NetApp reported 9.8 per cent revenue growth for its third fy2022 quarter, with a record all-flash array run rate and high public cloud revenue growth.

The quarter finished on January 28 with revenues of $1.61bn – they were $1.47bn a year ago – and a profit of $252m, up 38.5 per cent year-on-year.

The all-flash array (AFA) run rate grew 23 per cent to a record $3.2bn with 31 per cent of NetApp’s customer base buying into the AFA message, leaving plenty of headroom for growth.

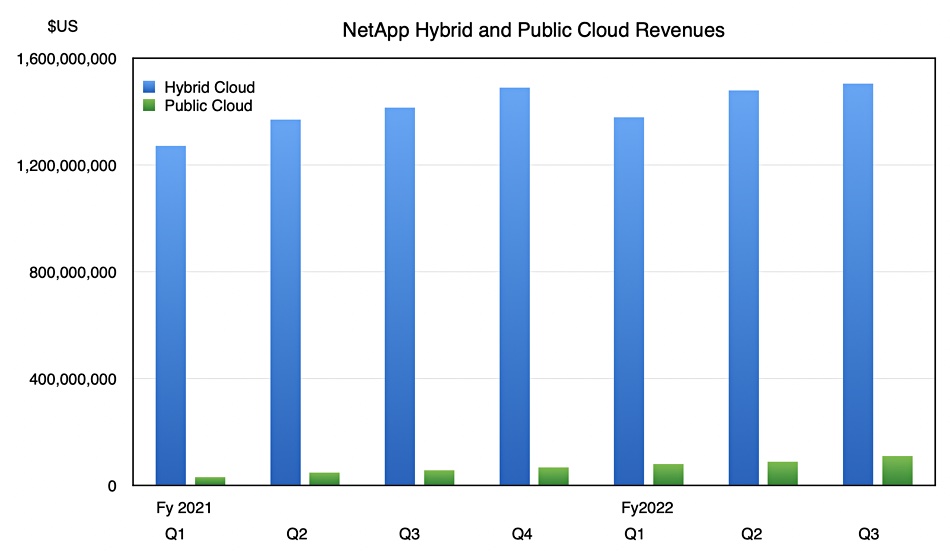

The public cloud business grew its annualized revenue run rate (ARR) 98 per cent with revenues of $110m in the quarter, double the year-ago number.

CEO George Kurian said in his prepared remarks: “We delivered another outstanding quarter, building on the momentum we’ve had in recent periods. Demand for our solutions is strong and powered by the alignment of our differentiated technology portfolio with customer priorities.”

He said NetApp delivered “record high gross margin dollars, operating income, and earnings per share.”

Hybrid cloud revenues, led by AFAs and object storage (StorageGRID) of $1.5bn rose 6.3 per cent with the $110m of public cloud revenues a long way behind but growing 100 per cent year-on-year.

Kurian noted: “Public cloud dollar-based net revenue retention rate remains healthy at 169 per cent, as customers increase their usage of our public cloud services and adopt new products.… which puts us well ahead of our plan to achieve $1 billion in ARR in FY ’25.”

CFO Mike Berry expects public cloud ARR to be between $525m and $545m at the end of NetAp’s fy2022. Kurian said: ”Azure NetApp Files was a really strong performer this quarter as it has been for several quarters now.”

In a hint of the demand for the newly announced AWS Fsx for NetApp ONTAP he said: “A global third-party logistics company chose FSx for NetApp ONTAP to host data migrated from Nutanix systems in its data centres.”

NetApp replacing Nutanix is a surprise.

Financial summary

- Billings of $1.76bn, up 10 per cent annually

- Product revenue – $846m, up 9 per cent and 4th quarter of growth

- Service and support revenues – $658m and up 2.8 per cent

- EPS – $1.10 vs $0.80 a year ago

- Cash and investments – $4.2bn

- Operating cash flow – $260m compared to $373m a year ago

- Gross margin – 67.3 per cent and unchanged from a year ago

- Deferred revenue – $4bn

Supply chain issues

CFO Mike Berry referred to supply chain problems in his remarks: “We navigate near-term component shortages, and expect revenue to continue to be constrained in Q4.” However: “We are increasing our full year guidance for revenue, EPS and Public Cloud ARR, driven by the outperformance in Q3 and a very healthy demand backdrop for Q4.”

The earnings call revealed more about the supply chain issues. Berry said: “In addition to a worsening freight and expedite environment, we also experienced component supplier decommits beginning in the second half of Q3, which required us to purchase components in the open market at significant premiums.”

The decommits were mostly in low volume analog semiconductors, used for things like voltage stabilisation across a lot of NetApp’s product families. The freight aspect was largely due to cargo airfreight issues. NetApp has multi-supplier and long-term agreements for CPUs, DRAM, NAND, and disk drives, and is not directly affected by the Kioxia/Western Digital chemical contamination problem.

“We were faced with the short-term decision of supporting the robust customer demand versus optimising near-term product margin. … we made this strategic decision to prioritise meeting customer demand with the trade-off being lower product margins in the short term. To be clear, the pricing and availability of our core HDD and SSD components are stable and are not a contributor to the near-term headwinds.”

“We believe these cost headwinds are temporary in nature; and… we expect that Q4 will be the trough for product margins… we do expect cost improvements in the coming quarters as the supply headwinds begin to ease throughout the first half of fiscal 2023.”

Berry sees $50m to $60m in extra Q4 costs from open market component purchases. NetApp has already raised its prices by about 10 per cent overall in response to the supply chain issues.

He said of the AFA market that NetApp was winning new customers as well as selling into its existing base, and growing sales faster than the overall market – so gaining market share over the competition.

Outlook

The Q4 expectation is for revenues of $1.685bn plus/minus $50m and representing an 8 per cent rise year-on-year at the mid point. That’s lower than otherwise because of the supply chain issues. Generally demand was stronger than supply in Q3 and should be the same in Q4.

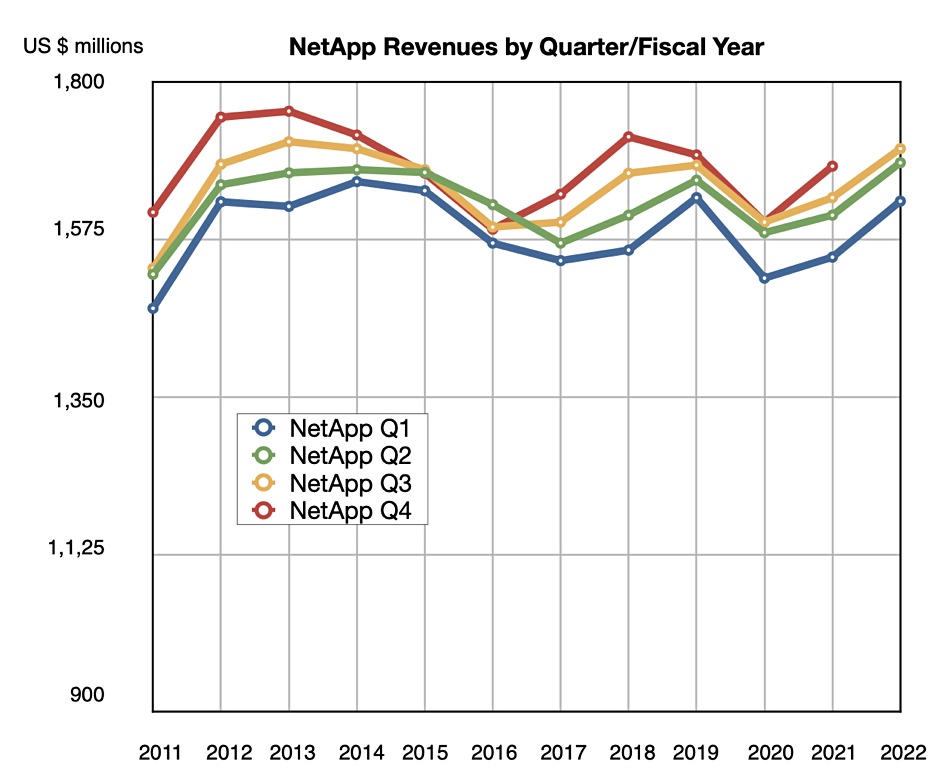

This would make full fy2022 revenues total $6.32bn, again at the Q4 mid-point, a 10.1 per cent increase from fy2021 and NetApp’s highest annual revenues since fy2014’s $6.33bn. It has been a long wait.

Comment

There is a sense that NetApp is very hopeful about growth in its public cloud revenues from its AWS FSx for NetApp ONTAP, Azure NetApp Files and the GCP equivalent. Kurian said: “Once the customer uses one of these cloud portfolios, they expand their use quite substantially.” Public cloud revenues could benefit from increased Spot portfolio new customer sales as well as from NetApp’s existing base moving workloads to the public cloud.

It does appear that NetApp is leading the storage market with its data fabric covering all three major public clouds and the cloud ops Spot portfolio driving NetApp product sales in a way that no other storage supplier, at this time, can emulate. NetApp’s total addressable market (TAM) has increased. Were Dell or HPE or Pure to compete here they’d face a build-vs-buy decision and NetApp is already busy buying the promising startups in this emerging field.

Its lead should increase over the next couple of quarters and there are opportunities to integrate the cloud ops products with the cloud products and so strengthen both. NetApp is looking well-placed for further growth.