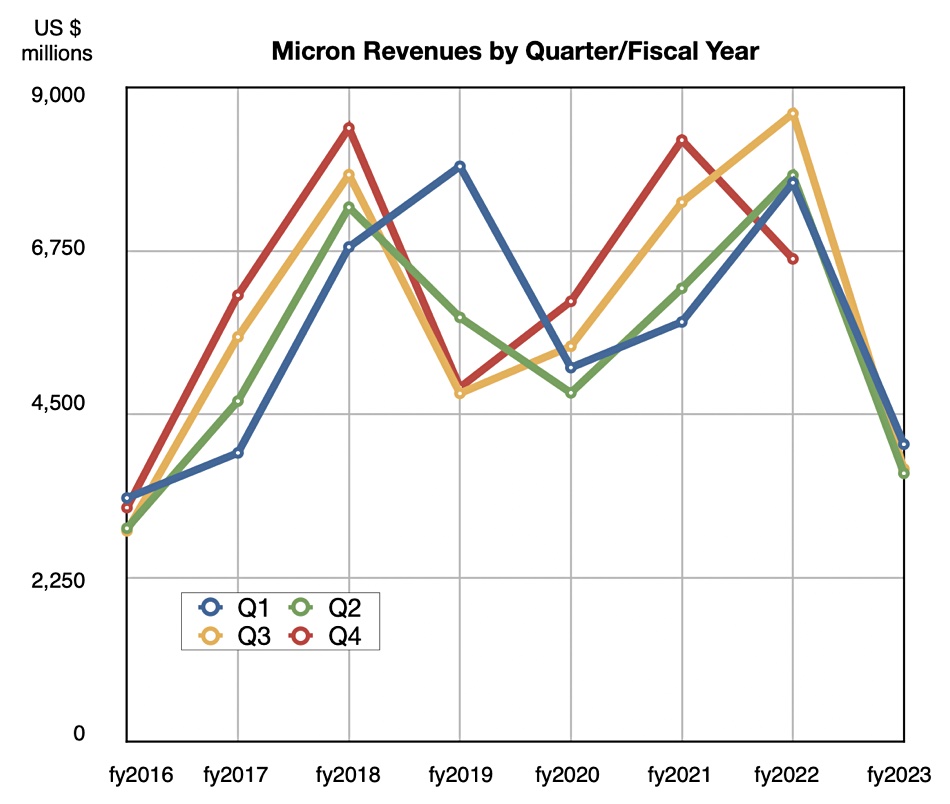

Micron had another poor quarter, with revenues 57 percent down annually, but it met its guidance, and still thinks the memory downcycle has bottomed out, although China’s security investigation could slow its recovery.

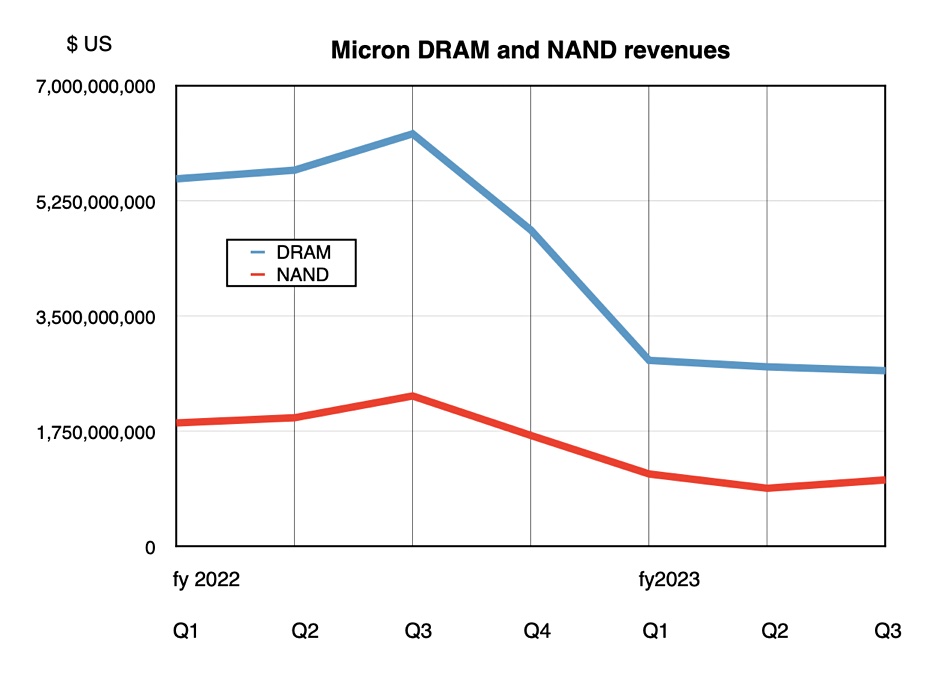

In the fourth quarter of the memory market recession, revenues were $3.75 billion in the third fiscal quarter ended June1, with a loss of 1.9 billion vs a profit if $2.6 billion a year ago. DRAM revenues were $2.7 billion, down 57.4 percent while NAND brought in $1 billion, down 56 percent.

CEO and President Sanjay Mehrotra said: “Micron delivered fiscal third quarter revenue, gross margin, and EPS all above the midpoint of the guidance range. We believe that the memory industry has passed its trough in revenue, and we expect margins to improve as industry supply-demand balance is gradually restored.”

He admitted that: “The recent Cyberspace Administration of China (CAC) decision is a significant headwind that is impacting our outlook and slowing our recovery,” referring to China’s decision Micron’s products represent a security risk, thought to be a tit-for-tat response to US blacklisting of Huawei. Up to 12.5 percent of Micron’s world-wide revenues could go away if China bans its products from being used by Chinese companies.

Financial summary

- Gross margin: 17.8 percent of revenue vs 46.7 percent a year ago

- Free cash flow: – $1.36 billion

- Diluted EPS: -$1.73 vs $2.34 a year ago

- Cash, marketable securities, restricted cash: $11.4 billion

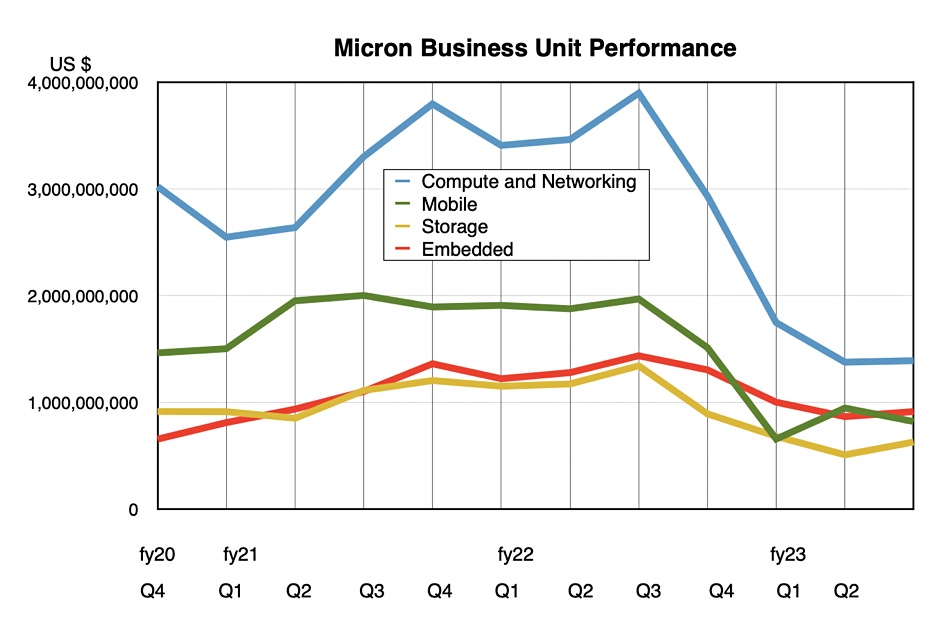

The compute and network business unit (BU) was most affected with revenues down 64 percent to $1.4 billion, while the embedded BU, with its growing automotive component, least affected with a 36 percent revenue fall to $912 million. Mobile BU revenues dropped 58 percent to 819 million and the storage BU brought in $627 million, a 53 percent fall.

Micron’s strategy is to cut its costs, lower production to help supply get back in balance with demand, keep up its technology status vs its competitors, and wait it out until recovery starts in calendar 2024. Its storage and embedded BUs are experiencing quarter-on-quarter slight revenue rises which could be an early indicator of a positive change, if they’re sustained next quarter.

Bright spots are the automotive sector where cars, SUVs, pickups and delivery vans are all getting smarter on the driver assistance and infotainment front, meaning more memory is needed.

But the biggest boost could come from AI where generative AI’s sudden boom could mean datacenter servers need much more DRAM and NAND, with SSD sales into storage growing as well. Mehrotra said: “AI servers have six to eight times the DRAM content of a regular server and three times the NAND content. In fact, some customers are deploying AI compute capability with substantially higher memory content. … We are in a strong position to serve AI demand for fast storage as these data-intensive applications proliferate.”

He added this in the earnings call [paywall]: “We consider 2024 to be a big banner year for AI, for memory and storage. And Micron will be well positioned to capture this with our strong portfolio of products.”

Micron will be hoping this AI boost will be long-lived and not short-term. [We asked the Perplexity ChatGPT-like chatbot abut this and it said: “It seems that the generative AI boom is likely to continue for the foreseeable future.”]

The China situation is a pain-in-the-proverbial for Micron. If it loses its China-based business it aims to keep its current market share. How? Mehrotra said: “Keep in mind that our share in DRAM is approximately 23 percent and our share in NAND is approximately 12 percent. So obviously, we have opportunities to gain share with other customers. And this is what we are focused on. It will take some time, and the CAC decision … is hurting our business. It is slowing our recovery. It can result in quarter-to-quarter variations as well. But over longer term, our target is to maintain our share.”

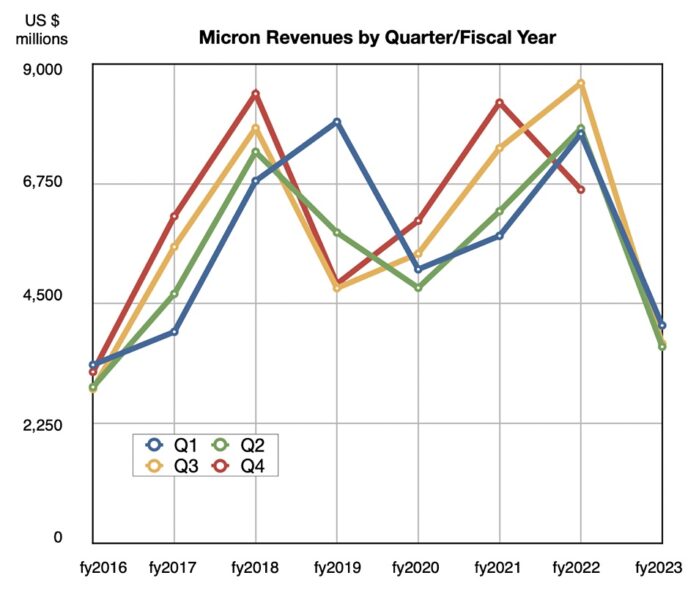

The outlook is for Q4 revenues to be $3.9 billion +/- $200 million, a 41.3 percent Y/Y drop at the midpoint. That’s less of a fall than in the previous two quarters. The full fy2023 revenues would then be $15.43 billion, a near enough 50 percent drop plunge on fy2022 and its lowest result since fy2016. Downcycles in the memory industry can be harsh.