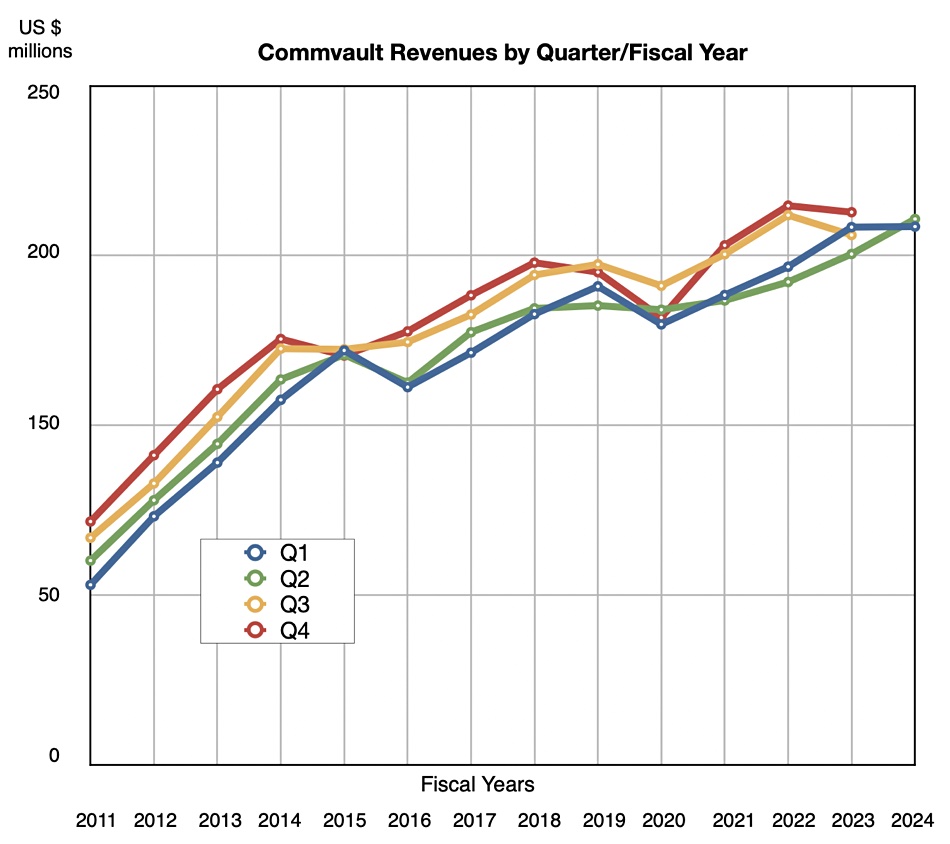

Revenue for Commvault’s calendar Q3, ended September 30, was up 7 percent year-on-year to $202 million, beating guidance. Net profit of $13 million was almost three times higher than a year-ago. William Blair analyst Jason Ader told his subscribers: “Commvault reported a solid top and bottom-line beat in its fiscal second quarter and provided a generally upbeat outlook for the remainder of the year.”

President and CEO Sanjay Mirchandani said in a statement: “Our Q2 total revenue growth accelerated, driven by our hyper-growth SaaS platform, and we delivered robust operating margin leverage. Next week, at Commvault SHIFT, we’ll unveil our cyber resilience platform, combining our leading data protection capabilities with comprehensive new security and AI-powered innovations that are critical for customers in an era of escalating cyberattacks.”

Financial summary

- Total annual recurring revenue (ARR): $711 million, up 18 percent annually

- Subscription revenue: $97.8 million, an increase of 25 percent

- Perpetual license sales: $14.39 million; down 27.5 percent

- Subscription ARR: $530 million, up 32 percent

- Metallic ARR: $131 million, up 77 percent

- Customer support revenues: $77 million, down 1 percent

- Operating cash flow: $40.3 million

- Free cash flow: $40.1 million

Ader noted: “The good news is that within the customer support revenue line, the mix continues to shift toward term and away from perpetual, with management expecting the crossover point to come next fiscal year. The result will be that customer support will be less of a headwind to revenue growth in future periods.”

The subscription customer count is now 7,800, more than 50 percent of Commvault’s customer base – up 500 sequentially and 2,200 annually. More than 60 percent of Metallic customers are new to Commvault and only about 25 percent of Metallic users are customers for Commvault’s enterprise protection products, we’re told.

US revenues grew 3.5 percent year-over-year while international revenues rose 12.3 percent, with the EMEA region seeing more and smaller deals than in the States.

Mirchandani’s said total ARR is “the primary metric we use to measure underlying growth.” He prepared the ground for a shift into cyber-resilience, claiming: “We are going to introduce a radically new approach that empowers customers to stand up to today’s non-stop and escalating cyber threats. We are bringing together what we’re known for – best in class data protection – and combining it with exceptional data security, recovery, and AI-driven data intelligence.”

This will be helped, we’re told, by new ecosystem partnerships. Commvault set up a Cyber Resilience Council yesterday, chaired by Melissa Hathaway. She’ll speak at the SHIFT event on November 9.

The earnings call revealed that Commvault is seeing increased caution in large deals, however.

The outlook for the next quarter is $208 million +/- $2 million, meaning a 6.6 percent annual increase at the mid-point. Commvault has upgraded its full fiscal 2024 revenue expectation from an $805-815 million range to $812-822 million.