The disk drive market is depressed with Seagate reporting its lowest annual revenues in 17 years, as Seagate’s largest buyers, the hyperscale cloud providers, bought far fewer nearline drives, and next quarter’s outlook isn’t much better.

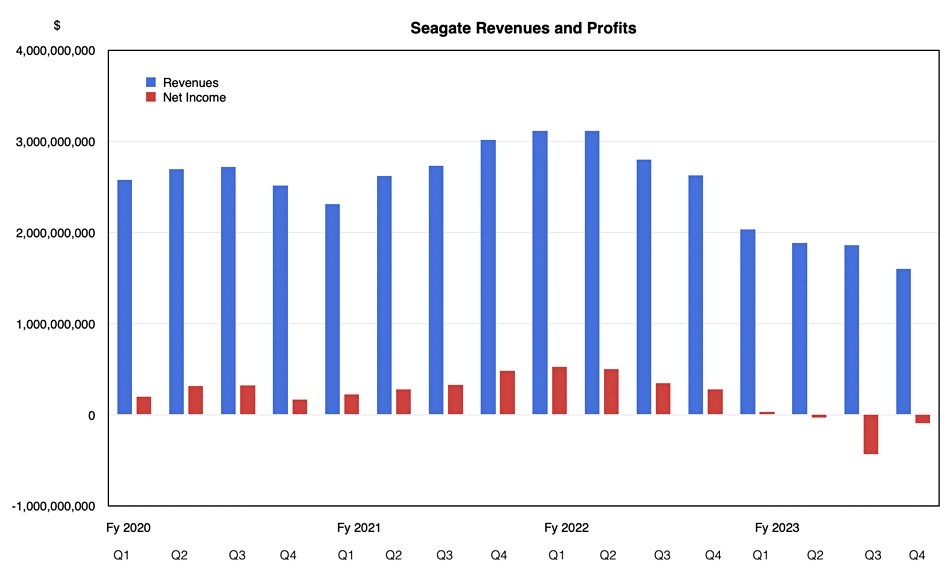

Revenues in the quarter ended June 30 were $1.6 billion, 39 percent lower Y/Y, with a loss of $92 million. That looks poor compared to the year-ago profit of $276 million but is much better than last quarter’s loss of $433 million. Full fy2023 revenues came in at $7.38 billion which compares badly with the year-ago $11.6 billion, meaning a 37 percent drop. There was a loss of $529 million contrasting sharply with the prior year’s $1.65 billion profit and its first annual loss in 13 years or more.

CEO Dave Mosley mentioned “a profound downturn in demand” and his results statement said: “Our fourth quarter and fiscal 2023 performance reflected the uneven pace of economic recovery in China, cloud inventory digestion, and cautious enterprise spending amid the uncertain macroeconomic environment.” Seagate expects the three adverse factors to persist in the next two quarters.”

“Through our actions, Seagate is now leaner, our balance sheet healthier, and our product roadmap even stronger, positioning the company to weather the near-term business environment, deliver financial leverage, and capture attractive long-term opportunities for mass capacity storage.”

The actions include lowering its cost structure and reducing output with a build-to-order approach. It’s also increasing prices. With not so much cash coming in, Mosley talked about increasing debt In the earnings call: “We’ve enhanced balance sheet flexibility taking out nearly $800 million of debt funded largely by monetizing non-manufacturing facility assets.” That means sale and leaseback of office facilities. Mosley said Seagate has a “focus on returning to profitability.”

The “product roadmap” statement alludes to the existing 20TB PMR technology being extended into the mid-to upper 20TB area, meaning 24/25TB with conventional drives and beyond with SMR tech, while the replacement HAMR technology is on track to begin its volume ramp in early cy2024 with Seagate preparing qualification with a broader number of customers beyond hyperscale buyers.

The company has paused stock repurchases for the reminder of the fiscal year, but it is still paying a dividend.

Financial summary for quarter

- Gross margin: 19 percent vs 28.9 percent a year ago

- EPS: -$0.44 vs $1.27 last year

- Operating cash flow: $218 million

- Free cash flow: $168 million

- Cash dividend: $0.70/share

- Cash and cash equivalents: $786 million

- Debt: $5.5 billion

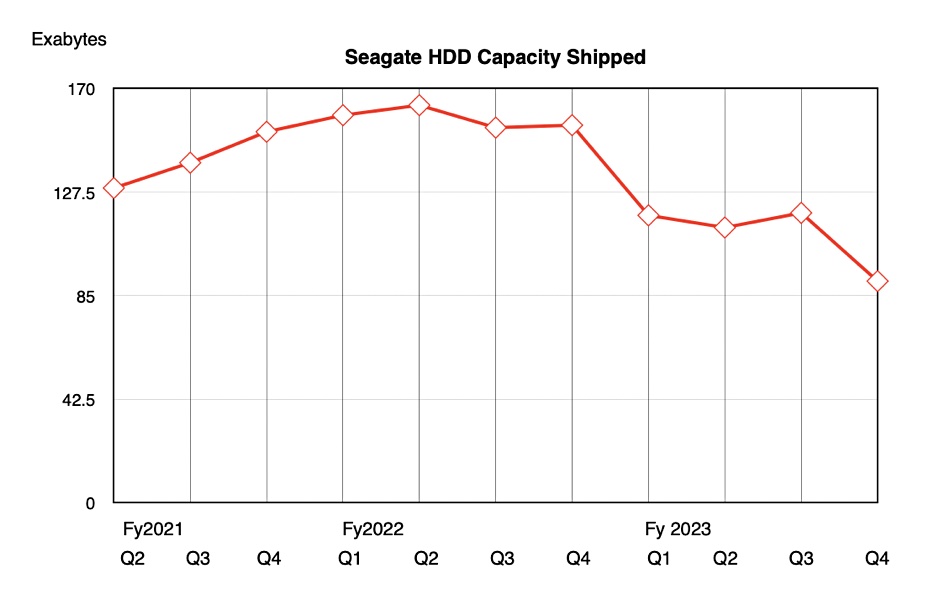

There was a large drop in disk drive capacity shipped, from last quarter’s 119EB and the year-ago year-ago155EB to 91EB; a 33.5 percent Q/Q fall. Average drive capacity fell from last quarter’s 8.2TB to 6.4TB, as cloud providers, Seagate’s largest buyers by far, bought fewer mass capacity nearline drive sales.

CFO Gianluca Romano said: “The average capacity is down because of mix. … in the June quarter, we shipped less to cloud and more to VIA, and of course the capacity is much higher in the cloud business.” (VIA is the video surveillance market.)

Oddly there was an increase in 10K rpm mission-critical drives, a market area prone to SSD cannibalization.

This is Seagate’s lowest annual revenue number since 2005’s $7.6 billion, and its first annual loss in many years, such is the savage nature of the disk drive market’s revenue fall.

Nearline drive sales to cloud buyers are the main focus for Seagate, with generative AI boosting them. Mosley said: “In addition to the ongoing migration of workloads to the cloud, which we believe is far from over, gen AI is expected to be a catalyst for data creation, underpinning future demand for mass capacity storage.”

He emphasized disk cost advantage over SSDs: “While flash will continue to feed high-performance compute engines, mass capacity HDDs will remain the most cost-efficient storage media to house the enormous volumes of data being generated and used for predictive analytics.”

No suggestion there that SSDs will kill new disk drive sales in the next 5 years as Pure Storage is predicting. Quite the reverse, with Mosley saying: “Even in today’s unsustainably low NAND pricing environment, HDDs are still roughly five times more cost-efficient than comparable flash solutions on a per bit basis, and we do not project that gap to close in the next decade.” Take that Pure.

But Mosley’s ignoring 5-year TCO arguments of flash drive superiority over disk put forward by both Pure and VAST data. If hyperscale cloud providers start using SSDs for their nearline storage needs, and thus believing the TCO argument, then the HHD manufacturers will have a severe problem. That’s the core HDD vs SSD market battleground.

Seagate revenues for the next quarter are forecast to be $1.55 billion +/- $150 million; a 34 percent Y/Y drop at the mid-point. We’ll see if Seagate’s tight controls can can eke a profit out of that.