After dismal client PC and unexpectedly low server CPU sales Intel boss Pat Gelsinger has fulfilled his infamous “I never want to be in memory” statement and killed off Intel’s Optane persistent memory business.

Intel’s results – it reported revenue of $15.3 billion, down 22 percent y-o-y, and a $454 million net loss for the quarter – set the scene for the mercy killing, while CXL memory pooling closed the door to any last minute reprieves. The death notice came as Intel reported drastically lower than expected revenues and a loss. Gelsinger said in prepared remarks that Intel was: “making the difficult decision to wind down our efforts in Optane as we embrace CXL, a standard which Intel Corporation pioneered.”

Optane’s prime pitch was that its persistent memory provided a way to get more memory into a server without buying expensive DRAM. CXL memory pooling implies that servers can get more memory by accessing an external pool shared between many servers and thus more affordable on a $/TB/server basis.

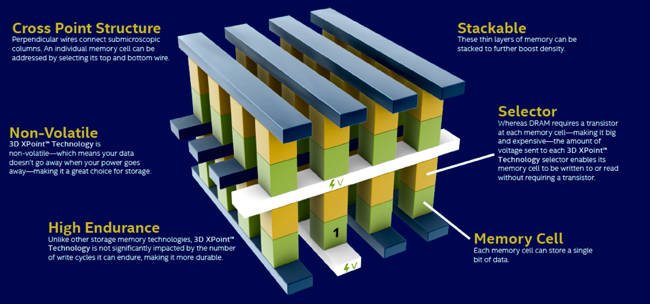

Intel said Optane filled a gap in the memory-storage hierarchy – one between expensive and fast DRAM and slower but cheaper flash SSDs. Optane was lower cost than DRAM but faster than SSDs. However, its persistence and slower-than-DRAM speed meant that it could not, in DIMM form, be treated as DRAM by host system software.

Optane history

Optane’s 2-layer 3D XPoint technology was launched by Intel (selling product) and Micron (building chips in its Lehi fab) in 2015, against a backdrop of secrecy about its memory cell operation and somewhat over-enthusiastic 1,000 times faster than flash performance claims. In the event an Optane DIMM’s read latency was 7-10μs and an NVMe SSD’s read latency was around 110-120μs – a 10x difference, nowhere near a 1,000x one.

Intel refused to reveal the base technology inside an Optane cell, saying the secret cell material has its resistance altered, through a bulk property change, between two levels by an undisclosed process. It became obvious that it was phase change memory (PCM) but Intel never openly admitted this.

The company produced Optane-based SSDs and also Persistent Memory (PMem) DIMMs and these had complicated software interfaces to enable them to be treated as memory in several ways, albeit slower than DRAM. This, in turn, required software changes in applications writing to Optane and it was, in retrospect, an uphill struggle for Intel to get a broad software ecosystem supporting the PMEM products.

Another – hindsight alert – Optane strategic weakness was that Intel ensured Optane PMem was only supported by its own Xeon server processors, not opening up the interface to other processor suppliers such as AMD or Arm. This limited the Optane PMem market size. Micron, which built the XPoint chips, said it was developing QuantX product, in a half-hearted kind of way, but never sold it. That restricted the selling effort.

Attempts to sell client Optane SSD products were not successful enough. The PCIe gen 4 interface sped up existing SSDs and Samsung (Z-SSD) and Kioxia (FL6) built accelerated SSDs with near-Optane SSD speeds.

Intel developed gen 2 Optane technology with 4 layers in 2019. The DIMMs were around 19 per cent faster at reads and 37 per cent faster at writes than gen 1 but with the same capacity levels, despite the increased layer count. It was not good enough to substantially increase Optane product demand.

Micron’s backhander

Eventually Micron realized that it couldn’t make money from building Optane chips, because they went into Intel’s inventory. Intel was not selling enough Optane product to use Micron’s supply. In March last year Micron withdrew from its 3D XPoint manufacturing deal with Intel, and then sold off the Lehi fab, leaving Intel with no manufacturing capability for the Optane product’s chips. This was a huge blow to Optane’s market fortunes. Intel’s manufacturing partner publicly said, in effect, that Optane was a dud.

By then Intel had sold its NAND and flash SSD business to SK hynix, and, in February last year, Gelsinger had made his now notorious “I never want to be in memory” statement to Stratechery’s Ben Thompson.

Intel incurred a more than $500 million loss with the Optane 3D XPOint business in February 2022. The leader of its Optane business, Alper Ilkbahar, VP and GM for Intel’s Optane Group, resigned at that point and joined Western Digital.

The writing was flickering on the wall. Intel revealed that gen 3 Optane would use gen 2 3D XPoint technology, there was no plan to develop a third 3D XPoint generation, and that gen 4 Optane products would not necessarily be based on 3D XPoint at all. Its commitment to 3D XPoint technology was leaching away in front of everyone’s eyes.

Storage system suppliers such as VAST Data that had relied on Optane products began to validate and certify alternatives, such as Kioxia’s FL6 accelerated NAND.

Optane exit

Intel publicly soldiered on, telling us in March that it was not backing away from 3D XPoint, and was planning to enable “our third-generation Optane Products with Sapphire Rapids.” Four months later and Intel’s 7-year Optane journey is ignominiously over.

What will happen to its Optane and 3D XPoint workforce? The signs are not good. CFO Dave Zinsner said the earnings call: “We expect to see restructuring charges in Q3.”

Now all the system suppliers that relied on Optane have to pick themselves up and look elsewhere. They have been let down by Intel. The majority will have started looking elsewhere months if not a year or more ago.

VAST Data founder and CEO Renen Hallak told us: “Intel helped create a market for this new category of storage class memory technology, which we applaud. It started a technology revolution that allowed us to introduce our game-changing storage architecture, Universal Storage. Since that time, there are a lot more choices for storage class memory that we have qualified for VAST’s Universal Storage. While we understand Intel’s decision, this has no impact on our business model since we implemented a multi-vendor strategy more than a year ago. Nothing will change for our customers.”

Final word

In summary, Optane’s technology never really delivered enough, and what it did deliver cost too much.