Analysis Every startup has a holy grail shimmering in front of it: the idea of being a disruptive innovator, upsetting the status quo and becoming a new product class, pulling in revenue glory and leaving incumbents struggling to catch up.

The roster of companies and technologies that claim to be disruptive is long while the recognized list of disruptors is much shorter. Disruption takes time to happen and be acknowledged. Incumbents can react and adopt the new supposedly disruptive technology and ruthlessly demolish startup pretensions. Not every wannabe disruptor will succeed, far from it in fact. That’s because disruption is in the eye of the innovator, with both non-reacting incumbents and market acceptance years away in the future.

We can recognize disruptive innovations in the past but not so well in the future. Is PureStorage disruptive? Is VAST Data disruptive? Nyriad? GRAID? DNA storage? Let’s see if we can make some sense of this.

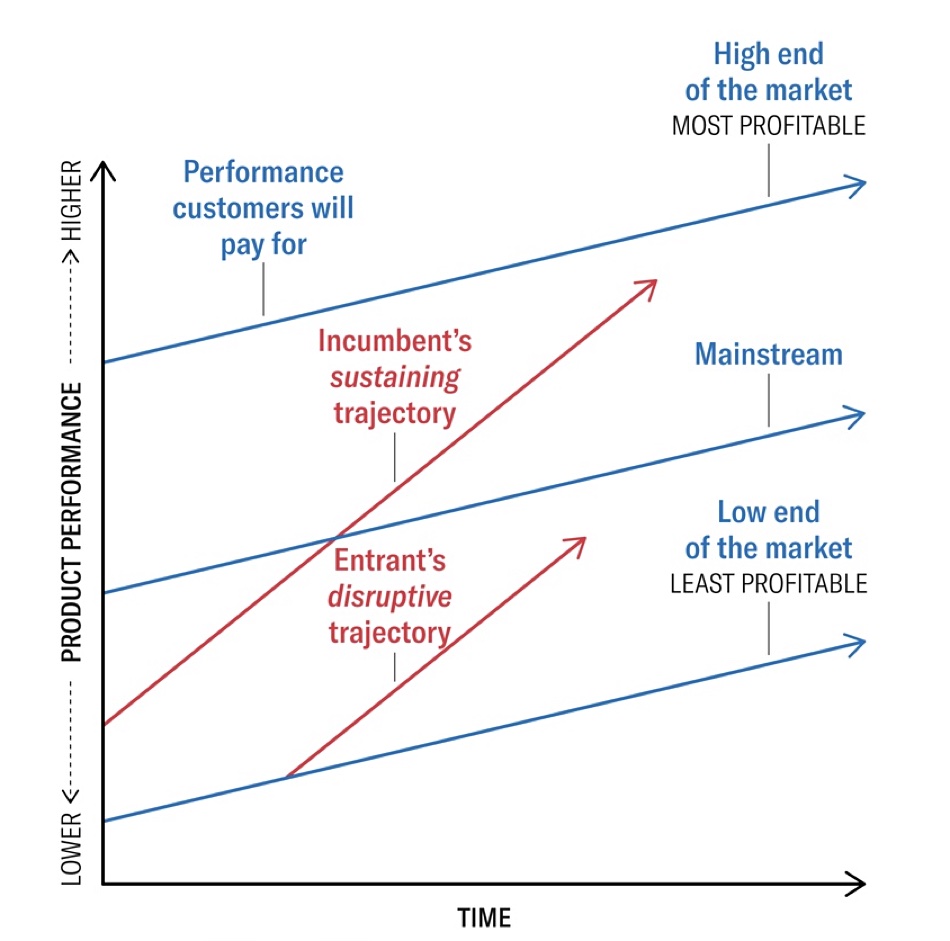

The disruptive innovation concept was devised by Clayton Christensen and Joseph Bower and presented in the Harvard Business Review in 1995 (paywall). It noted that leading companies didn’t always maintain their position and asked why they were vulnerable to disruption. A chart was used to illustrate how incumbent suppliers left market openings for innovative competitors and technologies to undermine their dominance.

The three blue lines show general business performance over time in the low end, mainstream and high end parts of a market, with profitability rising from the low end to the high end. Incumbent suppliers pursue profitability. They prioritize actives with a higher rather than lower return on investment and so, as a later HBR article says, overshoot the needs of low-end customers and ignore the needs of some others. “Entrants that prove disruptive begin by successfully targeting those overlooked segments, gaining a foothold by delivering more-suitable functionality – frequently at a lower price.”

The incumbents don’t respond and the entrants then move upmarket “delivering the performance that incumbents’ mainstream customers require, while preserving the advantages that drove their early success. When mainstream customers start adopting the entrants’ offerings in volume, disruption has occurred.”

It takes time. “Complete substitution, if it comes at all, may take decades, because the incremental profit from staying with the old model for one more year trumps proposals to write off the assets in one stroke.”

Disruption take place in low-end markets or in new ones through making a lower price but adequately functional product; personal printers versus multi-user mainstream printers for example.

Just because a new company is successful doesn’t mean it is disruptive in terms of Christiansen’s theory. The later HBR authors cite Uber as a company that broadened the taxi/ride share market. They argue that Uber attacked the mainstream market, not a low-end market or a new market, and with a superior product.

They say: “Disruption theory differentiates disruptive innovations from what are called ‘sustaining innovations.’ The latter make good products better in the eyes of an incumbent’s existing customers: the fifth blade in a razor, the clearer TV picture, better mobile phone reception.” Or the better taxi experience offered by Uber, as they write: “Most of the elements of Uber’s strategy seem to be sustaining innovations.” Apple’s iPhone is also classed a sustaining innovation.

Let’s look at VAST Data and see, using Uber as an example, if its innovation – the DASE (Disaggregated Shared Everything) single tier, all-flash array – is disruptive or sustaining. VAST targeted the high end of the storage array market, one served already by Dell, NetApp and Pure, and offered a faster and more easily scalable and manageable product. It has then moved downmarket, to the mid-range area, with the HPE GreenLake OEM deal. We’d argue that this is a classic sustaining innovation in HBR theory terms.

Pure Storage is in a similar position, we could argue. It offers mainstream all-flash arrays, built with its proprietary flash drives, with a better business model in direct competition to incumbent all-flash array suppliers. So too is WEKA with its fast parallel file system, better than existing ones.

The HBR article is not saying that you have to be a disruptive innovator to be successful. Nor that every disruptor is successful. Indeed, some are not.

Incumbents can face smaller competitors. The HBR authors write: “Small competitors that nibble away at the periphery of your business very likely should be ignored – unless they are on a disruptive trajectory, in which case they are a potentially mortal threat.”

Recognizing if they are a mortal threat is the hard thing. Startups like GRAID (GPU-powered RAID cards) and Nyriad (GPU-powered array controllers) are in, we’d argue, the smaller competitors nibbling away category.

Incumbents can acquire disruptors. The HBR authors say: “The theory of disruption predicts that when an entrant tackles incumbent competitors head-on, offering better products or services, the incumbents will accelerate their innovations to defend their business. Either they will beat back the entrant by offering even better services or products at comparable prices, or one of them will acquire the entrant.”

We could cite HPE buying Nimble as an example.

An example of a new market foothold is the use of ephemeral, raw NVMe storage in compute instances as the basis for public cloud storage services – witness Silk, Lightbits and Volumez. B&F thinks this is a disruptive innovation as far as the main cloud service providers are concerned.

A low-end market entry is, we think, low cost distributed storage (Web3) using spare capacity in existing datacenters, with Storj and Cubbit as examples.

DNA storage could be a disruptive innovation, but it is far too soon to tell.

Recognizing a company as a disruptive innovator is not the sole arbiter of whether it will be successful. Look at Pure and VAST to prove this point. And since we recognize a disruptive innovator after they have succeeded, trying to pick storage winners by assigning them disruptive innovation status early on is a risky proposition.