Seagate wants to raise $1 billion in a private bond placement to pay off debt as it begins the process of laying off staff following dreadful Q3 results.

Revenue for the three months ended 31 March fell 33.6 percent year-on-year to $1.86 billion – the third consecutive quarter of shrinking sales. A loss of $433 million contrasted sharply with the year-ago $346 million profit. It still paid dividends, however – $145 million – and had a $174 million free cash flow versus $363 million. Seagate said it needed to lower expenses and decided to make a round of layoffs and slash the most senior exec base salaries to zero for six months.

More than 100 job losses were recently reported at Seagate’s Springtown disk drive plant in Northern Ireland, for example. Unconfirmed reports in thelayoff.com claimed a 20-plus percent cut across the board. A Seagate spokesperson said up to 12 percent of global staff were affected.

The spokesperson told us today: “As noted in our FY23 Q3 Earnings press release on April 20, 2023, Seagate announced a restructuring program to reduce our cost structure in response to changes in macroeconomic and business conditions.

“These actions include a global workforce reduction, which is one of the most difficult decisions a leadership team undertakes. Our goal is to take these steps thoughtfully, treating all employees in the affected roles with the respect they deserve for their contributions to Seagate. We expect most of these global actions to be complete before the close of our fiscal year on June 30, 2023.”

Proceeds of the bond sale will be used to repay a senior notes (bond) issue due in 2024 and $450 million in outstanding loans under a credit agreement, with the remainder used for general corporate purposes, such as other debt repayments, capital expenditures and investment in the business. Seagate’s total debt at the end of its Q3 was $5.96 billion, compared to $5.64 billion a year earlier.

A Seagate 8K SEC filing, dated May 19, highlights a credit agreement amendment during a covenant relief period running from May 19 to June 27, 2025 (a covenant is an agreement between lender and borrower laying out loan policy conditions). The amendment permits a maximum net leverage ratio of 6.75 in the current quarter (ending June 30) shifting to a maximum total leverage ratio of 4 to 1 for any fiscal quarter ending outside the covenant relief period.

A leverage ratio refers to the amount of debt carried by a business compared to assets such as equity, with the notion of ensuring that a business has or generates enough cash to cover its debts.

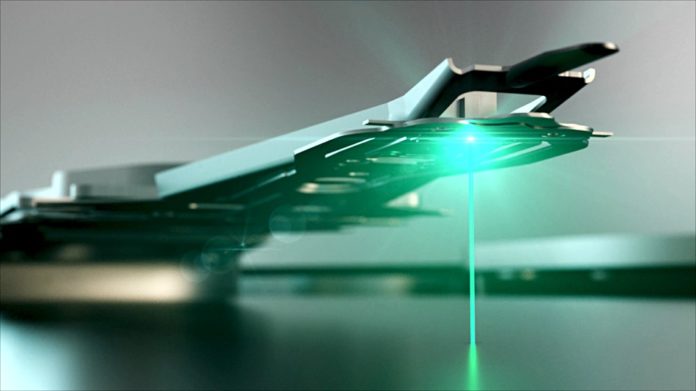

Seagate needs to increase its allowable leverage ratio because it is operating in a severe downturn and bringing in fewer dollars. It is relying on its HAMR technology disk drives, with 30TB+ capacities, to arrive this quarter and give it a lead over Western Digital and Toshiba. That may generate increased sales and provide a revenue and cash boost. That’s the plan anyway.