Seagate has a 30TB+ HAMR disk drive coming this quarter for its CORVAULT arrays, which will leapfrog the capacity of Western Digital’s 22TB and 26TB drives and leave Toshiba stumbling behind at the 20TB level.

Update: Is CORVAULT a JBOD or an RBOD? See bootnote at end of article. 27 April 2023.

The HAMR news was disclosed during an earnings call with financial analysts to discuss Seagate’s weak second quarter results. HAMR (Heat-Assisted Magnetic Recording) requires a read-write head to fire a laser pulse at a drive platter’s bit area to enable the otherwise high-resistance recording material to receive a magnetism change. Seagate says this will enable a step-change advance in areal density over conventional perpendicular magnetic recording (CMR or PMR) technology.

CEO Dave Mosley said: “We expect to recognize initial revenue from 30-plus terabyte platforms this quarter as part of our CORVAULT system solutions.”

The Exos CORVAULT product is a self-healing JBOD (Just a Bunch Of Disks – see note below) chassis first announced two years ago. It holds 106 SAS-connected disk drives, meaning 2PB of capacity with 20TB drives. Seagate launched its first 22TB drive earlier this month for NAS, direct-attach and RAID disk drive environments. It’s not been announced as available for CORVAULT. Why bother if a 30TB+ drive is coming?

What Seagate is not doing is announcing that its 30TB+ HAMR drive will be available to its OEM partners, such as the storage array suppliers, which is curious. It has shipped samples to only one cloud service provider, with Mosley saying Seagate “achieved the key milestone last week of shipping initial qualification units to a cloud launch partner.”

Neither is it announcing the actual capacity. Instead Mosley talked about “increasing capacities from three to four to five terabytes per disk or more” over time, with “disks” meaning platters.

CFO Gianluca Romana backed this up, answering a question during the call and mentioning: “In the future, 3 terabyte per disk or 3.5 terabyte per disk and 4 terabytes per disk, those are very interesting propositions for our customers.”

A 10 x 3.5TB/platter drive would be 35TB, but Seagate keeps saying 30TB+ and not 30TB or 35TB. We envisage it could add an extra platter and have an 11 x 3TB/platter drive with 33TB. Both Toshiba and Western Digital have discussed 11-platter drives in the past. This would tally with longer than normal qualification times by OEMs and CSPs as having both an extra platter and new recording technology would require more checking for reliability, power draw, and so forth.

Competition

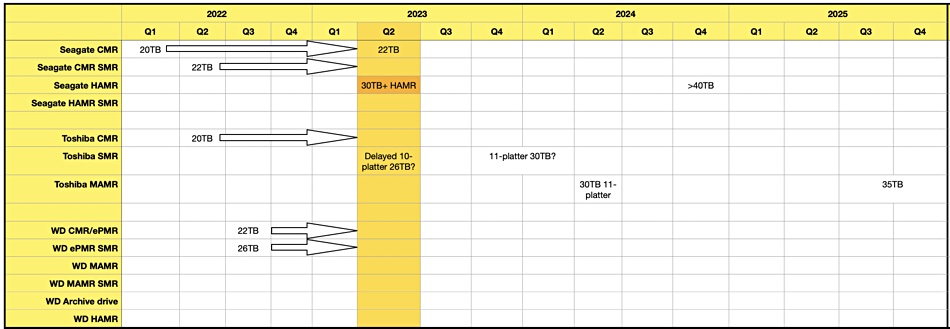

Let’s settle on a 33TB HAMR drive, with 10 x 4RU CORVAULT chassis providing a 35PB rack, and ask where this leaves competitors Western Digital and Toshiba. In a hole, frankly. Our view of the three HDD supplier’s capacity roadmap is in this table:

The current quarter is highlighted in yellow and we can see what the three suppliers have in their product ranges. Western Digital has been in the lead with 22TB CMR and 26TB SMR drives. But Seagate will leapfrog both and be able to tell customers they can store more data in less rackspace for less money with its HAMR tech.

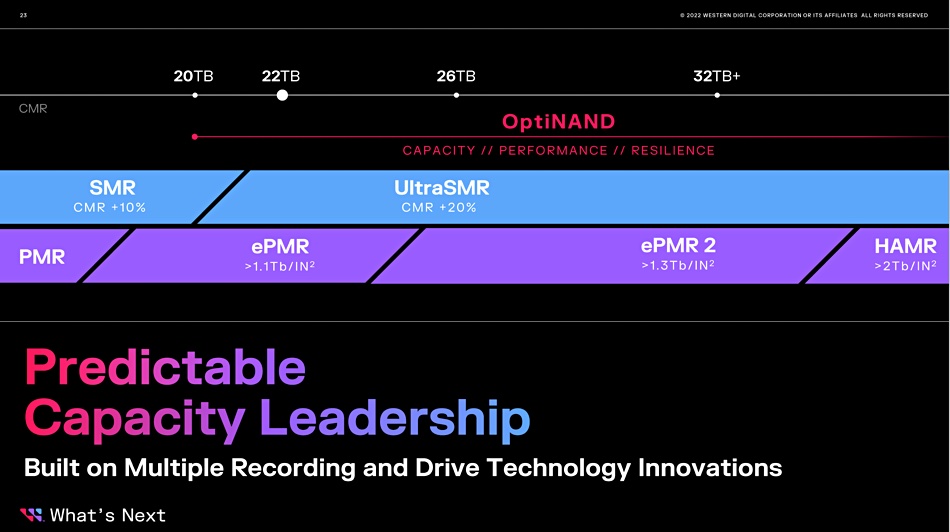

Western Digital discussed its HDD roadmap with analysts a year ago, but this was a directional thing with no dates, apart from HAMR drives appearing in 2026.

We are convinced that WD will announce something like a 26TB CMR drive, using its Optinand flash-enhanced technology along with a 30TB SMR (shingled magnetic recording) drive in the next couple of quarters. Otherwise it will lag Seagate and may lose nearllne drive market share.

Of course it might pull its 50TB archive drive concept out if its back pocket and try to overtake Seagate, but that will have to get over a large initial qualification hurdle and overcome concerns about being locked in to a single supplier.

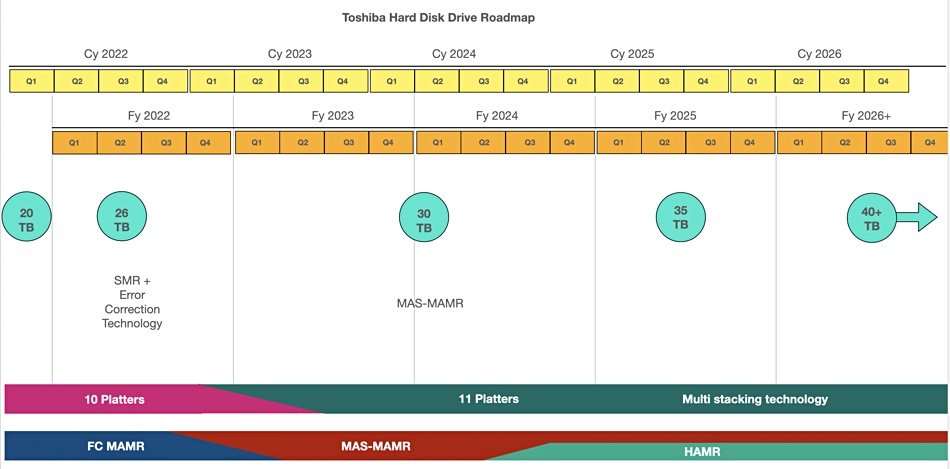

Toshiba is in a bad place. It has already dropped behind the schedule outlined in its 2022 roadmap and faces falling even further behind as it is still at the 20TB CMR drive level:

The nearline disk drive market is the HDD market these days. There’s little or no future in 2.5-inch, 10K mission-critical disk drives, and the notebook and desktop drive markets are being taken over by SSDs. Toshiba will need to keep up with nearline drive capacity demands.

TL;DR

Seagate could be about to become the disk drive market technology and capacity leader if its HAMR tech delivers the cost and reliability goods, leaving WD in second place and Toshiba in danger of lagging behind.

Bootnote

Seagate took exception to CORVAULT being described as a JBOD, even a self-healing JBOD, with a spokesperson saying: “CORVAULT is [an] RBOD (reliable bunch of disks) not JBOD. However Seagate marketing doesn’t call it [an] RBOD, they prefer to call it “self-healing”.

In our view CORVAULT is a JBOD with embedded intelligence (VelosCT ASIC) to give it a self-healing capability. It is not a block storage array in the Dell, HPE, NetApp, etc., sense. It is a kind of RAID array, as a CORVAULT data sheet says it suppports “Seagate ADAPT erasure coding -or- RAID 5, 6” for data protection.

So RBOD I think it shall be, for want of anything better.