Dell’s full fiscal 2022 results include pockets of storage glory but PCs sales led the charge with servers following behind as the US business battled supply chain problems that restricted order fulfilment.

The Texan-headquartered tech giant grew revenues to $101.2bn for the year ended 28 January, a 17 per cent year-on-year rise driven by record PC shipments and some growth across the infrastructure division. Profit was $5.71bn, up 62.8 per cent year-on-year, and it could have been even higher, as we shall see by looking at the fourth-quarter numbers.

Jeff Clarke, vice chairman and co-COO at Dell Technologies, said in a statement: “Fiscal 2022 was the best year in Dell Technologies history. We reached more than $100 billion in revenue and grew 17 per cent – a huge achievement and ahead of our long-term growth targets.”

CFO Tom Sweet added: “We achieved a number of milestones that unleashed shareholder value. We generated cash flow of $10.3 billion, achieved investment grade rating, and spun-off VMware.”

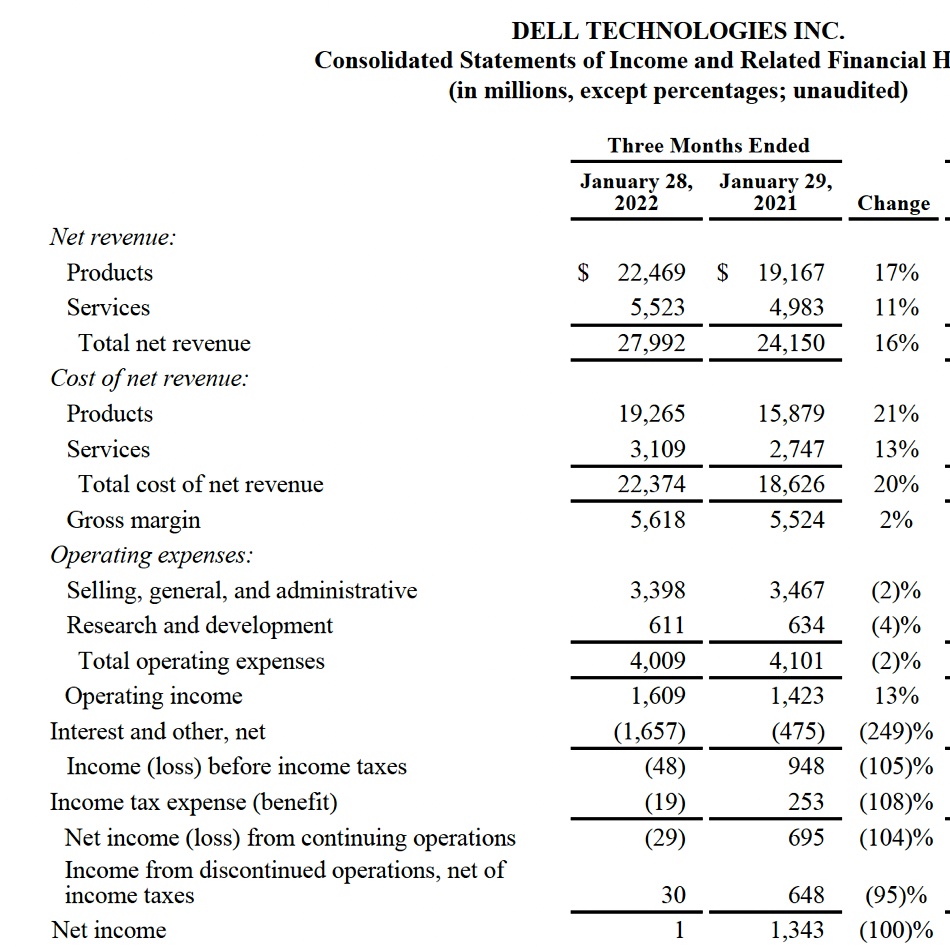

Fourth-quarter revenues increased 16 per cent annually to $28bn but they were down sequentially from $28.4bn in the third quarter. The traditional seasonal pattern for Dell is for Q4 to be higher than Q3. That happened in fiscal 2021, 2020, 2019, and 2018. What’s worse, Q4’s profit was just $1m, according to Dell’s financial tables.

A look at Dell’s Q4 financial tables suggests this was due to VMware dividends and debt repayments.

Supply chain

Clarke said in prepared remarks: “The global supply chain shortage of semiconductors and global logistics challenges for goods and components continues to impact just about every industry. We are still experiencing shortages of integrated circuits across a wide range of devices, including network controllers and microcontrollers…. freight costs have continued to rise… we expect PC backlog to grow in Q1… Our higher margin ISG backlog increased again in Q4 to a record level due to a combination of very strong demand and a lack of component availability. We expect our ISG backlog to remain elevated through at least the first half of the year as part shortages continue.”

The Kioxia/WD chemical contamination incident could make things worse. “We are awaiting information from the recent NAND contamination announcement from Kioxa/WD to evaluate the impact on Dell,” said Clark.

Other suppliers such as Quantum and NetApp are also suffering supply chain woes, although NetApp just recorded its seventh growth quarter in a row.

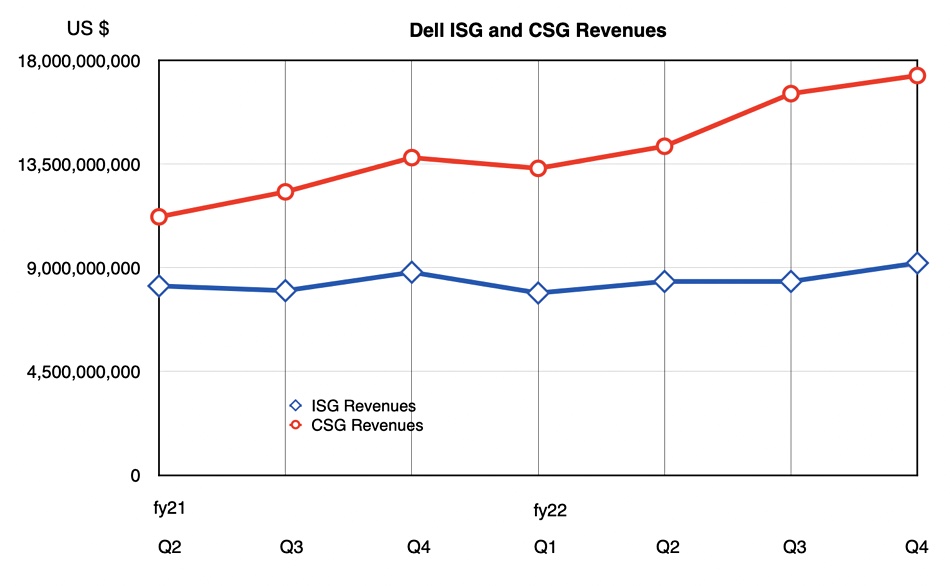

A look at ISG and CSG

Dell has two overarching business units: the Client Solutions Group (CSG) – PCs basically – and the Infrastructure Solutions Group (ISG), which sells servers, networking, and storage. CSG revenues in Q4 were $17.33bn, a rise of 26 per cent. PCs and laptops must have been flying off the warehouse shelves. ISG did not do so well: revenues were $9.2bn, a relatively anaemic rise of 3 per cent but its fourth consecutive quarter of year-on-year growth.

The chart above shows how CSG revenues are outstripping those of the ISG unit. We can see that ISG revenues have been flattish compared to those of CSG.

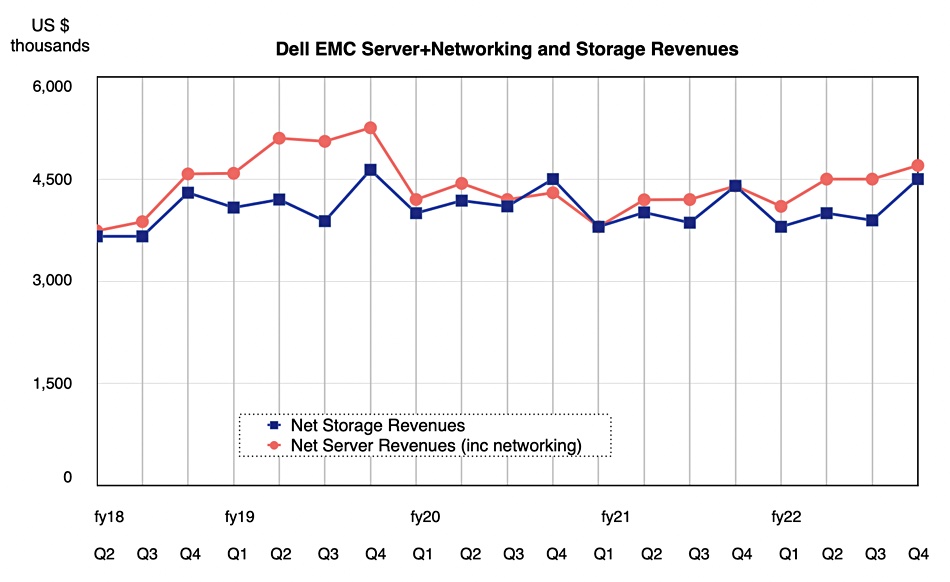

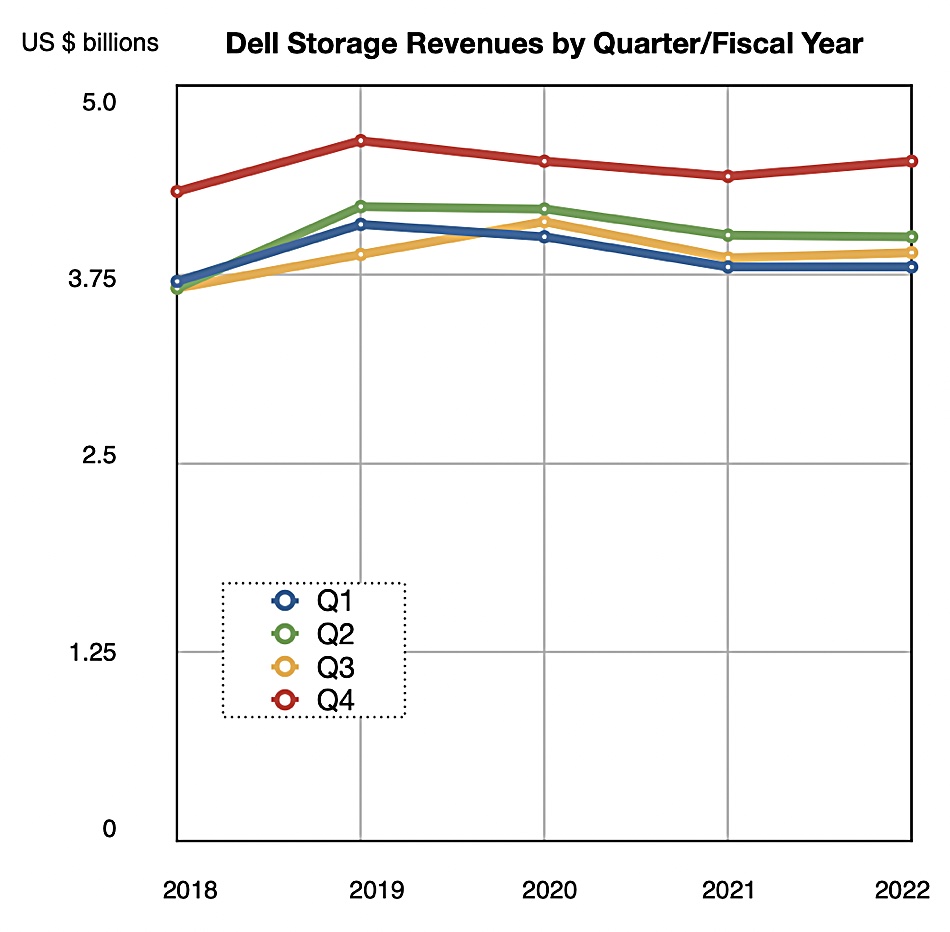

Dell’s Q4 servers + networking was $4.7bn, up 7 per cent annually, while storage was $4.5bn, a 2.3 per cent rise. The contributed least to Dell’s record quarter and year. However, Dell’s performance review slides pointed out that ISG saw the fastest growth in storage orders since Dell bought EMC in Q3 2017.

Dell said mid-range storage orders were up double digits in fiscal 2022, and PowerStore remains the fastest ramping storage product in Dell’s history. PowerStore was launched in May last year and unified prior mid-range storage products such as Unity/VNX, XtremIO, and the SC (Compellent) lines. The company also said that storage demand rose for the third consecutive quarter and was in the high single digits.

Storage revenues trail that and have risen slightly for two quarters in a row as the chart illustrates:

Co-COO Chuck Whitten said storage order growth was great. “We saw double-digit demand growth in the high-end driven by select enterprise customers, 25 per cent demand growth for our unstructured storage solutions and 8 per cent growth for HCI despite a tough Y/Y comparison. Within midrange, PowerStore demand continued to ramp in Q4, up +34 per cent sequentially and [is] now approximately 50 per cent of our midrange SAN mix. Encouragingly, 26 per cent of PowerStore buyers are new to Dell storage and 29 per cent were repeat buyers, important leading indicators of future growth.”

But he added: “Storage revenue was roughly flat Y/Y due to the aforementioned backlog build and storage software and services content that gets deferred and amortized over time.”

So it was the supply chain issues that limited Dell’s ability to ship its storage hardware. When that is resolved, hopefully over the next two quarters, then Dell’s storage revenues should bounce higher.

Dell instituted quarterly dividend payments of $0.33 per share and the the company has also gained an investment grade rating.

The outlook for the next quarter is for revenues of $24.5-25.7bn, $25.1bn at the mid-point and an 11 per cent increase on a year ago.