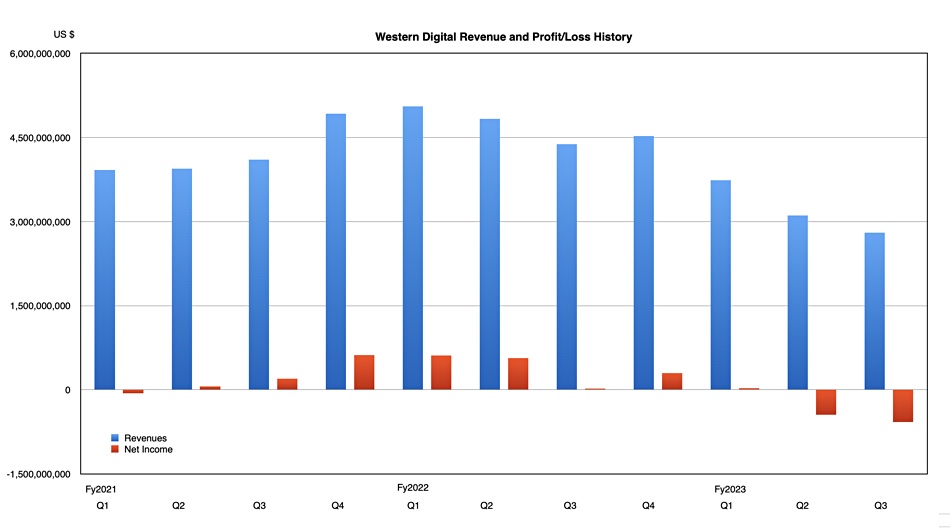

Western Digital saw Q3 2023 revenues sink 36 percent annually as the HDD and SSD downcycle continues, but it did beat its guidance – just.

Revenues for the three months ended 31 March came in at $2.803 billion, compared to the $2.8 billion guidance, with a loss of $572 million versus a $25 million profit a year ago.

The company has two businesses, making and selling disk drives and SSDs, which use NAND chips from its joint venture with Kioxia. WD took in a $900 million equity investment last quarter connected to an Elliott Management-promoted split between the two businesses and a potential SSD business merger with JV partner Kioxia. Western Digital also undertook restructuring efforts to lower its costs after last quarter’s relatively weaker results.

WD CEO David Goeckeler, said: “The groundwork we laid, combined with the actions we have taken since the beginning of this fiscal year to right-size and refocus our businesses, have enabled us to navigate a dynamic environment. I am pleased that we delivered non-GAAP gross margin at the higher end of our guidance range due to strong execution across both our HDD and Flash businesses.”

A chart shows WD’s recent revenue and profit/loss history up to the current quarter:

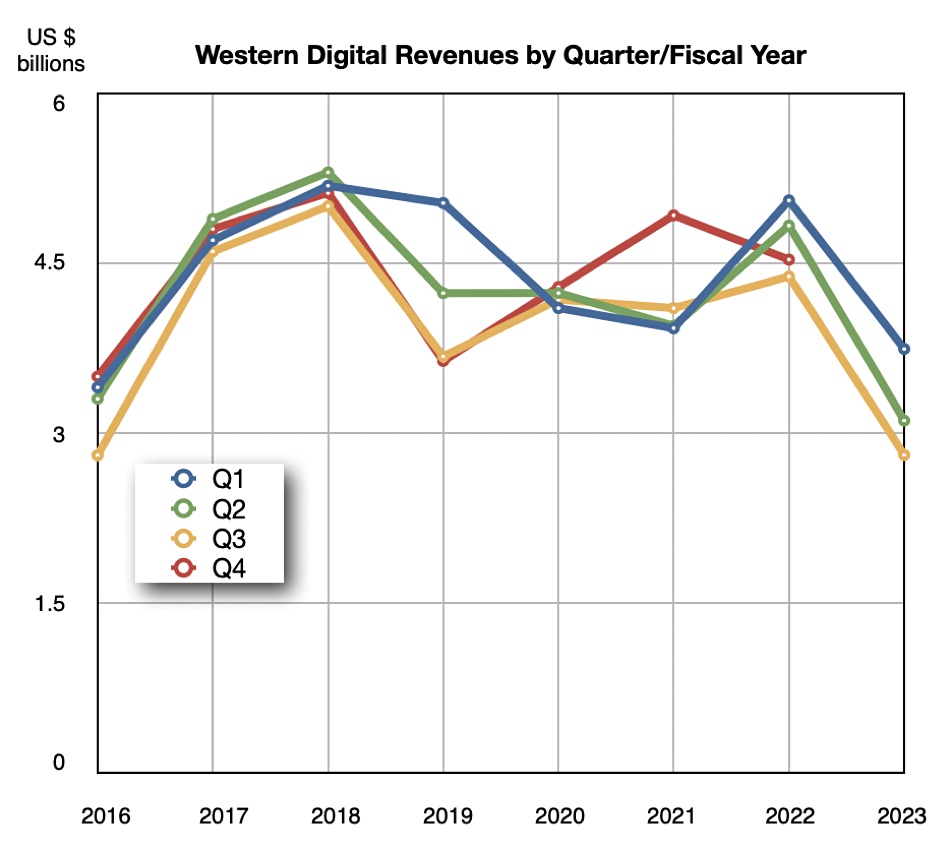

Down, down we go. We can highlight the annual changes in quarterly revenues by cutting the numbers differently and this shows a sustained and deep three-quarter revenue fall:

Financial Summary

- Gross margin: 10.2 percent vs 27 percent a year ago

- Operating cash flow: -$381 million

- Free cash flow: -$527 million

- Cash & Cash Equivalents: $2.2 billion

- EPS: -$1.82

WD’s Q3 was another tough quarter as worries around the Ukraine-Russia war persisted, a slowdown in China was noted, while supply chain complexities and rising inflation continued.

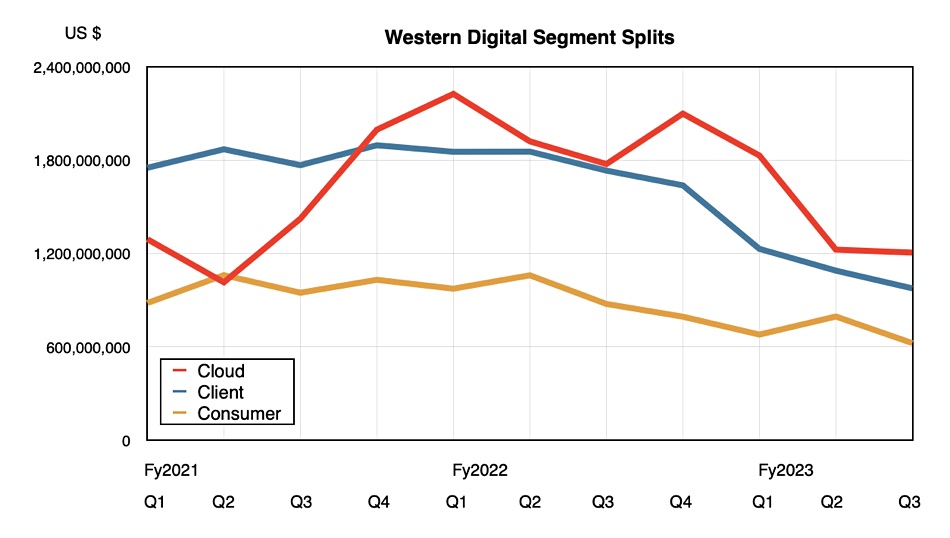

Cloud is WD’s main market in revenues terms (43 percent) and it fell 32 percent year-on-year to $1.205 billion. High-capacity nearline disk drive sales were particularly affected as public cloud buyers held off on some new drive purchases to use up existing inventories. SSD shipments to the cloud were also depressed and suffered from lower prices as well. But there were signs of recovery in this vital sector with the quarterly comparison showing a much reduced decline:

WD’s gross margin on flash tumbled to 5 percent from the year-ago 35.6 percent – a price decline effect – while the disk gross margin was down to 24.3 percent from the year-ago 27.7 percent.

The client device market brought in $975 million in sales for WD, 44 percent less than a year ago and depressed by SSD price falls and lower SSD and HDD unit shipments for PCs. The consumer market was 22 percent of WD’s revenue, at $623 million, 29 percent down on the year-ago $875 million. There were seasonal declines in disk and SSD ships, and flash price falls didn’t help either.

A look into the three HDD sub-markets shows a sequential unit shipment recovery in the cloud, from 5.5 million last quarter to 6.3 million this quarter, both lower than the year-ago 9.7 million but a sign that cloud inventory digestion may be easing. There were falls in client and consumer units after a prior seasonal uptick.

Disk drive ASPs rose to $109.00 from the prior quarter’s $99.00 as cloud buyers bought higher capacity drives. Western Digital said its 22TB conventional (not shingled) drive became its highest volume product at the 20TB and above capacity points. Goeckeler mentioned a “gross margin upside and profitable market share gains in HDD” during the earnings call. HDD revenues of $1.5 billion were down 30 percent year-on-year but up 3 percent sequentially – yes, up after five consecutive quarterly falls. Overall, the disk market could be stabilizing.

Earnings call

B&F turned into the earnings call for execs’ views on market trends and background matters such as the HDD/SSD demerger, and any information about the ongoing data breach and recovery.

There was no substantive CEO statement on the demerger other than: “The strategic review process is ongoing, and we will provide updates as we have them.” And this: “It’s progressing, very active. Everybody in it is under NDA, so I can’t say anything about it. And we look forward to talking about it when we reach a conclusion.” That sounds positive.

As for general market recovery, Goeckeler said: “Clearly, we’re going through one of the most severe downturns in a while, but we think as we move through the second half of the year, the market will come into balance.”

The effect of AI engines such as ChatGPT will be to provide a secular boost to both HDD and SSD sales to the datacenter and cloud. Specifically: “HDD is the lion’s share of storage in the cloud. So you would expect that’s where the bigger lift would be across those two technologies.”

Responding to a question about HAMR, he said: “Future technologies like HAMR will be there. We’re still a ways away before that product is going to be a volume-type product. The volume products are the 22s going in, and then SMR [26TB] are going to be the big volume products over the next couple of years. And after that, we’ll get to HAMR … I think everybody’s excited that it’ll be the roadmap for 30 and above when we need it.”

This implies Western Digital will have its 30TB or higher HAMR disk products in 2025 and beyond, while, if it meets its schedule, Seagate will be shipping them this year, giving it a two-year lead. That seems to be a substantial opportunity for Seagate to pick up HDD market share, particularly in the cloud.

As for the data breach, Goeckeler was in an almost congratulatory mood. WD has been very transparent about the incident: “We basically disconnected ourselves from the public internet to protect ourselves and then restore the environment … we’re nearly all the way back now as far as operations. We’ve got to bring the store online in another week or so.”

He added: “It was really, really good to see our business continuity plans. You don’t want to rely on them too often, but when we had to, they were there and they kept the company moving forward.”

Excuse us for pointing this out, but the consumer online and MyCloud business shut down. This wasn’t business continuity, it was business cessation – some would say a disaster. A seven-week recovery period suggests the business continuity plan basically failed, or there was no real plan for such an incident. Yes, the breach was a devilishly clever thing and WD’s technical staff no doubt achieved marvels, but this is just sugarcoating WD’s close-the-doors actions as business continuity.

CFO Wissam Jabre confirmed our view about the impact of this shutdown being felt next quarter: “For fiscal Q3 we don’t have any impact in the numbers related to the network security.” It was not mentioned as a factor in the guidance for the next quarter, though.

Guidance

Guidance for the final fiscal 2023 quarter is $2.5 billion give or take $1 billion, and a 44.8 percent fall year-on-year at the midpoint – more pain in other words. The CFO said this is partly due to continuing HDD inventory digestion by cloud customers and also lower flash prices.

Western Digital expects to complete qualification of its 26TB UltraSMR technology in the quarter and that will be competing with Seagate’s expected >30TB HAMR drives. Will Seagate’s HAMR attack on WD succeed? It will be a closely watched fight.