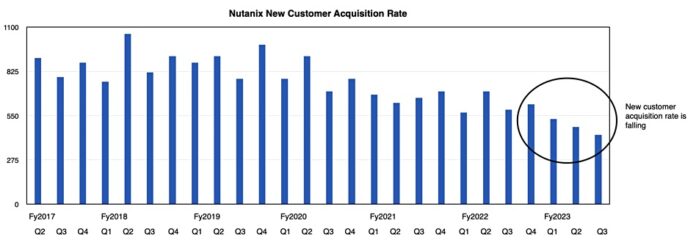

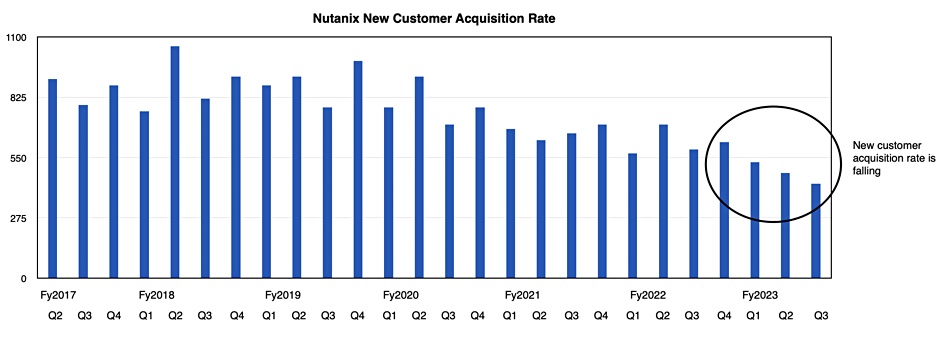

Hybrid cloud and hyperconverged software and cloud vendor Nutanix beat Wall Street with its third fiscal 2023 quarter results, but its customer acquisition rate is slowing.

Revenues in the quarter ended April 30 were $448.6 million, up 11 percent year-on-year and beating last quarter’s outlook of $430-440 million. There was a loss of $81.2 million, lower than the year-ago $112 million loss. Annual Contract Value billings rose 17 percent to $239.8 million and annual recurring revenues went up 32 percent to $1.47 billion.

CEO Rajiv Ramaswami summarized the results: “Our business performed well in the third quarter against an uncertain macro backdrop as the value proposition of our cloud platform continued to resonate with customers.”

Gross margin was 81.4 percent, up 80.2 percent annually, and free cash flow was $42.5 million compared to -$20.1 million a year ago. The operating cash flow came in at $64.3 million.

CFO Rukmini Sivaraman said: “Our third quarter results continued to demonstrate a good balance of growth and profitability, resulting in year-to-date ACV Billings growth exceeding 20 percent, combined with strong year-to-date free cash flow generation. We continue to execute on our growing base of subscription renewals and remain focused on sustainable, profitable growth.”

The average contract term remained at three years.

William Blair analyst Jason Ader said: “The third quarter outperformance was driven by strength in renewals, with customers renewing at higher prices and some customers co-terming multiple renewals … We expect continued progress on profitability and cash flow.”

The prior quarter’s results were marred by a discovery that third-party software, obtained for evaluation, had been used to gain revenue. This prompted an audit committee inspection and delayed quarterly report filing to the SEC. Ramaswami said: “We are … pleased to have completed the Audit Committee investigation regarding third-party software usage and to have filed our Form 10-Q for our second quarter of fiscal 2023.”

Evaluation software from two software providers was used in a non-compliant manner since 2014 and certain employees concealed this in violation of Nutanix’ policies. They have been fired.

Inadequate financial reporting controls are being fixed. This all resulted in cumulative estimated expenses of $11 million and there will be an ongoing annual impact in the low single-digit millions.

US law firms like Kuznicki Law, Glancy Prongay & Murray, and others are looking to assault Nutanix with class action law suits for investor losses over the issue.

Nutanix gained 430 new customers in the quarter, down from 480 in the prior quarter and 530 in the quarter before that.

Although the new customer acquisition rate is trending lower (see chart above), and for the third quarter in a row, customers are spending more money with Nutanix.

Life time bookings:

- 133 customers with >$10million – up 30 percent

- 209 customers with $5 – $10 million – up 20 percent

- 301 customers with $3 – $5 million – up 19 percent

- 1,442 customers with $1 – $3 million – up 18 percent

Land-and-expand is still working in Nutanix’ favour.

Ramaswami was asked in the earnings call how the Broadcom-VMware acquisition was affecting Nutanix. He said customer engagement had risen as a result but, since sales cycles for VMware to Nutanix migration were nine to 12 months, there was no visible revenue impact yet.

The Q4 outlook is for $470-480 million in revenues, a somewhat surprising 23 percent higher than a year ago at the mid-point. The full fy2023 revenue outlook is $1.84-1.85 billion, up 14.3 percent on fiscal 2022. Sivaraman said the good outlook was due to Nutanix “seeing continued new and expansion opportunities for our solution despite the uncertain macro environment,” and also due to better renewals income with improved execution by the renewals team.