Micron has moved deeper into a NAND market revenue trough with no sign the bottom has yet been reached. It’s making production cuts, lowering exec pay and laying off workers – with 10 percent of roles expected to be either cut or left empty in 2023.

Revenues were down 47 percent year-on-year to $4.1 billion in its first fiscal 2023 quarter, which ended December 1. Micron made a $195 million loss – its first loss in five and a half years.

CEO and president Sanjay Mehrotra said: “The industry is experiencing the most severe imbalance between supply and demand in both DRAM and NAND in the last 13 years.”

Wells Fargo analyst Aaron Rakers told subscribers: “It’s ugly, but finding that down-cycle bottom (F2Q23) is what really matters.”

Customers are using up their inventories and buying fewer DRAM and NAND chips, leaving Micron with its own inventory which needs using up. It’s lowering production to stop adding so many chips to that stash.

Financial Summary

- Gross margin: 22.9 percent compared to 40 percent in prior quarter and 47 percent a year ago

- Gross margin forecast: 8.5 percent plus/minus 2.5 percent next quarter

- Cash from operations: $943 million

- Free cash flow: -$1.5 billion

- Liquidity: $14.6 billion at quarter end

- Diluted EPS: -$0.04 compared to prior quarter’s $1.45 and year-ago $2.16

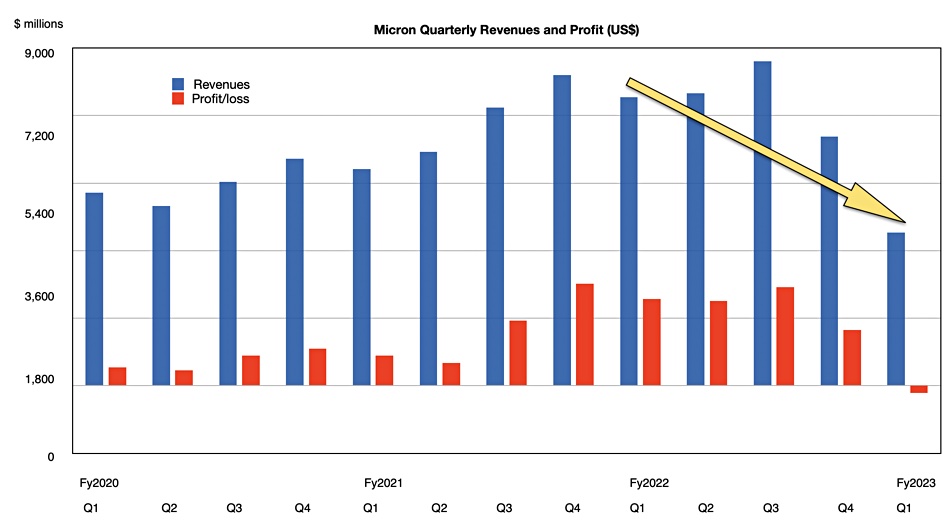

A quarterly revenue and profit history chart make Micron’s revenue and profit drops starkly visible:

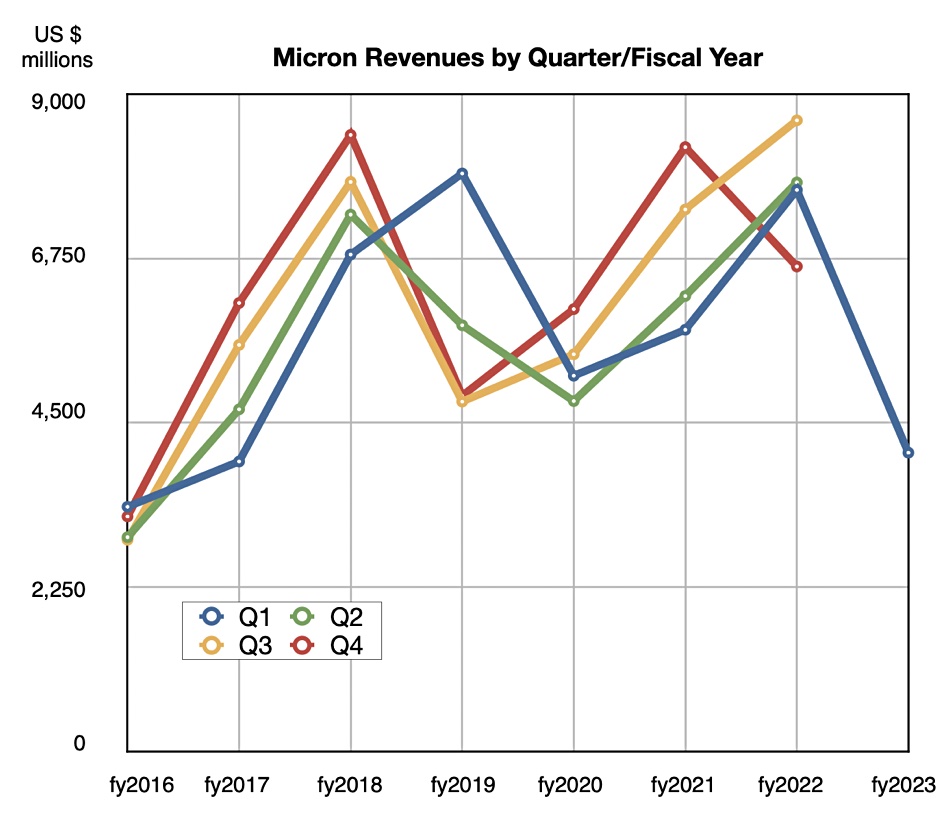

A second chart of revenues by quarter by fiscal year shows the steep sequential fall in revenues this quarter (blue line) following a less deep fall (red line) in the previous quarter:

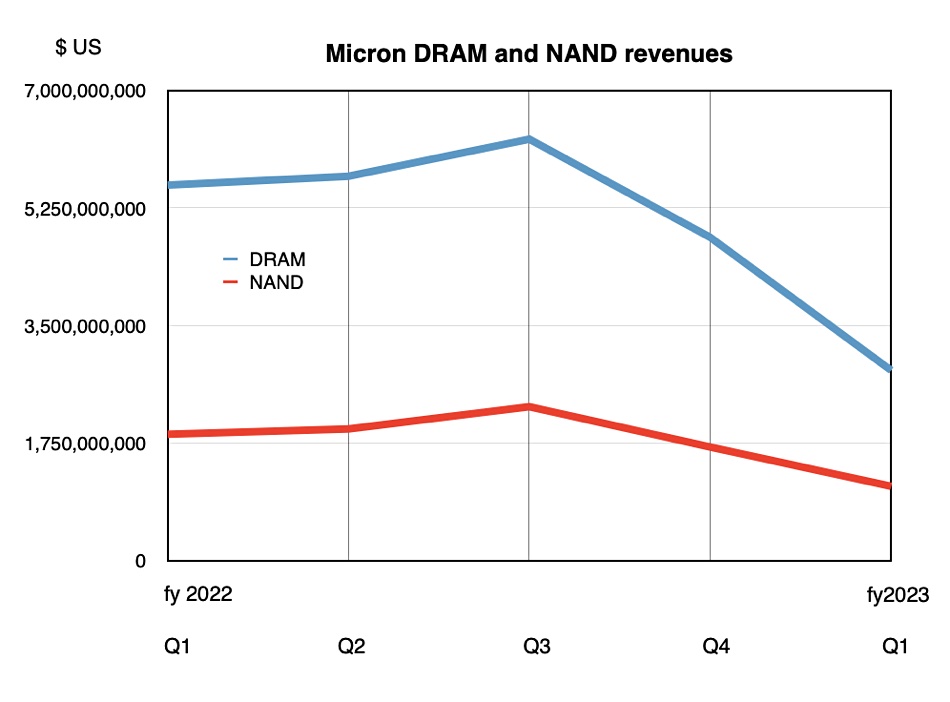

If we look into Micron’s DRAM and NAND revenues separately, we see that DRAM revenues declined 49 percent Y/Y to $2.83 billion with NAND falling less sharply with a 41 percent drop to $1.13 million:

Mehrotra said: “Across nearly all of our end markets, revenues declined sequentially in fiscal Q1 due to weaker demand and steep decline in pricing. Shipment volumes were impacted by our customers’ inventory adjustments, the trajectory of their end demand, and macroeconomic uncertainty. We believe that aggregate customer inventory, while still high, is coming down in absolute volume, as end market consumption outpaces ship-in.”

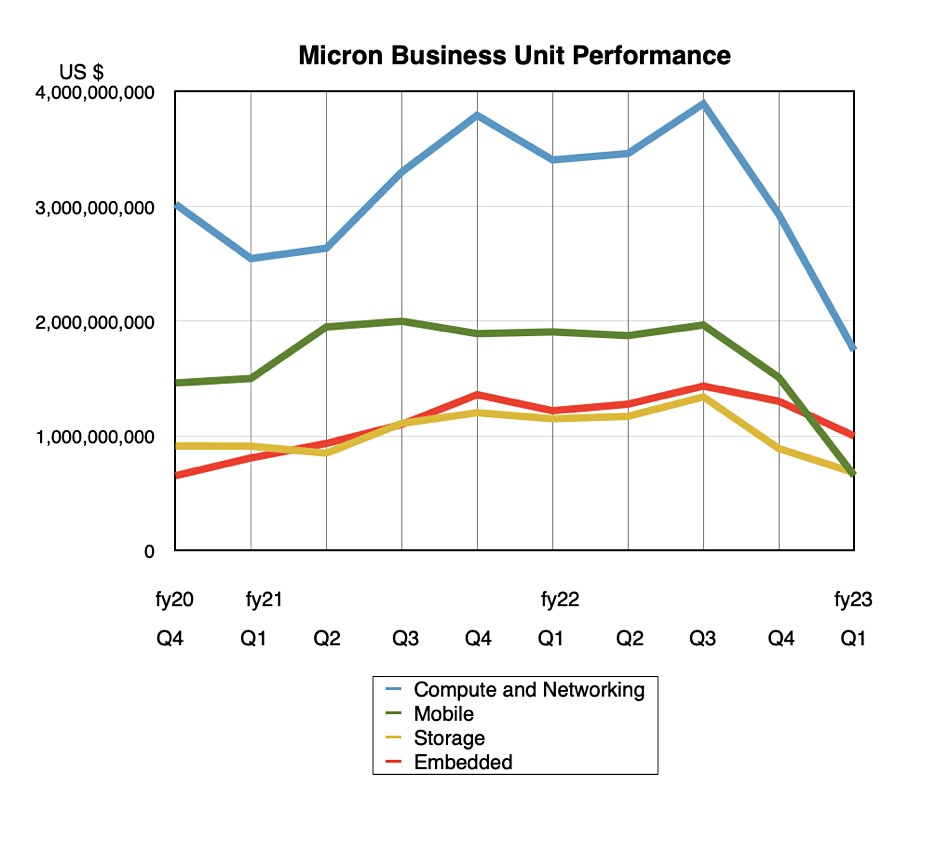

The storage and embedded segments saw less steep revenue declines: 41 percent to $680 million for storage and a mere 18 percent descent to $1 billion for the embedded market. The need for NAND chips in automotive driver assistance and entertainment systems is still quite strong and likely to grow.

Long story short? Compute (server and PC) and networking DRAM revenues fell off a cliff, NAND not so much, mobile revenues dipped markedly while embedded and storage revenues fared less badly.

Car infotainment rocks

The automobile part of the embedded market is a bright spot, apparently: “In fiscal Q1, auto revenues grew approximately 30 percent year over year, just slightly below our quarterly record in Q4 FY22. The automotive industry is showing early signs of supply chain improvement, and auto unit production continues to increase. The macroenvironment does create some uncertainty for the auto market, but we see robust growth in auto memory demand in fiscal 2023.”

And that should last at least until 2027, the company hopes: “Over the next five years, we expect the bit growth compound annual growth rate (CAGR) for DRAM and NAND in autos to be at approximately twice the rate of the overall DRAM and NAND markets.”

Mehrotra and his team are not forecasting when the revenue trough will bottom out as demand is being seen as continuing at a weak level: “In datacenter, we expect cloud demand for memory in 2023 to grow well below the historical trend due to the significant impact of inventory reductions at key customers.”

And when will the down cycle bottom be reached? Some time in 2023 possibly. Mobile phone demand may improve in 2023: ”We forecast calendar 2023 smartphone unit volume to be flattish to slightly up year over year, driven by improvements in China following the reopening of its economy.”

But Micron’s overall DRAM and NAND outlook is weak: “For calendar 2023, we expect industry demand growth of approximately 10 percent in DRAM and around 20 percent in NAND.”

It’s due to “reductions in end demand in most markets, high inventories at customers, the impact of the macroeconomic environment, and the regional factors in Europe and China.“ And that means production cuts.

Production and expense cuts

Micron and the DRAM/NAND foundry industry will supply fewer DRAM and NAND bits than previously planned with “an approximately 40 percent reduction year on year, and we expect fiscal 2023 wafer fab equipment (WFE) capex to be down more than 50 percent year on year. We expect fiscal 2024 WFE to fall from fiscal 2023 levels, even as construction spending increases year on year.”

Technology transitions to denser DRAM and NAND chips are being delayed: “Given our decision to slow the 1ß DRAM production ramp, we expect that our 1γ (1-gamma) introduction will now be in 2025. Similarly, our next NAND node beyond 232-layer will be delayed to align to the new demand outlook and required supply growth.”

There will be short-term pain measures with: “Reductions in external spending, productivity programs across the business, suspension of a 2023 bonus company-wide, select product program reductions and lower discretionary spend.”

Then it gets personal: “Executive salaries are also being cut for the remainder of fiscal 2023, and over the course of calendar year 2023, we are reducing our headcount by approximately 10 percent through a combination of voluntary attrition and personnel reductions.“

It has some 48,000 employees so this means 4,800 of them will hit the streets.

And that may not be all: “We are prepared to make further changes and remain flexible to exercise all levers to control our supply and manage our cost structure.”

Outlook

Mehrotra added: “While the environment remains challenging, we currently expect second-half fiscal 2023 revenue to improve from the first half. We are confident that the broad advantages enabled by data-centric technologies will create long-term growth for our industry, and we expect the total available market to reach approximately $300 billion by 2030.”

The outlook for next quarter is revenues of $3.8 billion plus or minus $200 million. The $3.9 billion mid point would be a 50 percent drop from a year ago. It might be the bottom of the down cycle.

The NAND foundry canary may be tweeting in distress, but in their view, what’s going down will rise up again. Just not in a flash (ahem.)