Dell’s co-COO, Chuck Whitten, has resigned just two years after joining Dell, following board-level discussions.

Anthony Charles “Chuck” Whitten joined Dell in August 2021 after spending 23 years and two months at Bain, the business consultancy group that was working with Dell to help shape its strategy and growth initiatives.

When Whitten joined Dell to work alongside its other COO, Jeff Clarke, Michael Dell said: “As our top advisor, Chuck has been an integral part of the team for a long time working across strategy, transformation and operations. I couldn’t be happier to have him as co-COO to capture big growth opportunities across our portfolio as the world becomes more digital and data-driven.”

Now he’s gone, as a post in LinkedIn said: “Sharing the announcement that went out to Dell team members today announcing that I will be stepping down as Co-COO of Dell Technologies.”

No reason was given. All he said was: “It has been a privilege working alongside and learning from Michael Dell and Jeff Clarke the last 14 years, and the company has never been better positioned for the current moment in technology. I will forever be cheering on Dell Technologies – the future is bright!”

Whitten shared an image of an internal Dell communication showing a message from Michael Dell and his own response:

The joint Dell-Whitten decision came “after discussions with Chuck and the board of directors about the leadership profile the company needs in its next chapter.” Both say great times lie ahead for Dell. Currently times are not so great as Dell’s results have been blighted by poor PC sales.

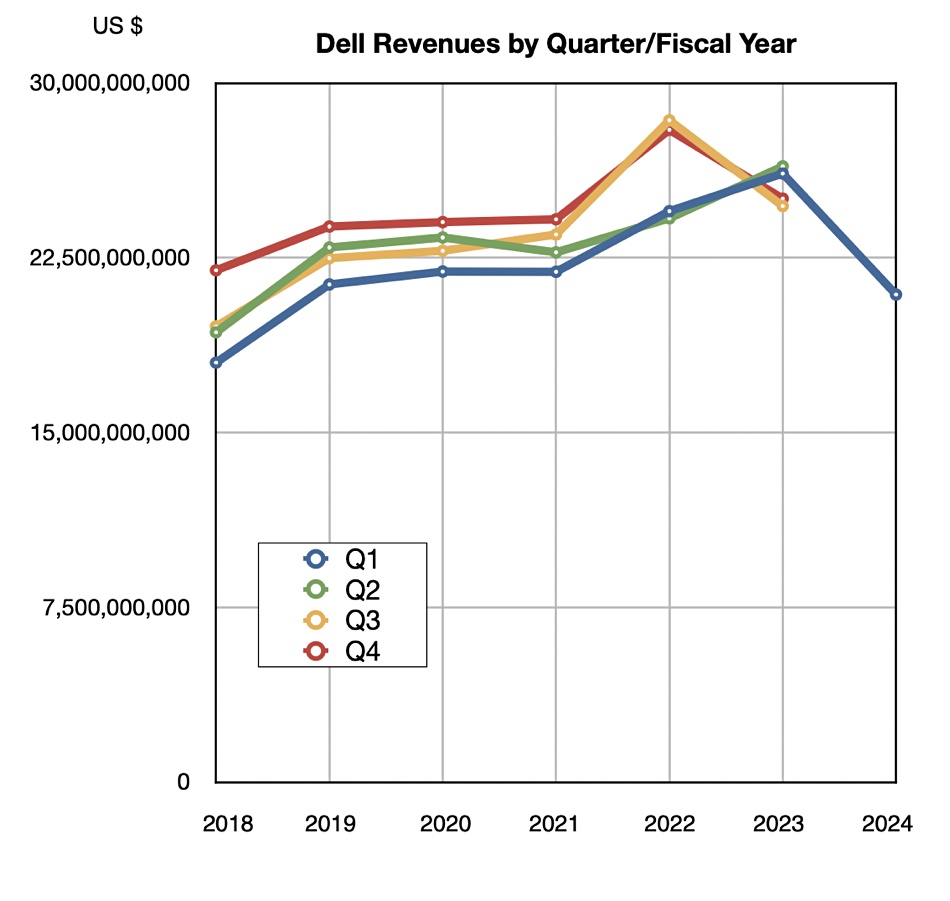

Whitten joined in Dell’s Q2 fy2022 and that and the next four quarters were revenue growth quarters for Dell, with an all-time high of $28.4 billion in Q3 fy2022.

Starting in the third fiscal 2023 quarter, however, PC sales fell off a cliff as makers faced a post-COVID slowdown. Since then Dell’s revenues have been declining for three quarters in a row:

The Q4 fy2023 revenue decline was mostly due to lower PC and server sales, both limited by supply chain difficulties. Revenues fell by 20 percent Y/Y in its latest quarter (Q1 Fy2024), with PC sales down 23 percent to $12 billion in a fifth successive down quarter for PC shipments. The smaller ISG business unit, selling servers and storage, also slumped 18 percent to $7.6 billion. Dell said it would lay off more than 6,500 staff in February.

The company is expecting the current Q2 fy2024 quarter to be poor as well, forecasting a 12 to 18 percent Y/Y decline.

Right now, though, Dell claims it is seeing a monster Generative AI-led growth opportunity. It’s adding GPUs to its workstations and servers in an edge AI effort. Its PowerScale F600 all-flash scale-out filer supports Nvidia’s GPD Direct protocol for sending data to GPU servers. There’s nothing for Whitten to do here.

Whitten won’t leave empty-handed though. We understand from SEC filings he was given a $5 million sweetener bonus to join Dell, and he has $19 million in stock options.