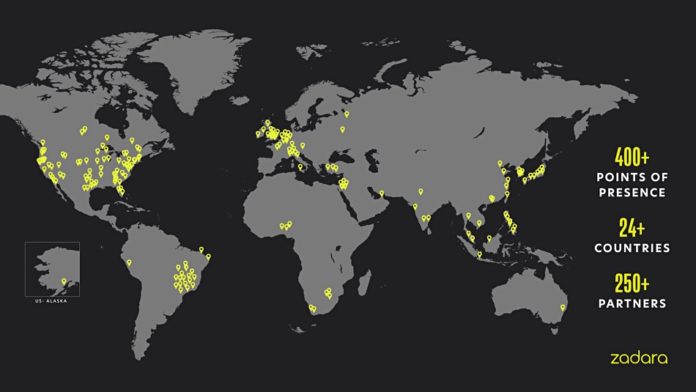

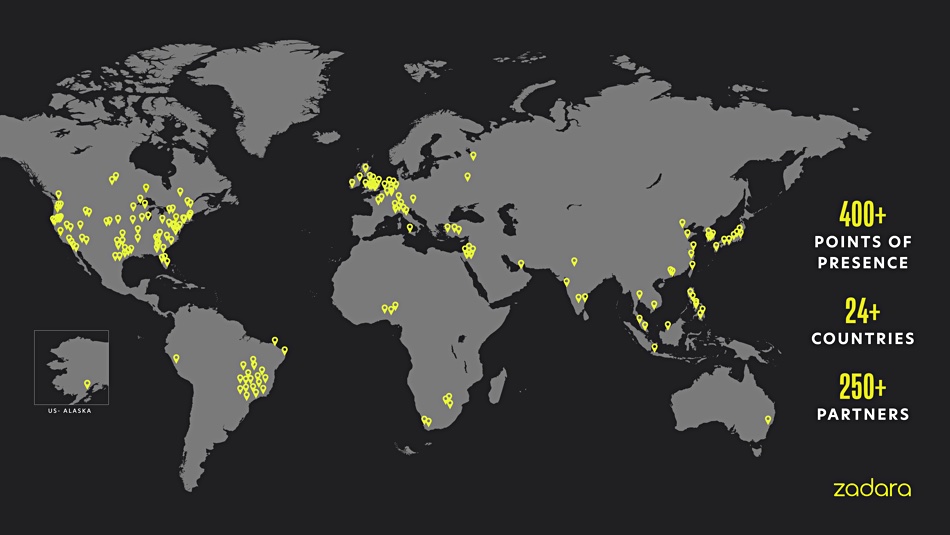

Zadara has surpassed 400 global points of presence spanning 24 countries, and said it plans to have more, with edge cloud locations near every major city in the world powered by its partner network.

It has an ecosystem of more than 250 managed service providers (MSPs), with 441 locations in every part of the globe. Partners include Seagate, Cyxtera, Sandz, Viatel, Lumen, NTT, KT Corporation, KDDI, Africa Data Centres, and Rakuten.

Nelson Nahum, CEO and co-founder, said: “Zadara is realizing its vision to deploy and support a network of service providers that scale without the need to build new data centers, while offering cloud services anywhere in the world. Bringing a better than public cloud experience, with optimized price, performance, security and compliance to our partners, means faster times to innovation and new growth opportunities.”

Nahum claimed Zadara has “more global points of presence than any other edge cloud provider.” But it is seemingly lagging its own targets as a July 2020 blog written by Nahum said: “By the end of 2021 we expect to have over 1,000 locations in our partner network allowing us to serve our customers with edge-like capabilities to solve for low-latency.” Even though it’s fallen short, it claims it has more edge points of presence than other public clouds.

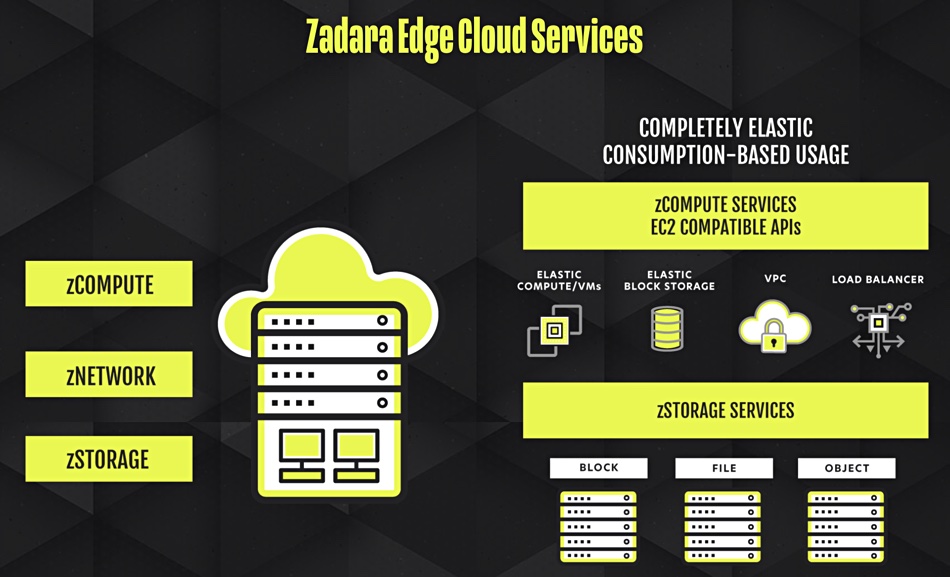

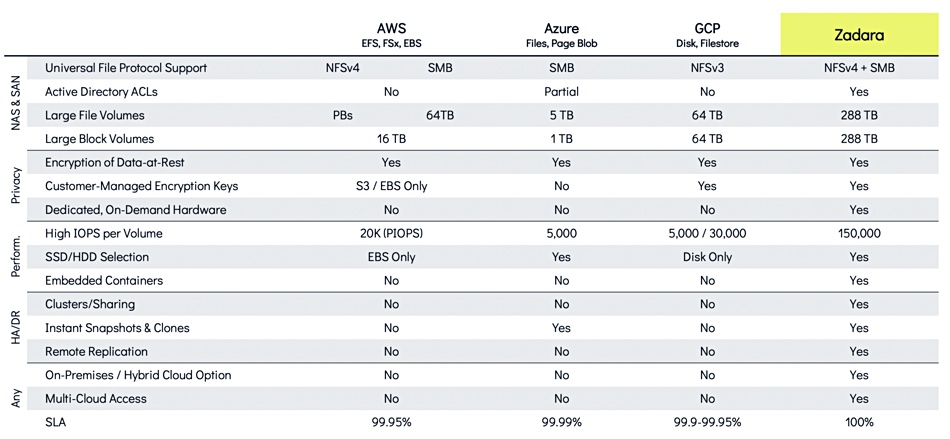

The company provides compute (EC2-compatible), storage (block, file, object), and networking facilities as managed services located on-premises, in hybrid and multi-cloud, and at the edge. Customers can have the hardware in their central datacenters or edge locations and lease it from Zadara, and also use Zadara’s IT resources in the main public clouds and its own public cloud. This is an alternative to AWS, Azure, Google, and Oracle’s cloud.

Zadara has doubled its headcount during the past 12 months and expanded its corporate presence in Tokyo, Tel Aviv, and throughout the US, where it is headquartered. The company started out from its Israeli base by offering managed storage-as-a-service, and has since expanded into compute, by acquisition, and networking (infrastructure-as-a-service).

A blog says: “After 17 consecutive quarters of growth, we are proud to share our gross profit year-over-year has increased 93 percent This was driven by the strength of our partner network and 100 percent increase in new customers year-over-year.”

Where’s the money for this growth coming from? The company has raised more than $60 million in six rounds since it was founded in 2011, with the last being an undisclosed venture round in 2019. This followed a $25 million raise in 2018. We think there is a substantial element of self-funding from revenues here.

It’s recently entered Formula 1 Grand Prix sponsorship, having a relationship with Sauber Motorsport, which runs the Alfa Romeo F1 Team ORLEN. This suggests it has marketing money to burn.

All the major system and storage suppliers now offer subscriptions, such as HPE GreenLake and Dell APEX, with deals for MSPs. Presumably Zadara has a competitive offer concerning costs, performance, points of presence, support, etc, yet it has to source its own hardware and software from original equipment manufacturers. You would think this would give the OEMs a pricing edge yet Zadara is growing and growing. Should we view this as being like some airlines leasing airplanes from intermediaries who buy them from the manufacturers?

We look forward to Zadara filing for an IPO because then we should get to see details of how its business operates and its financial performance. Until then we’ll watch it grow some more and maybe get acquired.