Now in its seventh year, Lightbits Labs is broadening its scope from being an NVMe/TCP-focused storage vendor to becoming a data services supplier which happens to use NVMe/TCP as part of its composable, disaggregated and scale-out storage. Its future looks to be based on moving to the public cloud, selling to MSPs, and using an Intel partnership and vSphere certification to open doors and raise credibility.

Lightbits Labs was started up in 2015 by a group of seven co-founders led by chairman Avigdor Willenz and CEO Eran Kirzner. In 2019, it announced Lightbox SuperSSD storage appliance, a 2U x 12 or 24-slot box with its LightOS software providing a global flash translation layer looking after wear-leveling across the SSDs and scale-out capability.

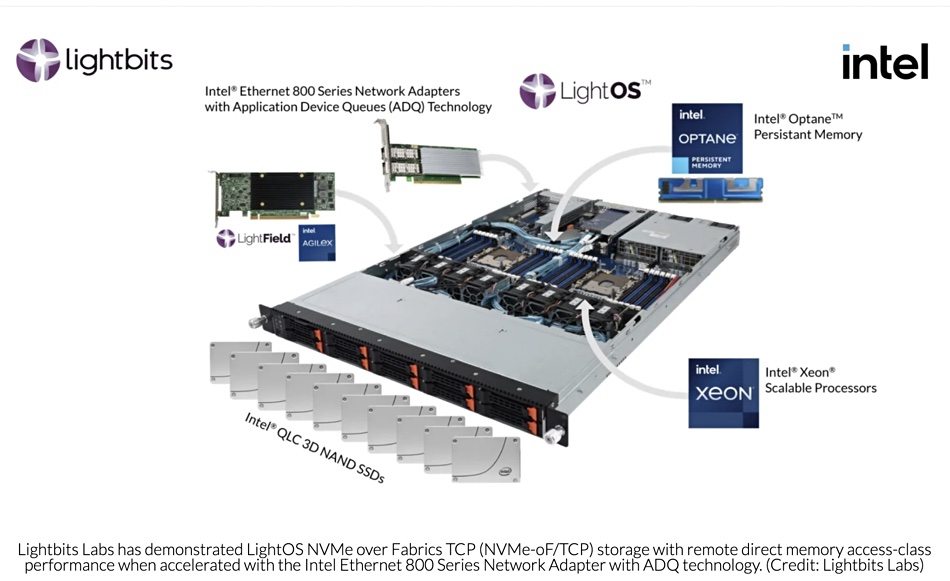

The OS also provides high-availability, thin provisioning, compression, RAID, erasure coding, and multi-tenant quality of service. There was an optional LightField acceleration card, with data reduction, data protection, NVMe/TCP, and global FTL acceleration, several years ahead of today’s SmartNICs, but that has been dropped.

It added a Kubernetes CSI plugin in 2020, and snapshots and thin clones came along in 2021, as well as multi-way replication and clustering.

This system was similar in overall scope to other NVMe storage arrays of the time, from Apeiron, DSSD, E8, Excelero, and Pavilion Data. Apeiron failed. DSSD was bought by EMC and subsequently canned. E8 was bought by AWS and Excelero has just been acquired by Nvidia. All these startups faced the same problem: the major incumbents bought or developed their own all-flash arrays and added NVMe networked access, often using RoCE – the datacenter-class lossless Ethernet protocol.

NVMe/TCP offers similar remote direct memory access (RDMA) speed using ordinary Ethernet so provides less expensive data access. The incumbents have adopted this as well, and it means that Lightbits Labs is selling and marketing its NVMe/TCP all-flash storage in competition against Dell, HPE, Hitachi Vantara, IBM, NetApp, and Pure Storage, as well as newcomers like StorOne.

The big issue is how to differentiate itself from the pack with a product tech message that is unique and relevant. In a briefing Pete Brey, Lightbits’ VP for Product Marketing who was hired in December last year, said that recent business results have been encouraging with the customer count doubling in 2021 compared to 2020, increased deal sizes and a 2.3x expansion in its sales pipeline.

One differentiating factor is price, with Brey saying: “We can deliver the same performance at a much lower cost than competitors like NetApp and Pure.”

He said Lightbits’ LightOS was the first software-defined storage to be certified by vSphere and there are more than 10 vSphere customers running LightOS proof-of-concept tests and “a lot of runway with Tanzu and ESX.” Other deals are focused on OpenStack.

Another partnership is with Intel, which has invested in the company, while a German cloud services provider is a joint Intel and Lightbits customer. The LightOS software supports Optane SSDs.

Brey talked about the idea of LightOS running in the public cloud as the Lightbits Cloud Data Platform. The focus would be on edge clouds with general availability later this year. He discussed applications moving from private to public clouds and between public clouds, and said they needed a consistent (storage) interface across these environments.

“This is where Lightbits shines because it can deliver a consistent interface across the environments.”

Brey thinks the customer needs to buy a complete system and Lightbits should encourage an ecosystem that could deliver this. It could cover on-premises systems with hardware and software included, and it could also cover the public cloud, with managed service providers (MSPs) delivering a storage service as part of their offer.

He mentioned the idea of developing an AIOPs capability so that customers would not need a storage admin.

We’d suspect that Lightbits may need a slug of go-to-market funding in a year or so. Its last funding event was with Intel Capital in 2020, with $55 million raised so far.

There was a phenomenal burst of all-flash storage hardware and software array creativity in Israel in the 2000-2015 era with E8, Excelero, ExtremIO, Lightbits, and StorOne all part of it. Lightbits and StorOne are still around and growing but the others are gone, or their technology now part of something else.

We could see Lightbits focusing more on MSPs, and it may also find success selling to enterprises via a network of services-based resellers as a vSphere-certified software-defined storage supplier. Let’s check back at the end of the year and see how well it has done.