Quantum saw a 2.8 per cent decline in revenues in its latest quarter as severe supply chain issues – some suppliers “holding it to ransom” – cost it $62 million in unfilled orders and sent it into cost-cutting mode to get through the coming quarters of constrained supply.

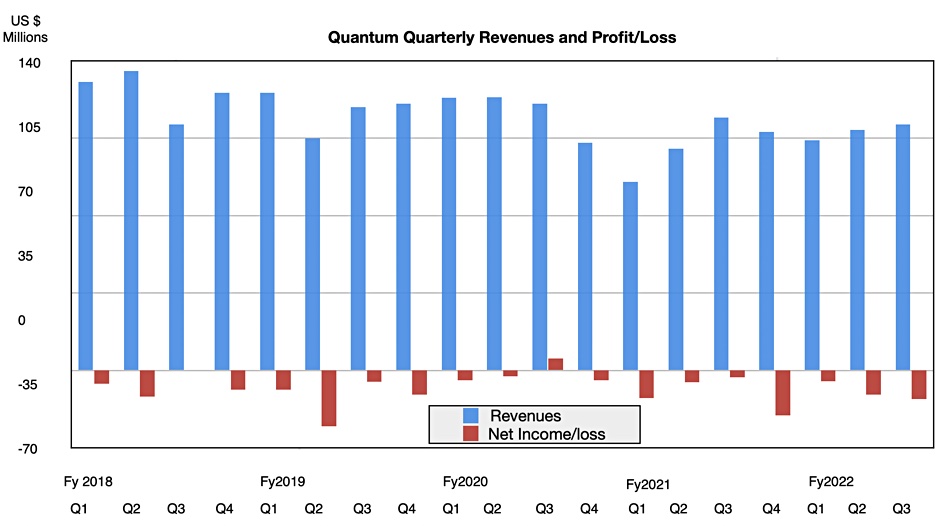

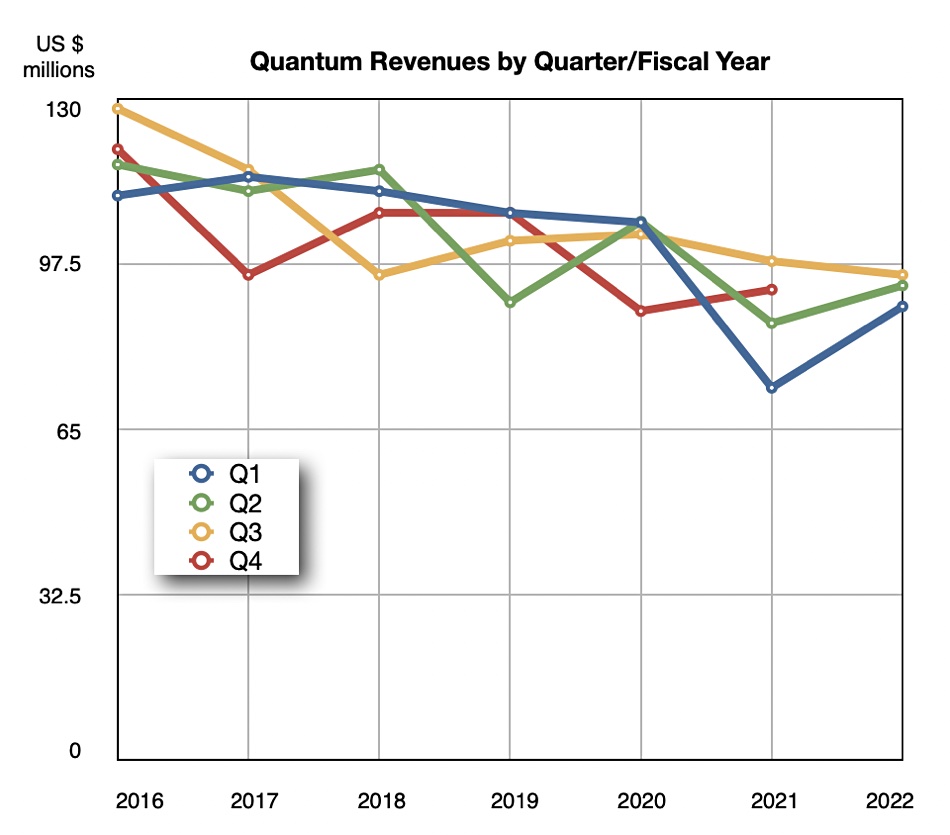

Revenues in the quarter ended Dec 31, 2021, were $95.3 million compared to $98 million a year ago. There was a loss of $11.1 million, much worse than the year-ago loss of $2.7 million. But bookings rose and were higher than revenues for the fifth quarter in a row as demand grew strongly, particularly with tape use by hyperscalers and in conjunction with Pivot3 video surveillance orders.

Chairman and CEO Jamie Lerner said in the earnings call: “While our bookings were at the highest level they’ve been at in years, we have to recognise that the global supply situation put us in a position where the results have fallen beneath all of our expectations. But I’m confident in the underlying strength of this business. Our bookings levels, our hyperscaler wins, the strides we’re making in video surveillance, tell me that we have a growing business.”

Demand up

The CEO added that “backlog increas[ed] sequentially to $62 million, another quarterly record for the company, with strong demand.”

Demand for tape was notably good. “As of today, four of our hyperscale customers now utilise more than an exabyte of storage capacity, and we continue to view this business as a growth driver in future years.”

Orders grew. “One of our largest hyperscale customers … converted a large order for LTO-8 drives to LTO-9 drives during the quarter and increased their order by $10 million.”

But it could not be satisfied – there weren’t enough LTO9 tape drives.

Video surveillance was affected too. “We closed a multimillion dollar video surveillance deal at a government agency, which is currently in backlog.”

Object storage grew. “We closed a multimillion dollar object storage deal with a genomics research institution and closed our first six-figure software-only object storage win at a large semiconductor manufacturer with a third party providing the hardware component.”

The recurring revenue transition accelerated. “With more than 255 customers utilizing Quantum’s subscription solutions, up 30 per cent sequentially and 98 per cent year-over-year, and with more products transitioning to a subscription contract, our year-over-year subscription revenues increased more than 190 per cent.”

Lerner said “We are … closing a higher number of deals, both in number and dollar value across a larger customer base.”

But it was to no avail.

Supply down

Quantum’s business is seeing a terrific growth in demand coupled with a severe downturn in component supply, as Lerner said: “We’re just having very good traction with our orders, but we are having a hell of a time fulfilling those orders.”

There were “unprecedented headwinds … within our supply chain.”

Tape supply was affected. “During the third quarter, LTO-9 tape drives started shipping, but overall supply of LTO-9 drive has been constrained due to initial manufacturing challenges.”

There were “broad-based shortages of components for servers, network cards and circuit boards.” An example: “we’re just getting much longer lead times sometimes as much as five months for just a server.”

According to Lerner, “We’ve just had so many de-commitments or delivery schedules that our suppliers did not meet or pricing levels that they did not meet.”

He expressed his frustration with the some component suppliers, saying “We can’t be in a position where we’re held for ransom quarter after quarter.” Some suppliers of low-margin, low-value components – $2 or $3 socket connectors for example – simply stopped making them and switched to high value, higher margin products. Others instituted unacceptable plus price rises.

As a result, “We’re designing our products to use more popular components that have more supply available and are available at lower prices.”

Cash getting tight

Quantum’s results announcement contained this surprise: “Cash and cash equivalents including restricted cash was $4.3 million as of December 31, 2021, compared to $23.2 million as of September 30, 2021.”

That was a reduction of 81.5 per cent.

CFO Mike Dodson said that, in the quarter, “We experienced much higher manufacturing costs, combined with higher freight, warehouse and other logistics costs.”

Although Quantum’s cash went down a lot, “We remained in compliance with all debt covenants. But given our current expectations that the supply chain disruptions we have experienced in the last four quarters will continue in the foreseeable future, we have begun to work with our lenders to address any potential future covenant compliance issues, as well as any potential need for additional liquidity.”

That could mean another two to three quarters of constrained revenues for Quantum. Will other storage suppliers in the same boat? Tape library-shipping SpectraLogic for example?

What to do

Lerner said Quantum’s response was this: “We are immediately implementing a series of cost reduction measures. We are instituting pricing increases across our product categories, and we are focusing on supply chain and operational excellence.”

Its prices have already risen five per cent and will probably go higher. Dodson talked about “doing things like shutdowns, right. And then it’s looking at your typical items that you look at, the temporary employees, the contractors. You look at all your discretionary spending, you look at all of your contracts and where can you renegotiate or postpone or push-out.”

The outlook for next quarter, Quantum’s Q4, is for revenues of $92 million, plus/minus $5 million. The mid-point would be a slight year-on-year decline from the prior Q4’s $92.4 million, and imply full year revenues of $369.6 million – a 5.8 per cent rise year-on-year. A slight rise, but a rise nonetheless. With supply constraints looking to continue for a few quarters yet, Quantum will be thankful for what it can get.