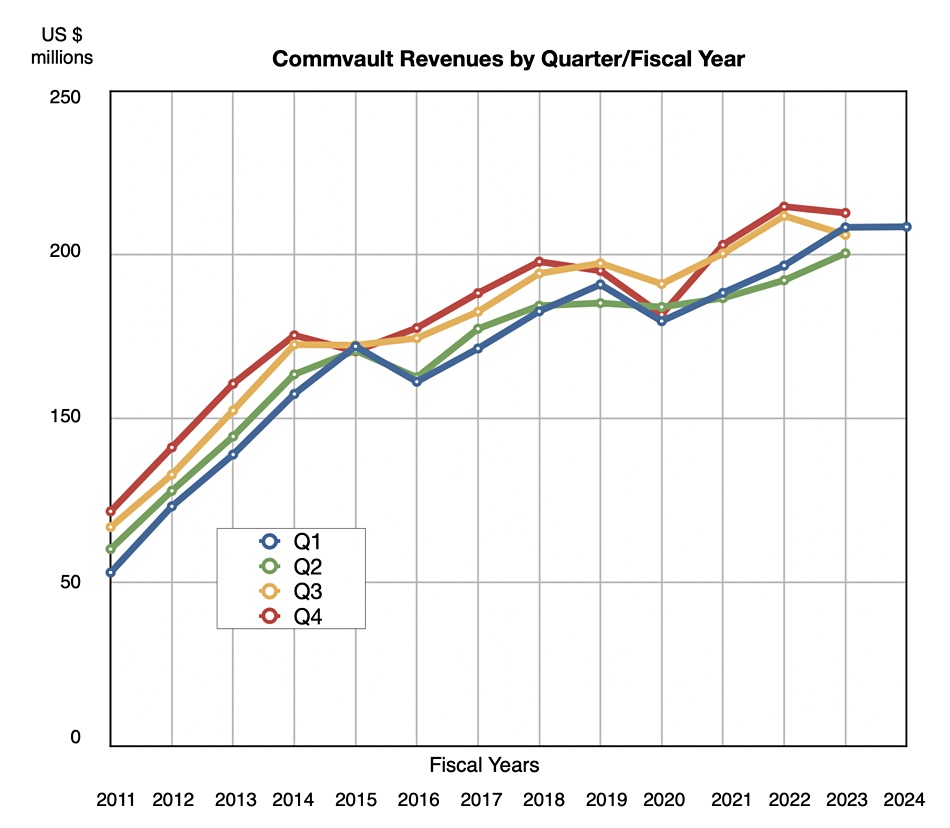

Commvault’s quarterly revenues have consistently been around $200 million for the past seven quarters as subscription and Software as a Service (SaaS) revenues begin to overtake traditional license sales.

The company, known for providing on-premises data protection software with robust security features, along with the Metallic SaaS data protection service, reported revenues of $198.2 million in its first quarter of fiscal 2024, ending on June 30. This represents a modest increase of $150,000 from the previous year. Profits have surged to $12.6 million, marking a substantial 259 percent increase from the Q1 $3.5 million profit of the previous year.

CEO and president Sanjay Mirchandani said: “We’re off to a solid start to our fiscal year, highlighted by accelerated subscription revenue momentum and continued operating discipline.”

Mirchandani highlighted three subscription-related numbers. Total annual recurring revenue (ARR) rose 15 percent year-over-year to $686 million. Subscription ARR expanded 32 percent to $500 million, and Metallic increased its ARR 72 percent year-over-year to $113 million. Currently, Metallic has nearly 4,000 customers, up from over 3,000 just two quarters ago. Based on this growth, I reckon Metallic could reach a $500 million run rate within the next couple of quarters.

Commvault used to publish metrics such as the number of large deals in a quarter, its services revenue, and software and product revenue. However, recent reports have shifted focus towards ARR, subscription ARR, subscription customers and revenue, and SaaS revenue.

All of these subscription-related metrics are growing:

- ARR: $686,000,000, up 15 percent Y/Y

- Subscription ARR: $500 million, up 13 percent

- Subscription customers: 7,800, up 39.3 percent

- Subscription revenue: $95 million, up 11 percent

- SaaS: $113 million and growing 72 percent

Metallic continues to present opportunities for customer acquisition and cross-selling for Commvault, with 60 percent of Metallic customers being new to Commvault and showcasing a 118 percent net dollar retention rate. Wells Fargo analyst Aaron Rakers told subscribers: “40 percent of customers have Metallic plus CommVault core solutions.”

A mere 25 percent of Metallic customers are enterprise customers, typically those with over 1,000 employees, which indicates that Metallic is helping to broaden the customer base.

Projections for the next quarter anticipate revenues between $193 million and $197 million, representing a midpoint of $195 million and a modest 3.7 percent increase from the previous year. This moderate growth is attributed to the ongoing transition to subscription models and SaaS client acquisition.

Full fiscal 2024 revenues are projected to be approximately $820 million, reflecting a 4.5 percent increase from fiscal 2023.

Mirchandani finished up his prepared remarks by pointing out: ”In the Fall, we will be announcing some exciting capabilities and offerings that will further empower customers and redefine the industry.” That’s not long to wait.