Western Digital experienced another quarter of depressed revenues but saw signs of an uplift in its client and consumer businesses.

The company has two divisions: hard disk drives and SSDs built with NAND from its joint-venture fab operated with Kioxia, with whom merger discussions are ongoing. WD generated revenues of $2.68 billion in its fourth quarter of fiscal 2023, ended June 30, a 41 percent year-on-year decline. It reported a net loss of $715 million, compared to net income of $301 million.

CEO David Goekeler said on the earnings call: “Western Digital’s fiscal fourth quarter revenue exceeded expectations as our access to broad go-to-market channels, enviable retail franchise and strong client SSD portfolio enabled us to capture demand upsides in both client and consumer end-markets, reaffirming our strength in a challenging market environment.”

The flash/SSD business unit reported $1.38 billion in revenues, down 42.6 percent Y/Y but a 5.4 percent Q/Q increase, indicating a possible flash turnaround. HDD revenues were down 39 percent Y/Y and 13.4 percent Q/Q at $1.3 billion. HDD units dropped 28.5 percent Y/Y to 11.8 million. The cloud sector bought 5.8 million units, down 37.6 percent Y/Y, client buyers bought 3.3 million, 15.4 percent lower Y/Y, and the consumer market purchased 2.7 million drives, an 18.2 percent Y/Y decrease. HDD capacity ships went down 18 percent Q/Q as well, with customers buying fewer high-capacity nearline drives.

WD said its 26TB SMR disk drives are shipping in high volume and it is about to begin sampling a new and as yet unannounced 28TB SMR drive. This suggests a 24TB conventional non-SMR drive might be coming, with 2TB higher capacity than its current 22TB drives. Goekeler said 30TB and 30TB+ SMR drives were also on the way, all using WD’s ePMR, OptiNAND and Ultra SMR technologies.

He added: “Going forward … several of the major cloud providers are standardizing on an SMR deployment, UltraSMR for us, and we expect have a significant ramp of that technology over the next several quarters.”

Financial summary

- Gross margin: 3.4 percent vs 31.9 percent a year ago

- Operating cash flow: -$68 million vs last year’s $295 million

- Free cash flow: $-219 million vs last year’s -$97 million

- Cash and cash equivalents: $2 billion

- Diluted EPS: -$1.98 vs $1.78 a year ago

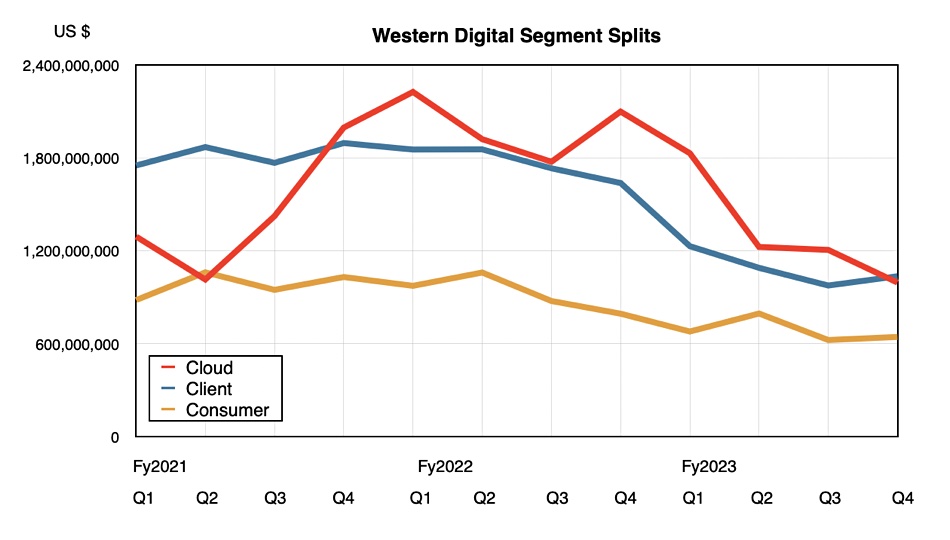

WD has three main market sectors: cloud, client and consumer. Cloud revenues of $994 million were down 53 percent Y/Y due to declines in both SSDs and HDDs. Nearline drive shipments declined Q/Q as well. Reported client revenues were $1.04 billion, a 36.8 percent annual decrease but a 6.2 percent Q/Q increase as game buyers bought more capacity, while the $643 million in consumer revenues were down 18.9 percent Y/Y. Consumer revenues increased ever so slightly Q/Q; 3.2 percent due to higher SSD sales.

This was the first time in nine quarters that cloud revenues have dropped below client revenues, as a chart indicates:

We also see the slight upturns in client and consumer revenues after several quarters of decline. There have been previous Q/Q upturns in the consumer business which were not sustained so lets not pin too much hope on that; the trend is still downwards. The client upturn, the first after seven successive down quarters, is perhaps more significant.

Goekeler put a positive spin on the flash side of things: “We are encouraged by several indicators signaling improving flash market dynamics. Our two largest end markets, client and consumer, are returning to growth, inventories are normalizing, content per unit is increasing and price declines have been moderating. Western Digital is well-positioned to capitalize on improving market conditions and capture long-term growth opportunities in data storage, spanning from client to edge to cloud.”

Client HDD ships also increased sequentially.

WD is a leaner business than it has been, with inventory lowered by $300 million Q/Q, cash capital expenditure run rate reduced by over 50 percent in the past two quarters, and a consolidated HDD manufacturing footprint.

Nothing was announced about the ongoing merger talks between Kioxia and WD, which form part of WD’s strategic business review. This review is being driven by activist investor Elliott Management which reckons that WD’s flash business is under-valued and dragging WD’s total stock market valuation down. Separating it off, and merging it with JV partner Kioxia, would make its value more visible in stock market terms, meaning a higher share price.

HDD competitor Seagate reported revenues of $1.6 billion in its latest quarter, also down 39 percent Y/Y but a larger sum than WD’s $1.3 billion for its HDD business. Goekeler said WD would move towards a HDD build-to-order manufacturing process from its current build-to-forecast process. Seagate has already said it’s making this change.

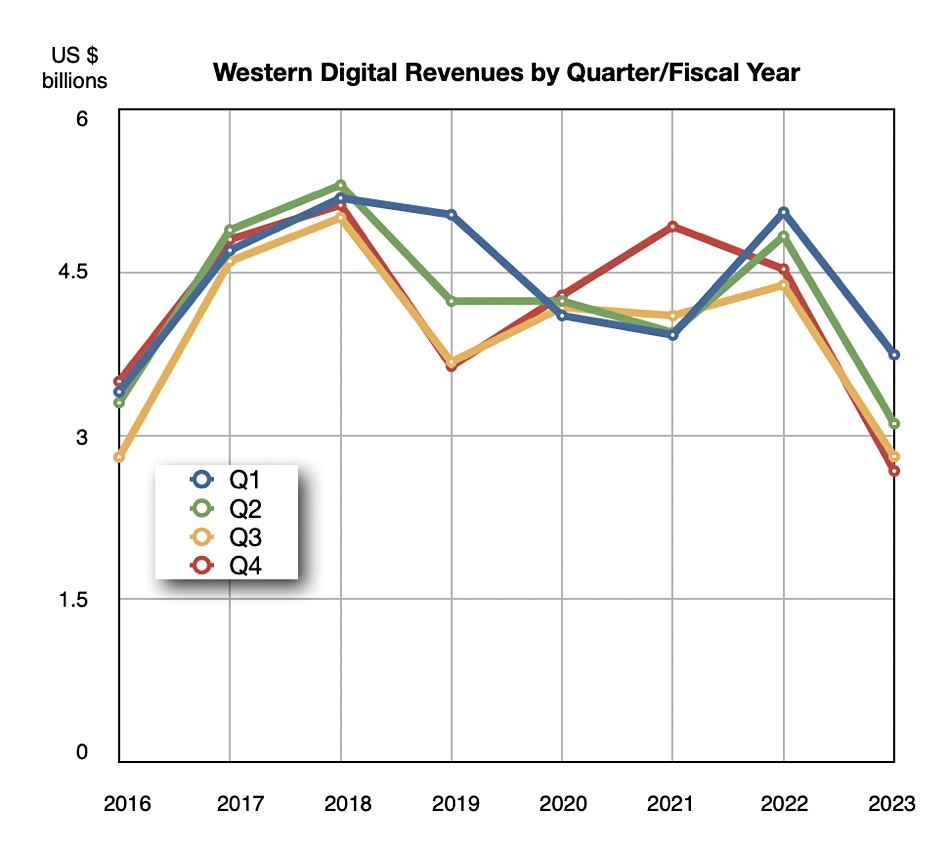

Full fiscal 2023 revenues were $12.3 billion, down 34 percent on the previous financial year, with a loss of $1.7 billion versus profit of $1.5 billion. What a difference those twelve months made.

A question on the earnings call was asked about Pure’s notion that SSDs will kill HDDs. Goekeler said: “HDD is the predominant storage mechanism in the data center. We don’t expect that to change. Our customers don’t expect that to change. .. And we expect robust growth of HDD storage in the data center going forward. We also expect growth of enterprise SSD storage in the data center going forward. It’s probably growing a little bit faster than HDD, but not in a way where you’re looking at one is a substitute for the other. They’re highly complementary technologies, and we expect that to be the case for any useful planning horizon in the future.”

WD said it foresees significant and persisting cost differences between HDDs and SSDs in the next decade.

Goekeler said he expects there to be “improving demand and new product ramps to drive growth in revenue and profitability” in the HDD business after the next quarter, with the flash business improving as well. There should be “sequential exabyte growth in capacity enterprise HDD throughout the fiscal year, but it’s going to be towards the end of the year, end of the first quarter, where we start to get line of sight to all of the customers coming back.”

It seems that WD thinks the next quarter will reach the bottom of its revenue trough. Expected revenues for this next quarter are $2.65 billion +/- $0.1 billion, which would be a 29 percent Y/Y decrease; the sixth successive quarter of revenue decline. The bright lights at the end of the depressed revenue tunnel could be shining in the quarter after that. And generative AI could help, with Goekeler saying: ”it’s a catalyst for a profound increase in the rate of data creation.”

Bootnote

WD’s President of Technology and Strategy, Siva Sivaram is leaving the company to become President at QuantaScape, a lithium battery startup.