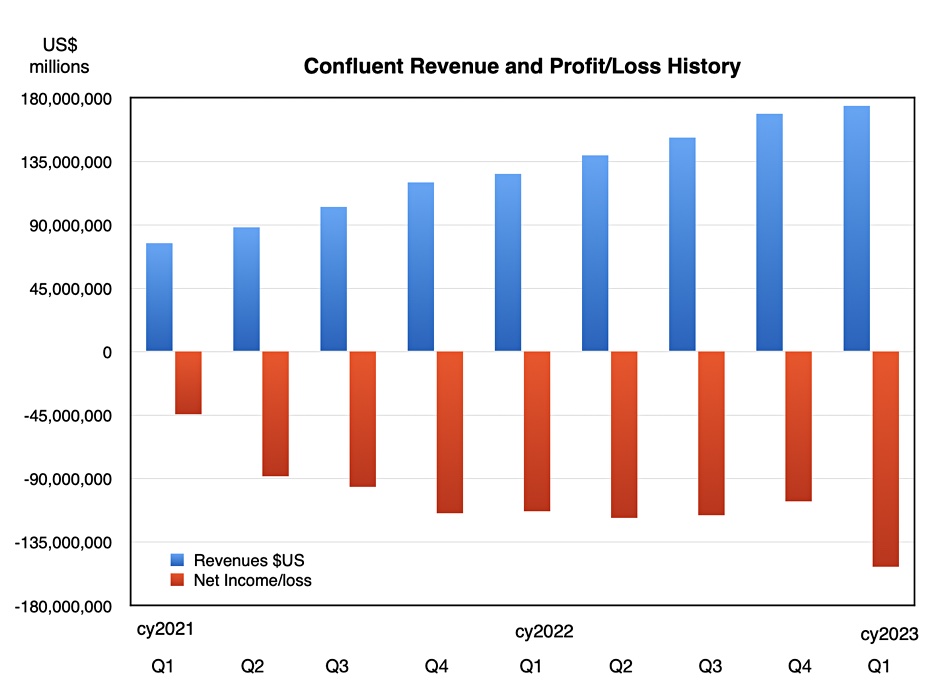

Streaming data storage and analysis platform Confluent continued making heavy financial losses during calendar Q1 of 2023, according to recently filed profit and loss accounts.

For the three months ended 31 March, the business reported a loss of $152.6 million compared to a loss of $113 million a year earlier. This is latest in a string of quarterly losses since Confluent IPO’d in June 2021 with a share price of $36 giving it a market cap of $9.1 billion. The share price – at the time of writing – was $22.12 and company valuation was $6.5 billion.

Confluent did, however, beat its own revenue guidance by coming in at $174.3 million, up 38 pecent year-on-year and higher than the $167-168 million management estimated.

Co-founder and CEO Jay Kreps said: “Confluent started fiscal year 2023 with a strong first quarter, beating all guided metrics and highlighted by 89 percent year-over-year growth in Confluent Cloud revenue. Achieving this high growth as companies scrutinize every dollar spent is a testament to the mission criticality of our cloud-native platform and the lower total cost of ownership customers receive from using Confluent.” Cloud revenue in Q1 was $74 million.

A revenue and profit/loss history chart daubed in red ink shows that Confluence has heavily prioritized top-line growth over profitability:

CFO Steffan Tomlinson said Confluent has a “consumption-oriented land and expand strategy,” but added: “We remain focused on driving efficient growth and building a profitable business.”

Venture capitalists made a highly profitable exit as Confluent had raised $455.9 million in its pre-IPO life and went public with a $9 billion valuation. Following the IPO, Confluent execs and board members moved their focus to running the business for the longer term. Confluent’s shares peaked at $93.60 on November 5, 2021, and then took a dive. They ducked below $40 on April 2, 2022, and have remained mostly in a $20-$30 range since.

Confluent has started emphasising RPO (Remaining Performance Obligations) and large deal growth in its quarterly reports. RPO represents the amount of contracted future revenue from a customer that has not yet been recognized as of the end of each quarterly period. RPOs this quarter totalled $742.6 million, increasing 35 percent year-over-year, and there were 1,075 large deals, meaning customers with >$100,000 in annual recurring revenue, up from last quarter’s 991 and 34 percent higher than a year ago. It has 4,690 customers in total.

Bootnote

Confluent was started by the founders of Apache Kafka, software for a distributed event store, ingesting data streams in real time and supporting low-latency data processing. William Blair analyst Jason Ader described Confluent in May 2021 as “the No. 1 contributor to the Kafka open source project as well as its primary commercial vendor.”

The company’s on-premises software acts as an event broker, forwarding incoming data (time-stamped events) to the database, and data warehouse repositories that need it, and providing data pipelines for analysis runs. Confluent Cloud is sold as Software-as-a-Service, hosted across AWS, Azure and GCP, to provide data pipelining services software. With it, Ader said, customers don’t have to manage the back end or worry about how to scale it.